BIX ARTICLE

Convertible Bonds in Malaysia

Oct 16, 2025

|

5 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

In the dynamic world of corporate finance, companies are constantly seeking innovative ways to raise capital. One such instrument that has gained traction in Malaysia is the Convertible Bond. Often dubbed a "hybrid security," a Convertible Bond blends the features of debt and equity, offering a compelling proposition for both issuers and investors.

A convertible bond enables the investor to convert the bond into equity, typically an ordinary share, within a specified time period. The number of shares the investor will get will depend on the ‘conversion price’ as determined in the terms of the bond.

What is Convertible Bonds?

At its core, a convertible bond is a type of corporate debt. An investor lends money to a company and, in return, receives regular interest payments (the "coupon") and the promise of their principal back at maturity just like a regular bond.

The key differentiator is the embedded option. The bondholder has the right, but not the obligation, to convert their bonds into a predetermined number of the company's ordinary shares. This conversion can typically happen at specific times before the bond matures.

Why do Malaysian companies issue Convertible Bonds?

For Malaysian public listed companies (PLCs), convertible bonds are a strategic financing tool:

- Lower Cost of Capital: Because investors are granted the valuable conversion option, companies can issue Convertible Bonds with a lower interest rate compared to conventional bonds. This reduces the company's interest expense.

- Deferred Equity Dilution: Issuing new shares immediately dilutes the ownership of existing shareholders. A Convertible Bond allows a company to raise debt now, with equity dilution occurring only if and when investors choose to convert, typically when the share price has risen.

- Attracting a Broader Investor Base: Convertible Bonds appeal to both conservative bond investors and growth-oriented equity investors, widening the pool of potential capital.

- Funding Growth and Acquisitions: They are often used to finance expansion projects, R&D, or acquisitions, especially for growth companies in sectors like technology or healthcare.

For investors, Convertible Bonds offer a "heads-I-win,-tails-I-don't-lose-much" structure:

Downside Protection: If the company's share price performs poorly, the investor can still hold the bond to maturity and receive the principal back, collecting interest along the way. This provides a safety net not available with direct equity investment.

Upside Participation: If the company thrives and its share price rises above the "conversion price," the investor can convert their bonds into shares, locking in a profit.

Regular Income: The coupon payments provide a steady income stream while the investor waits for a conversion opportunity.

Convertible Bonds issuances in Malaysia

The Malaysian market, regulated by the Securities Commission Malaysia (SC), has seen a steady flow of Convertible Bonds issuances. They are particularly popular among small to mid-cap companies looking to fund their growth trajectory without the immediate pressure of high debt servicing costs or significant equity dilution. Investors can find Convertible Bonds issued by Malaysian PLCs traded on the Bursa Malaysia.

Example of Convertible Bonds in Malaysia

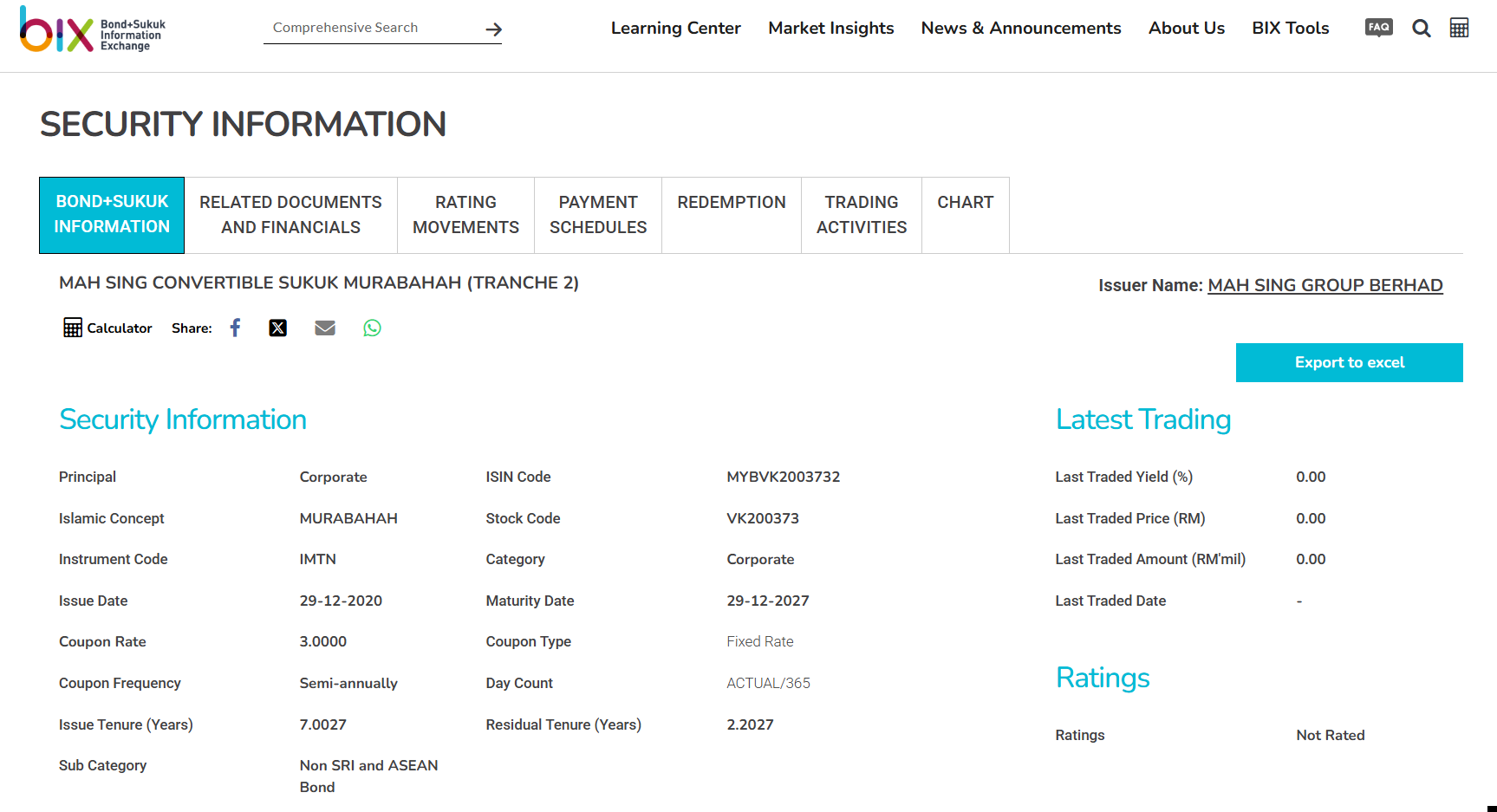

Mah Sing Group Bhd issued up to a RM100 million unrated seven-year redeemable convertible sukuk murabahah to fund future investments and working capital requirements. For the RM100 million fresh capital to be raised, the group has earmarked RM95 million for future investments in its business. The balance RM5 million would be used for working capital requirements.

In a bourse filing, the group announced that the RM100 million sukuk issuance with a conversion price of RM 0.755 which is part of its RM1 billion Islamic Medium Term Note (IMTN) programme which allows for multiple issuances of rated, unrated, secured and/or unsecured IMTNs.

If all sukuk holders convert their bond into shares, this would result in Mah Sing's share capital to increase by 132.45 million shares.

Conclusion

Convertible bonds represent a sophisticated and flexible instrument in Malaysia's capital markets. For companies, they are a cost-effective bridge to future equity. For investors, they offer a unique blend of security and growth potential. As the Malaysian economy continues to evolve, convertible bonds are likely to remain a key tool for corporate financing and strategic investment.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalized financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read