BIX ARTICLE

Malaysia Bond and Sukuk: Quarterly Report 1Q2025

Apr 10, 2025

|

7 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

1Q2025 – Malaysia’s Bond and Sukuk Market Hits RM2.145 trillion in Q1 2025

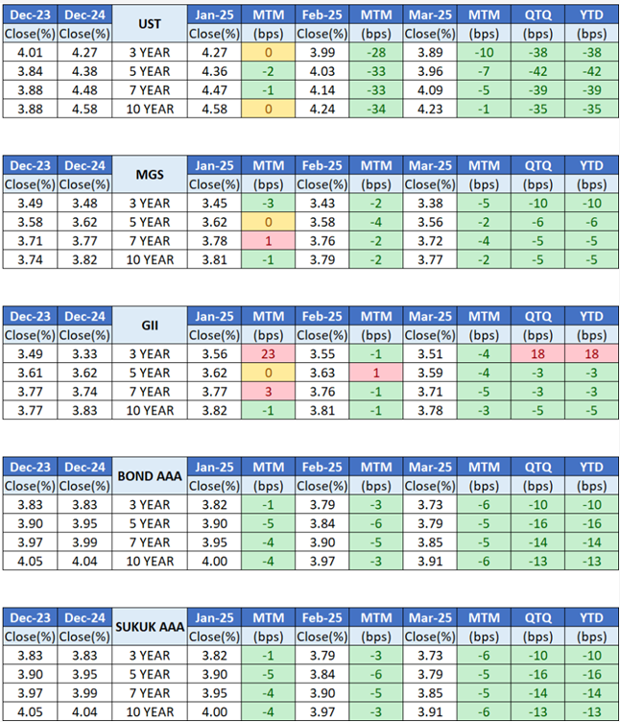

Malaysia’s bond and Sukuk market kicked off 2025 well, reaching an astounding RM2.145 trillion in outstanding issuances within the first three months. The growth is influenced by solid domestic demand, stable PMI readings, and optimism over the Malaysia-ARM deal anchored bond yields. Monetary Policy Committee’s (MPC) decision to keep the Overnight Policy Rate (OPR) at 3.00% reinforced policy stability, while tighter scrutiny of large-scale project financing highlighted a commitment to fiscal discipline. These factors boosted demand for Malaysian bonds and pushing yields lower.

GOVERNMENT BOND AUCTION

Overview

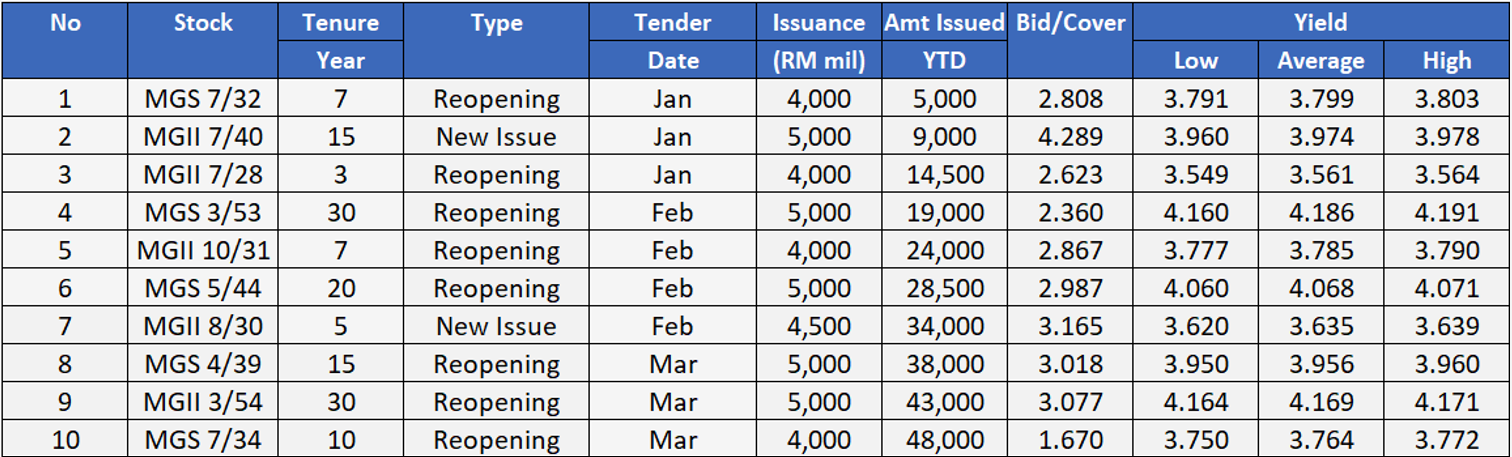

| Government bond auction for 1Q25 garnered an average BTC of 2.886x, surged from the previous quarter (4Q24: 1.991x). New issuance of MGII 7/40 marked the highest BTC at 4.289x. The new/reopening issuances for MGS/GII stood at RM45.50 billion, larger by 35.82% compared to the previous quarter (4Q24: RM33.50 billion). Outstanding amount of MGS/GII stood at RM1,235.92 billion, grew by 2.30% in Q1 2025 (4Q24: RM1,204.64 billion). Domestic bond gained as Malaysia appeared relatively less impacted from Trump’s tariff blow during this period. |

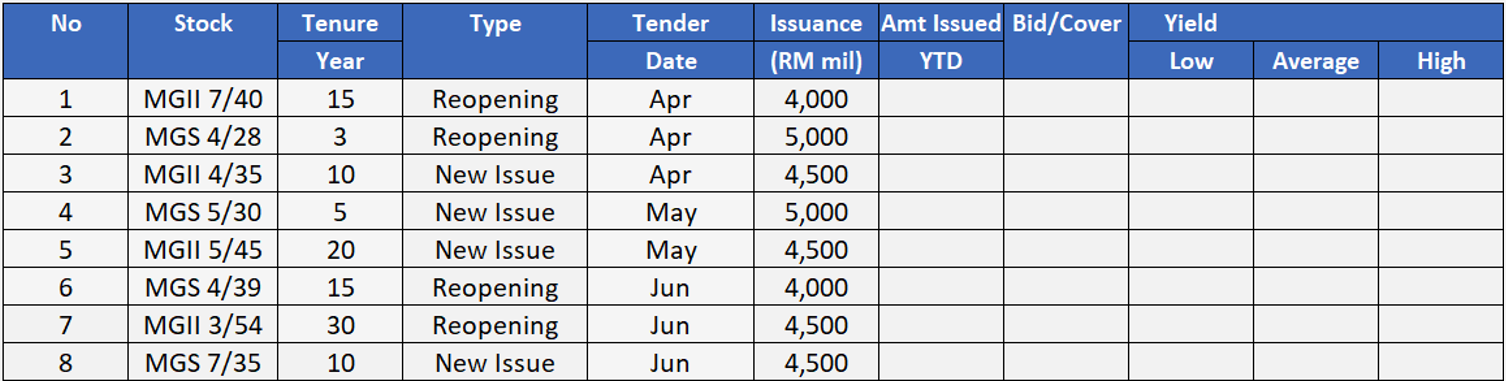

| In the upcoming 2Q25, there will be two (2) new issuances and two (2) reopening of MGS. On the other hand, there will be two (2) new issuances and two (2) reopening of GII, totalling to four (4) new issuances and four (4) reopening. |

FOREIGN HOLDINGS OF MGS AND GII

Overview

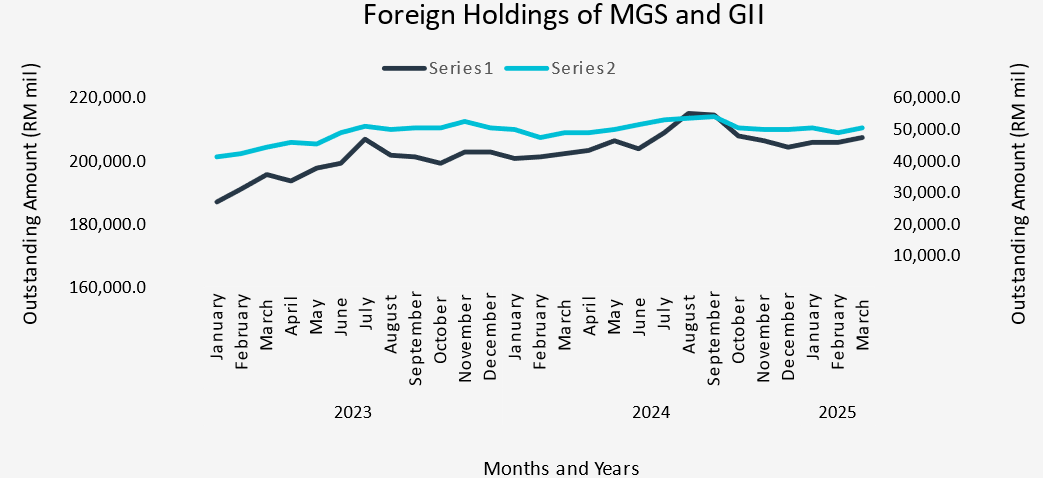

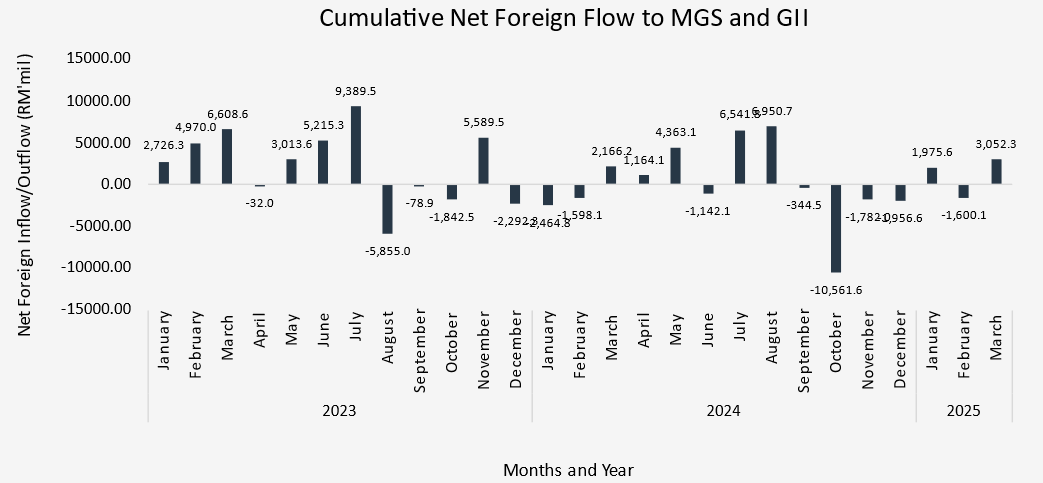

| The foreign net flow to MGS and GII in 1Q25 amounted to RM1.97 billion, -RM1.60 billion and RM3.05 billion in January, February and March respectively, with foreign investors turned net buyer. As of March 2025, the total foreign holdings of MGS and GII stood at RM258.35 billion (December 2024: RM254.92 billion), 1.33% higher from the previous quarter. |

CORPORATE BOND & SUKUK

Overview

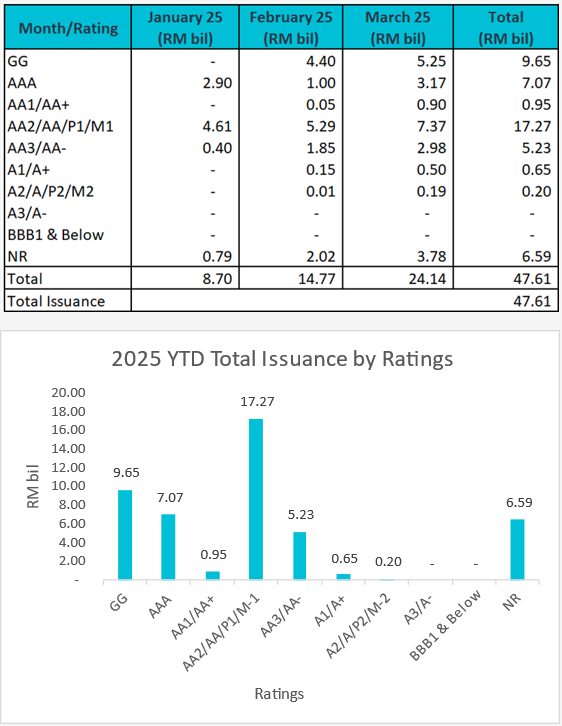

| RM47.61 billion corporate bonds and sukuk were issued in 1Q25 (4Q24: RM48.57 billion), 1.97% lower than the previous quarter. The AA2/AA/P1/M1-rated bonds and sukuk recorded the biggest issuance at RM17.27 billion issuances, followed by government guaranteed bonds at RM9.65 billion issuances. For 1Q25, the largest corporate issuances were issued by CAGAMAS BERHAD, namely CAGAMAS IMTN 3.780% 24.03.2028 worth RM1.11 billion. |

RATING OUTLOOK

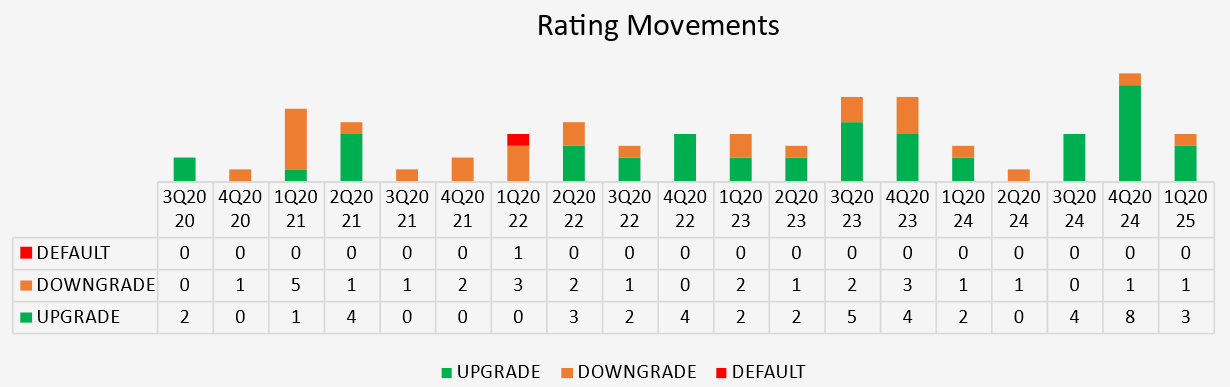

| There was zero (0) default and one (1) downgrade recorded in 1Q25. However, there were three (3) upgrade bonds/sukuk in the quarter. ⬆️ Upgrade

|

Source: MARC, RAM and BIX Malaysia

BOND STATISTICS

Overview

Outstanding Amount by Bond Classes

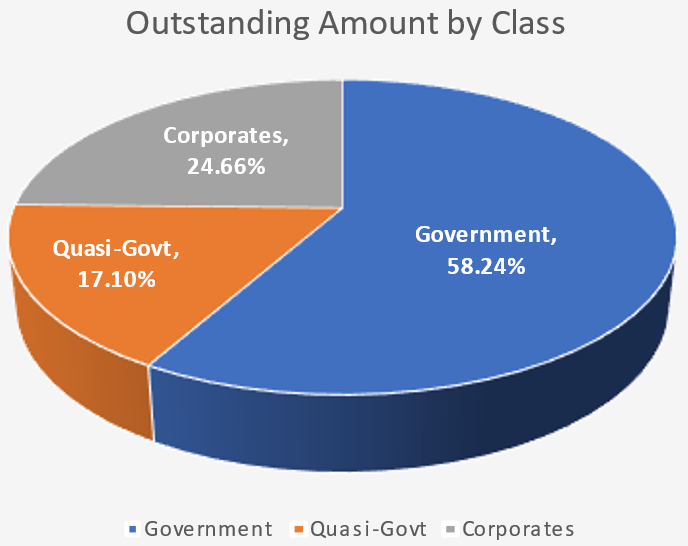

| As of March 2025, the outstanding amount of the Malaysian bond market stood at RM2.145 trillion, increased by 2.24% compared to the end of 4Q24 (December 2024: RM2.098 trillion). The largest outstanding bonds were from government issuances which consist of 58.24% of total issuances at RM1.249 trillion, followed by corporate issuances of 24.66% at RM529.08 billion, and Quasi-government issuances of 17.10% at RM366.97 billion. |

Overview

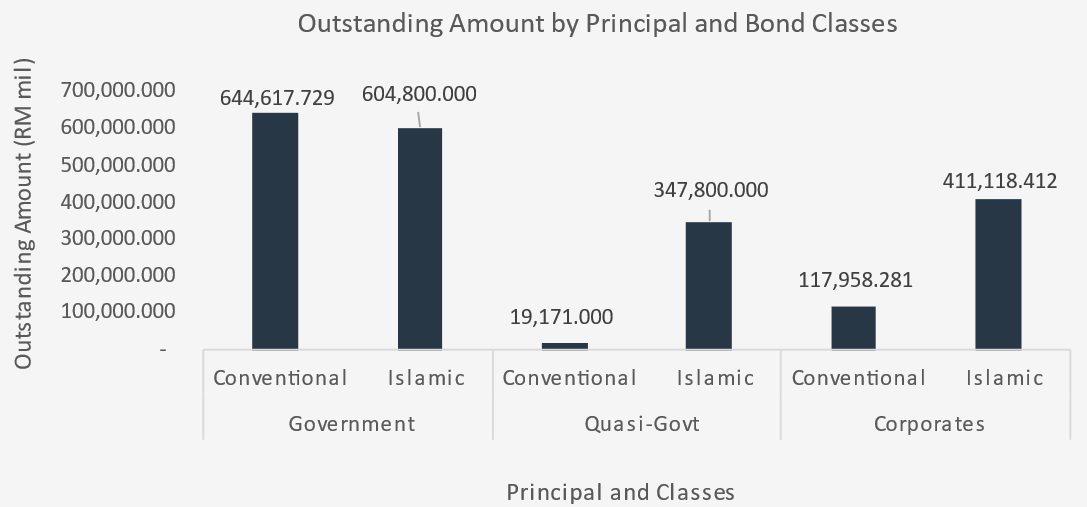

Outstanding Amount by Principal and Bond Classes

| As of March 2025, the outstanding amount of Government conventional bond and Government Sukuk stood at RM644.62 billion and RM604.80 billion, respectively. The conventional Quasi-govt outstanding amount stood at RM19.17 billion, much smaller compared to its Shariah-compliant counterpart of RM347.80 billion. For corporate issuances, the conventional bond outstanding amounted RM117.96 billion while the corporate Sukuk was recorded higher at RM411.12 billion. |

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalized financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Jan 09, 2026

|

7 min read

ARTICLE

Oct 08, 2025

|

7 min read

ARTICLE

Jul 08, 2025

|

7 min read

ARTICLE

Apr 10, 2025

|

7 min read