BIX ARTICLE

Riding the tokenisation wave

Aug 25, 2025

|

11 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

The presence of tokenised assets in Malaysia remains insignificant despite their exponential growth globally. But all this could change rapidly in the next five years, especially when it comes to bonds and unit trusts.

Tokenised assets are real world assets represented by digital tokens on a blockchain. They can be stocks, bonds, real estate, commodities like gold or more.

Investors with a cryptocurrency (crypto) wallet in their smartphone might be able to trade not only digital assets but also traditional assets in tokenised form. The line between the "new" and the "old" is fast blurring.

An indication of this emerged during MyFintech Week, Malaysia's flagship financial technology event, which was held in August. In his opening speech, Bank Negara

Malaysia governor Datuk Seri Abdul Rasheed Ghaffour announced that the central bank will publish a discussion paper on asset tokenisation by the end of the year.

Sitting on stage with Abdul Rasheed during a panel session titled "Navigating the Fintech Frontier'' was Securities Commission Malaysia (SC) chairman Datuk Mohammad Faiz Azmi.

Mohammad Faiz said the regulator wants the size of the digital asset market to grow to 8% of the equity market, without giving a specific timeline. Its current market size, five years after the first digital asset exchange (DAX) licence was issued, is roughly 1 % of the equity market

Mohammad Faiz also signalled that the regulator is adopting a more liberal approach for the DAXs to list digital tokens on their platforms for trading. "The other thing we are thinking about is, why be a nanny?

Let's put the onus on the players to figure out which [digital tokens] they want to offer clients. We are kind of shifting the regulatory perspective on that."

During the same session, two other panellists - Monetary Authority of Singapore (MAS)managing director Chia Der Jiun and Hong Kong Monetary Authority chief executive Eddie Yue - elaborated on the policies and intentions of each jurisdiction with regard to stablecoins, another form of blockchain-based tokens with values pegged to specific currencies.

A day later, Kenanga Investment Bank Bhd released its white paper titled "Project Juara: Malaysia's Asset Tokenisation Opportunity", jointly authored by Saison Capital Pte Ltd, Helicap Labs Pte Ltd (Helix) and Satori Research Ltd.

Saison Capital is the venture capital arm of Japan-based Credit Saison, which invests in early-stage companies; Helix is a blockchain-based tokenisation start-up founded in 2023, while Satori Research is a liquidity provider, market maker and algorithmic trader for digital assets.

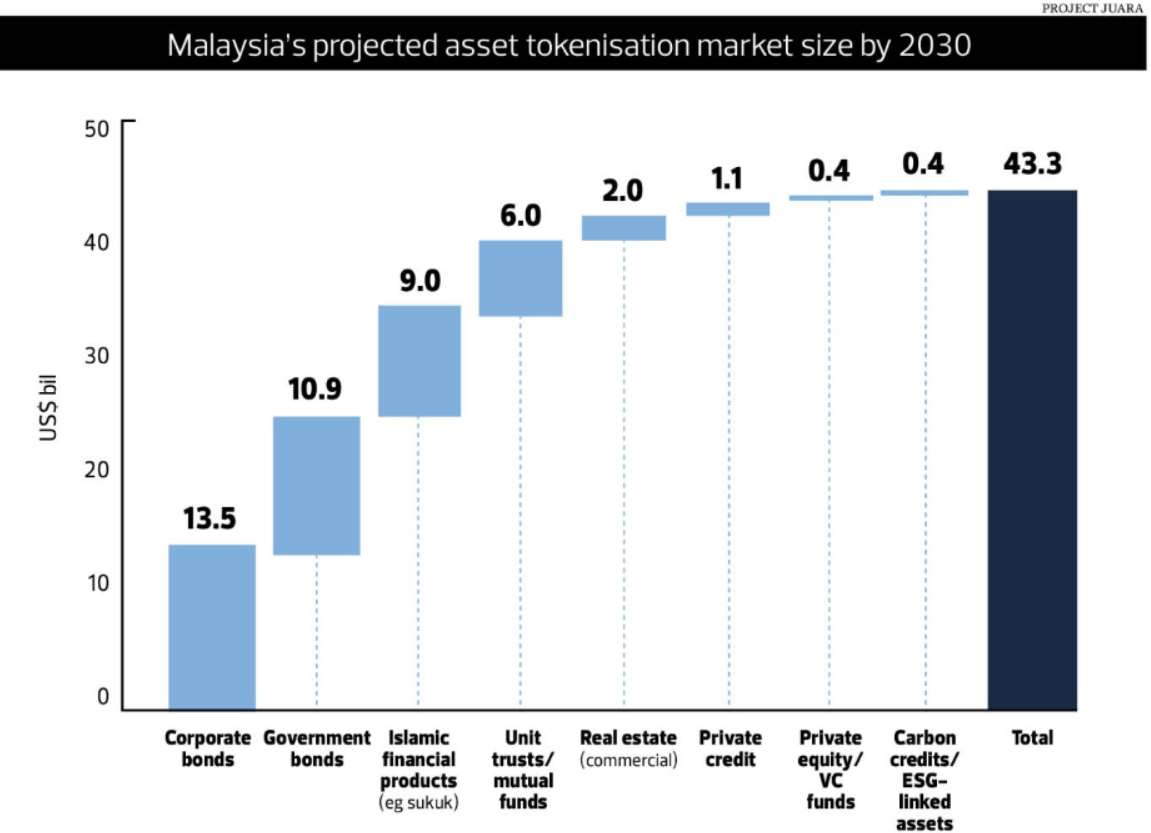

Just how big could tokenised assets grow in the next five years? Kenanga and its co-authors tag it at US$43 billion.

According to Project Juara's estimation, bonds and sukuk are the front runners in tokenisation. Tokenised corporate bonds could garner a market size of US$13.S billion by 2030 while government bonds could hit US$10.9 billion. This is followed by Islamic financial products, mainly sukuk (US$9 billion) and unit trust funds (US$6 billion).

In total, bonds are expected to take up US$33.4 billion, or 78% of the estimated total tokenised asset market size in Malaysia by 2030,according to the report.

Saison Capital partner Qin En Looi says the figure is a conservative estimate based on international growth trends for each asset class. The actual growth could be a lot higher.

"Back in 2020, tokenised asset [market size] was only at US$50 million. As at Aug 7 this year, the figure was at US$25 billion (RM106 billion). This figure excludes stablecoins and consists mainly of us Treasuries (UST) and [corporate] bonds. The market has grown by about soo times globally in the past five years. We benchmark the growth in Malaysia against this and made an estimation on each asset class," he says.

GAINING TRACTION

Globally, widely tokenised assets are the UST, money market instruments, private credit and specific commodities, such as gold, says Helix co-founder and CEO Jitendra Singh Jaitawat.

"The first breed [of asset class] that always gets tokenised is fixed income instrument. It is a natural fit due to its yield generating characteristic [where yields can be automatically distributed to token holders via smart contracts]," he explains.

On the local front, the SC introduced its regulatory sandbox in October last year to encourage securities tokenisation and spur innovations in the capital market. It also announced a collaboration with Khazanah Nasional Bhd to explore the issuance of tokenised bonds.

Several industry players say they expect Khazanah's tokenised bonds to be the first tokenised product in the market, partly due to the status, size and capability of the sovereign wealth fund. They believe that the Khazanah project will take time as its success is vital and Khazanah will have to decide on fundamental issues, such as which blockchain it wants to use to issue its tokens.

However, Hann Liew, co-founder and CEO of digital asset fund management firm Halogen Capital, says traditional assets - be they bonds or equities - can be easily tokenised through a unit trust fund structure. It is the lowest hanging fruit for asset tokenisation.

Why? Liew says assets, whether bonds, equities, real estate or gold, are already fractionalised into smaller units within a fund. For instance a bond fund breaks down bond issuances, typically worth several million ringgit per lot in the primary market, into much smaller units for retail investors to access. A real estate investment trust (REIT) does the same to real estate. The key difference lies in the underlying blockchain technology.

A unit trust fund is also known as a collective investment scheme that allows investors with similar objectives to pool their money to be invested in a portfolio of securities, including bonds and equities.

These securities are usually bought in large aggregated transactions with the fund house's master or omnibus trading account, instead of each investor's individual account. The securities are then fractionalised and assigned to each unit holder, while the calculation and recording of the "units" are done internally by the fund managers and trustees.

Liew says the fractionalising of "units" does not involve the transfer of actual shares or bonds from one central depository system (CDS) account or authorised depository institution (ADI) account to another, which involves interacting with the existing systems of Bursa Malaysia and Bank Negara, which is why tokenisation can be done more easily within a unit trust fund structure.

"The next step is merely to adopt blockchain technology.so you don't just rely on the trustee to do the calculations for the units. You rely on [computer] codes. Rather than using the word 'units', you use 'tokens'. It is the lowest hanging fruit in my opinion," he explains.

Liew's words are backed by action. He says Halogen Capital has tokenised its Halogen Shariah Ringgit Income Fund, a fixed income fund. The process started as early as 2023 when the company received funding from the SC's Digital Innovation Fund (Digid), which was set up to co-fund innovative projects to allow new and competitive propositions in the Malaysian capital market.

"We're piloting the project. The tokenised version of our fixed income fund has already been running for six months internally. All the tokens now are sitting in the wallet controlled by our trustee without being distributed to the users," Liew says, adding that those tokens are ready to be deployed and traded once the regulations permit.

"We're piloting the project. The tokenised version of our fixed income fund by already been running for six months internally. All the tokens now are sitting in the wallet controlled by our trustee without being distributed to the users." - Liew, Halogen Capital

It is not just the emerging and boutique fund houses that are looking into tokenising unit trust funds. Kenanga Investors Bhd, a long-established and reputable fund house, is actively looking at tokenising its money market fund, says Datuk Ismitz Matthew De Alwis, its CEO and executive director.

"We are exploring tokenising our money market funds through some live case studies. It is a process that is still in its early stages. As we go along, we are in consultation with the regulators about the regulations surrounding tokenised assets, before we make our next decision," he says.

"We are exploring tokenising our money market funds through some live case studies. It is a process that is still in its early stages." - De Alwis, Kenanga Investors

While they may not garner much attention, digital tokens are already in use locally for fundraising purposes. BidNow, a Malaysian auction platform, raised RMlO million from 469 investors last year through the pitchIN Token Crowdfunding(TCF) platform.

The second project raising funds on the TCF platform is Frac, a company that specialises in helping enterprises tokenise real-world assets, according to the pitchIN official website. As at Aug 12,it had raised RMl.54 million from 13 investors, exceeding its minimum fundraising target of RMl.5 mi11ion.

PitchIN and Kapital DX Sdn Bhd (KLDX) are currently the only two initial exchange offering (IEO) platforms licensed by the SC, allowing them to facilitate fundraising activities for start-ups and companies by issuing digital tokens.

KLDX's official website shows it has conducted seven primary listings, with the sole issuer being Integra Healthcare, a healthcare solutions provider. The most recent listing was the Integra Health-T9, a fixed-income instrument with a minimum funding amount of RMl million and a profit rate of 8%.

STABLECOIN AS HOT AS AI

Elsewhere, the adoption of asset tokenisation is growing, especially for stablecoins, according to C K Ong, chief operating officer of SBI Digital Markets, a Singapore-based digital solution provider regulated by MAS that is actively involved in asset tokenisation services.

Stablecoin, or tokenised cash - mostly backed by fiat currency or government debt paper - is taking the world by storm as Hong Kong passed its Stablecoin Bill in May, followed by the US passing its Genius Act in July that set up a regulatory regime for stablecoins.

"There is a lot of interest in stablecoins. It's almost as hot as AI (artificial intelligence) now," Ong says. SBI Digital Markets is a subsidiary of SBI Digital Asset Holdings, the digital asset arm of Japanese financial conglomerate SBI Group.

The latest trend surrounding stablecoin is how issuers can distribute yields to token holders.

Depending on the regulations of a specific jurisdiction, stablecoin issuers may back their digital tokens with fiat currency or government debt papers that pay interest periodically. The interest can be distributed to stablecoin token holders.

"However, if interest is distributed directly to the token holders, the regulators might look at them as securities and subject them to different sets of regulations;' he says.

So, industry players are coming up with solutions, such as enrolling clients under a "different programme" that entitles them to monetary returns.

Over the years, Ong has realised that the demand and risk appetite for tokenised assets can vary widely, which led SBI Digital Markets to tokenise niche assets for specific groups of clients like intellectual property.

"I'm trying to structure more specialised products that are harder for the bigger institutions like banks or asset managers to do. These are the more 'exotic' alternative products."

At the moment, Ong says stablecoin remains less explored by banks for obvious reasons, including cybersecurity and legal risk.

"A lot of people say this year is the year of tokenisation. But I don't see the industry showing a lot of transactions and trading volumes. I think it's just the start, rather than 'the year'." - Ong, SBI Digital Markets

In Malaysia, Blox Blockchain Sdn Bhd (Blox) is the only stablecoin issuer that has announced its product to the public while engaging with regulators.

Blox's MYRC, the ringgit stablecoin backed by the fiat currency at a one-to-one ratio, had 644 users that went through its know-your-customer process as at July 18.They transacted a total of RM53.18 million MYRC, with a total of RMl.16 million MYRC circulating in the market during the corresponding period.

Blox isn't a regulated entity and the MYRC is not legal tender, but the company has been engaging with regulators and is a participant of the PayNet Fintech Hub, Malaysia's first fintech-focused community and accelerator programme.

Blox co-founder and chief financial officer Ashwin Chockalingam says the firm continues to engage with Bank Negara for updates regarding the Digital Asset Innovation Hub launched in June. The hub aims to provide a controlled environment for fintech companies and innovators to test new products and services, such as programmable payments and ringgit-backed stablecoins, according to news reports.

While industry players agree that asset tokenisation is a major trend globally, SBI Digital Markets' Ong says it's still early days - the reason being transaction volumes in many of these tokenised assets remain thin.

"A lot of people say this year is the year of tokenisation. But I don't see the industry showing a lot of transactions and trading volumes. I think it's just the start, rather than 'the year'. I think it'll take another three to five years for adoption to pick up significantly," he opines.

Article by Kuek Ser Kwang Zhe. "Riding the tokenization wave." The Edge Malaysia, August 25, 2025, Wealth, p. 6 & 7.

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile. The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 25, 2026

|

3 min read

ARTICLE

Feb 24, 2026

|

7 min read

ARTICLE

Feb 23, 2026

|

5 min read

ARTICLE

Feb 23, 2026

|

3 min read