Feb 23, 2026

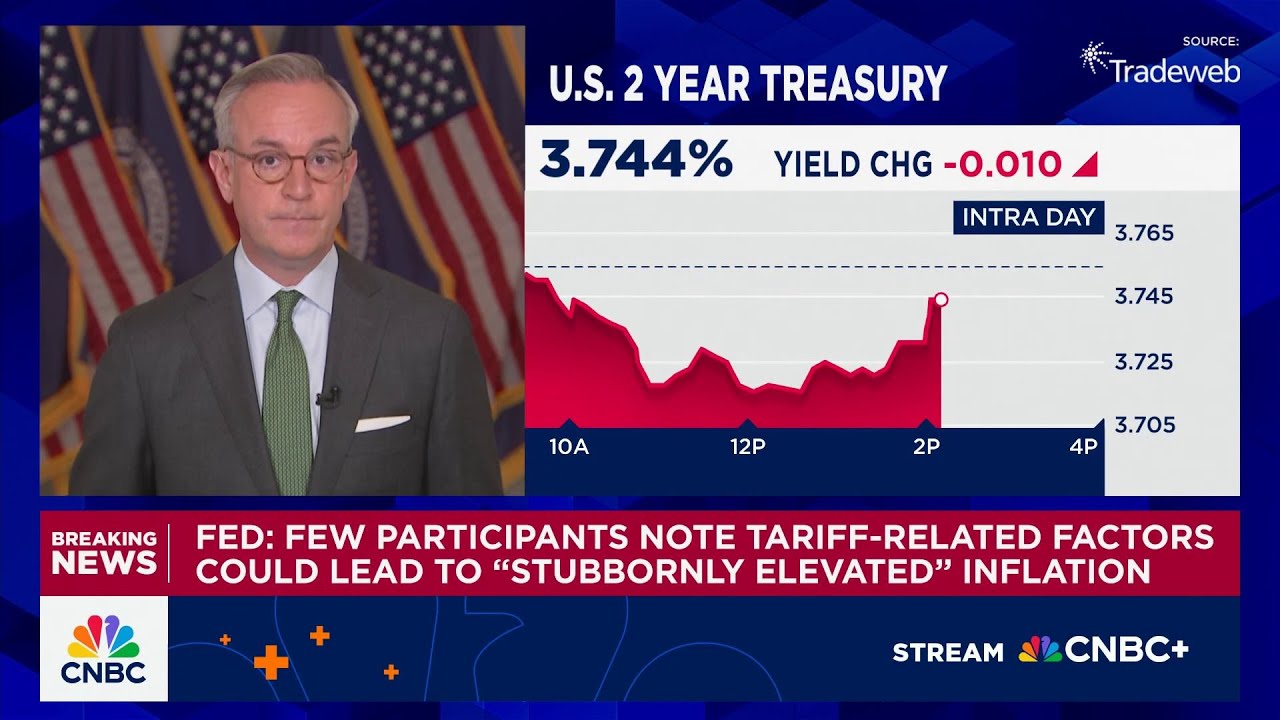

The Supreme Court decision striking down President Donald Trump@s (pic) sweeping global tariffs reverberated across the US$30 trillion US bond market by threatening to increase the government@s budget deficit and pour fuel on an economy already contending with elevated inflation.

Feb 23, 2026

The Securities Commission Malaysia (SC) says the digital asset liberalisation initiative aligns with a broader global shift where industry development has accelerated due to significant external tailwinds.

Feb 16, 2026

GROWING numbers of emerging-market companies are borrowing overseas at cheaper rates than their countries of origin, a sign that sovereign risk is becoming less of a drag for the stronger, export-focused names. @

Feb 13, 2026

The Joint Committee on Climate Change (JC3) held its 16th meeting on 29 January 2026 to review ongoing progress and set strategic priorities for 2026. At the meeting, JC3 also reaffirmed its priority in accelerating climate action in the real economy by mobilising finance for impactful climate...

Feb 13, 2026

The Malaysian economy advanced by 6.3% in the fourth quarter of 2025 (3Q 2025: 5.4%), driven mainly by domestic demand. Growth in household spending was higher, driven by positive labour market conditions and income-related policy support. The strong investment growth was underpinned by stronger...

Feb 12, 2026

The Digital Asset Innovation Hub (DAIH) has onboarded three initiatives to test real-world applications involving ringgit stablecoins and tokenised deposits in 2026, according to Bank Negara Malaysia (BNM).

Feb 06, 2026

Malaysian assets are drawing global investors as a soft US dollar and rising geopolitical tensions spur diversification and the country@s stability and growth are seen as an attractive alternative to stuttering regional rivals.

Nov 18, 2025

Aug 21, 2025

Jul 23, 2025

Jul 02, 2025

Jun 29, 2025

Jun 19, 2025

Dec 20, 2024

Oct 16, 2024

Aug 26, 2024

Jun 07, 2024