BIX ARTICLE

Monthly Fixed Income Report: July 2025

Aug 01, 2025

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

MONTHLY FIXED INCOME REPORT : JULY 2025

Ringgit Bond and Sukuk Market Surpasses RM2.205 trillion in July 2025

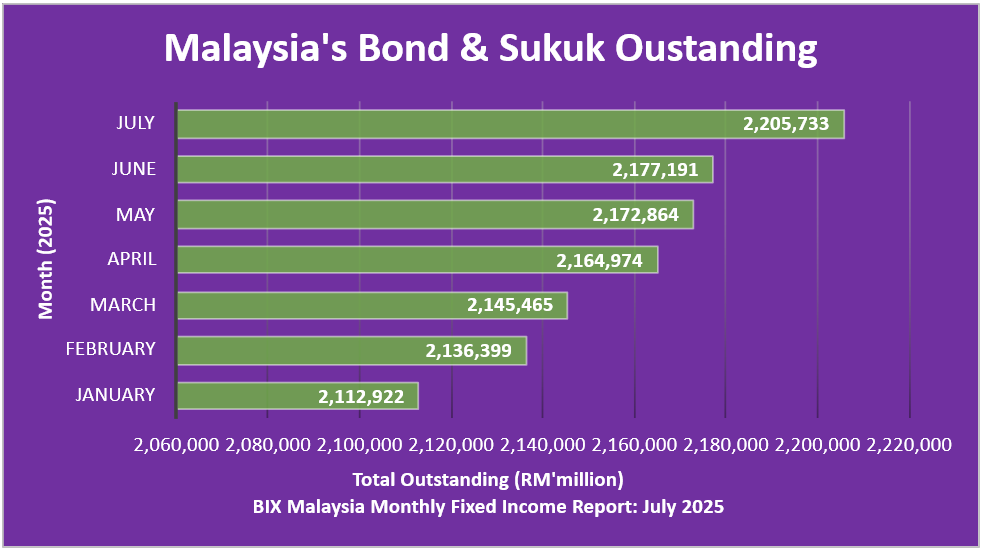

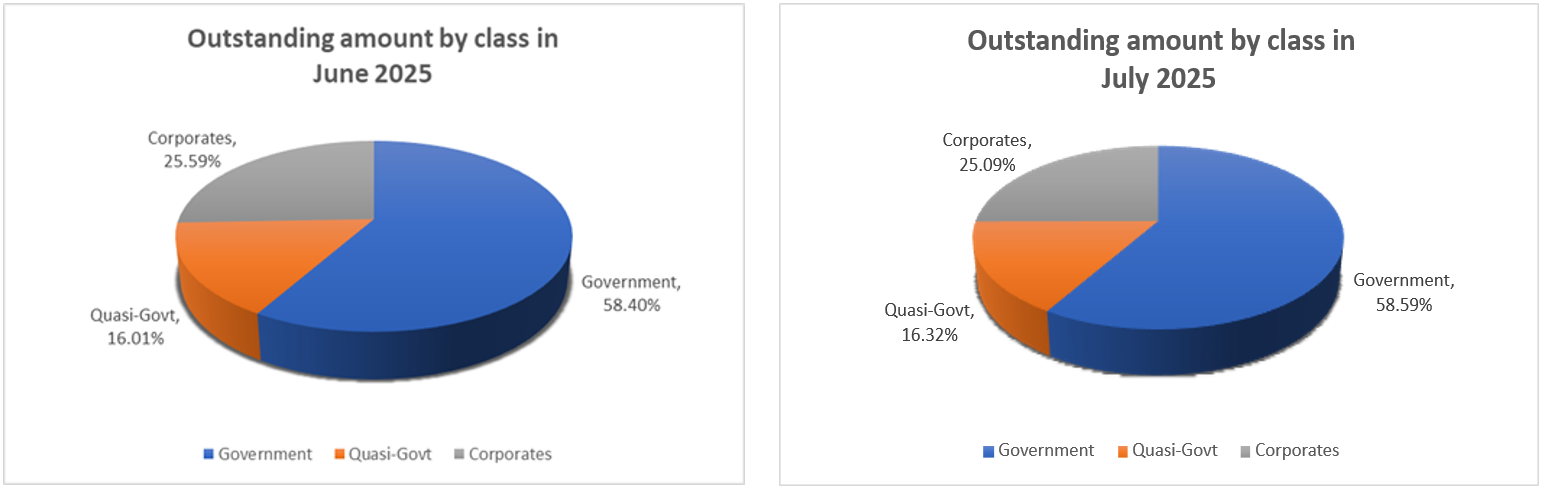

Malaysian ringgit bond and sukuk market sustained its positive momentum in July 2025, posting a steady month-on-month (MoM) growth of 1.29%. The total outstanding volume rose to RM2.205 trillion, up from RM2.177 trillion in June, reinforcing a gradual yet consistent upward trend. Government issuances continued to lead the market, accounting for 58.59% of the total, while quasi-government (16.32%) and corporate (25.09%) segments maintained their respective shares.

On a year-to-date (YTD) basis, the market has grown by RM105 billion, marking 5.00% increases since December 2024, when outstanding volume stood at RM2.10 trillion. This sustained expansion highlights the market’s resilience and robust investor confidence in Malaysia’s fixed-income securities amid evolving economic conditions in 2025.

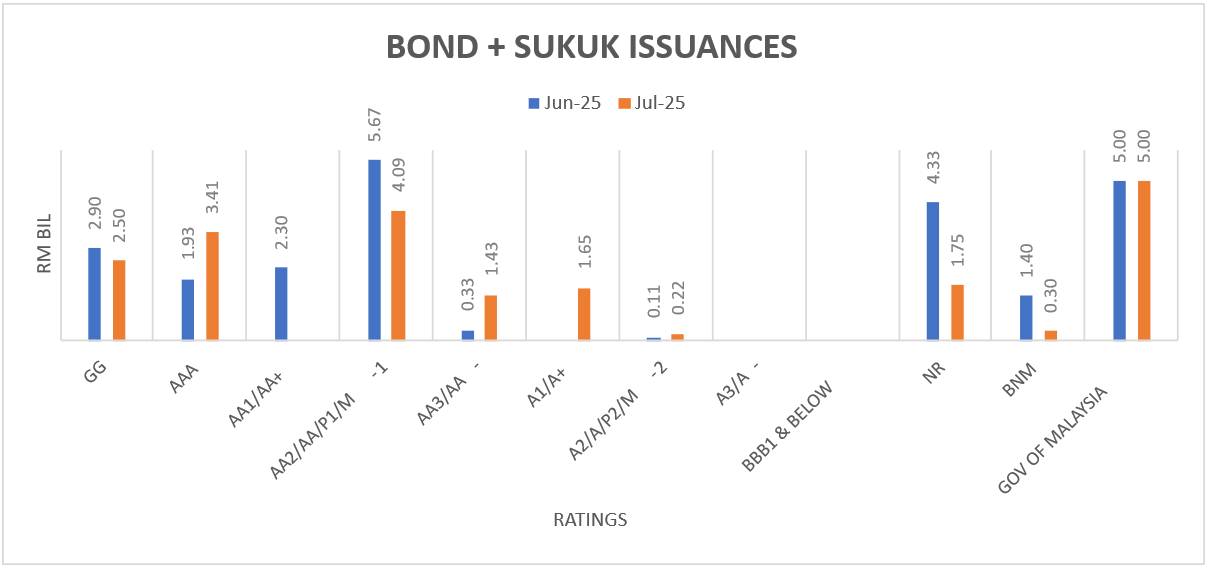

The Malaysian ringgit bond and sukuk market recorded an 8.21% month-on-month (MoM) declined in total issuance, falling to RM20.35 billion in July 2025 from RM22.17 billion in June. Government bond issuances remained steady at RM5.00 billion, while Bank Negara Malaysia (BNM) saw a sharp 78.57% drop in issuances, settling at RM0.30 billion compared to RM1.40 billion the previous month.

Meanwhile, the corporate segment experienced a 14.34% MoM decline, with total issuance falling to RM15.05 billion. This decrease was driven by weaker activity in AA2/AA/P1/M-1 rated bonds, which fell to RM4.09 billion from RM5.67 billion in June. Notably, there were no AAA/AA+ rated bond issuances in July, following RM2.30 billion worth of issuances in the preceding month. The overall slowdown reflects subdued activity across both government and corporate debt markets.

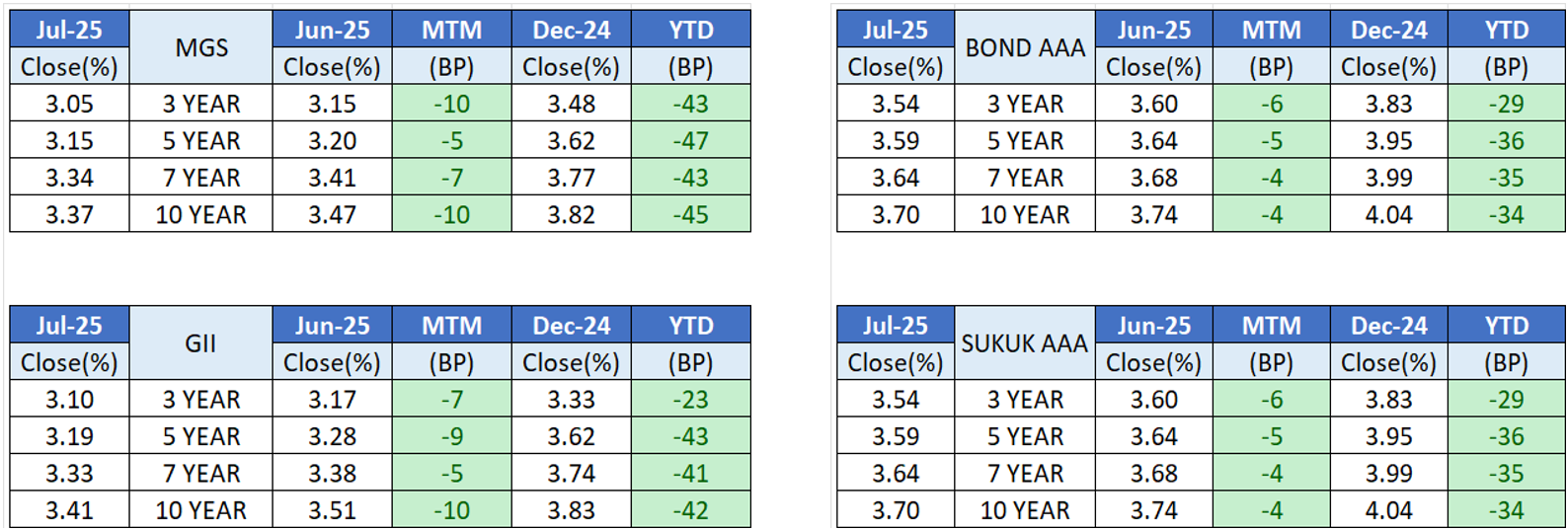

The Malaysian fixed income market experienced widespread yield reductions across both sovereign and corporate instruments during July 2025, reflecting favourable market dynamics. The downward trend followed Bank Negara Malaysia's decision to lower the overnight policy rate to 2.75% on 9 July 2025.

In the sovereign space, benchmark yields showed consistent softening. Malaysian Government Securities (MGS) recorded a 10-basis point decrease for both 3-year and 10-year tenors, settling at 3.05% and 3.37% respectively. Government Investment Issues (GII) followed a similar pattern, with 3-year yields declining 7 basis points to 3.10% while the 10-year yield fell 10-basis points to 3.41%.

Corporate debt instruments mirrored this trend, though with more moderate movements. AAA-rated 3-year bonds and sukuk saw yields contract by 6-basis points to 3.54%, while their 10-year counterparts experienced a 4-basis point reduction to 3.70%. The across-the-board yield compression underscored the market's positive reception to the central bank's accommodative monetary policy stance.

END OF REPORT

1st August 2025

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

(201701039928) (1254101-K)

YOU MAY ALSO LIKE

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read

ARTICLE

Oct 16, 2025

|

5 min read

ARTICLE

Sep 03, 2025

|

4 min read