BIX ARTICLE

Green bond and sukuk in Malaysia

Aug 07, 2024

|

10 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

What is Green Bond?

A green bond is a type of debt instrument issued by governments, municipalities, or corporations to raise funds specifically for projects and activities that have positive environmental impacts. The key feature of a green bond is that the proceeds must be allocated exclusively to projects that promote environmental sustainability and address climate change through mitigation or adaptation strategies.

Characteristics of Green Bond

The primary purpose of green bonds is to finance projects that have positive environmental impacts. These may include renewable energy projects (such as solar or wind power), energy efficiency improvements, sustainable waste management, clean transportation initiatives, and projects aimed at mitigating climate change effects (like climate-resilient infrastructure).

Issuers of green bonds are required to allocate the proceeds specifically towards eligible green projects. This is typically verified and monitored through a process of reporting and certification to ensure transparency and accountability.

To maintain credibility and integrity, green bonds often adhere to internationally recognized standards or guidelines, such as the Green Bond Principles (GBP) established by the International Capital Market Association (ICMA), or the Climate Bonds Standard developed by the Climate Bonds Initiative.

Green bond appeals to investors who prioritize environmental sustainability and wish to support projects that contribute positively to addressing climate change and environmental challenges. Demand for green bonds has been increasing as investors seek to align their investments with sustainability goals.

Green bonds typically offer financial returns similar to conventional bonds issued by the same issuer, with comparable interest payments and principal repayment terms. The distinction lies in the dedicated use of funds for green projects and enhanced transparency regarding the environmental impact of these projects.

Benefits of Green Bond

Green bonds have emerged as a powerful tool, offering a unique avenue for companies, governments, and investors to work together towards a more sustainable future.

For companies and governments looking to finance green initiatives, green bonds offer a compelling solution. Firstly, they provide access to a dedicated pool of capital earmarked for environmentally beneficial projects. This could include financing renewable energy infrastructure, sustainable construction projects, or clean transportation initiatives.

Secondly, issuing green bonds can significantly enhance an issuer's reputation. Demonstrating a commitment to environmental stewardship through green bonds attracts positive publicity and positions the issuer favorably amongst environmentally conscious consumers and investors. This reputational boost can translate into a competitive advantage in today's market.

Furthermore, some governments offer favorable interest rates or tax breaks for green bonds. This can translate into lower borrowing costs for issuers, making green bonds an even more attractive financing option. Finally, issuing green bonds aligns perfectly with the growing focus on Environmental, Social, and Governance (ESG) factors. Companies and governments that prioritise ESG goals can leverage green bonds to showcase their commitment to sustainability and attract investors who share these values.

On the other hand, investors seeking to make a positive environmental impact while earning competitive returns will find green bonds a valuable addition to their portfolios. By investing in green bonds, individuals can directly contribute to financing projects that address climate change and promote environmental sustainability. This allows investors to align their financial goals with their environmental values.

Green bonds also offer diversification benefits. They represent an alternative asset class, potentially helping investors spread risk and achieve a more balanced portfolio. Importantly, green bonds generally offer market-competitive returns alongside the environmental benefits. Investors don't have to sacrifice financial goals to make a positive impact.

Challenges of Green Bond

While green bonds are instrumental in mobilizing capital for sustainable projects, ensuring transparency and accuracy in the use of proceeds remains a significant challenge. Robust verification and reporting processes are essential for confirming that funds are directed towards projects with verifiable environmental benefits. These processes require stringent frameworks to uphold market credibility and prevent issues such as greenwashing.

Furthermore, verifying the use of green bond proceeds involves intricate processes to track and document expenditures. Transparency is paramount in assuring investors that their funds support initiatives aligned with sustainability goals. This necessitates clear reporting from bond issuers detailing the allocation of funds and distinguishing between green and non-green expenditures. Such differentiation can be complex, requiring rigorous standards to prevent misleading claims and ensure that investments genuinely contribute to environmental stewardship.

Moreover, assessing the environmental impact of financed projects presents another hurdle. Establishing consistent metrics to evaluate outcomes across diverse sectors from renewable energy installations to sustainable infrastructure developments is essential. Accurate measurement requires reliable data and robust verification mechanisms to validate reported environmental benefits. Third-party certification further enhances credibility by independently confirming adherence to established sustainability criteria, mitigating risks such as greenwashing and bolstering investor confidence.

In addition to verification and reporting challenges, aligning with market standards and definitions presents another layer of complexity. Variations in definitions and standards across different green bond frameworks can lead to confusion and inconsistency in the market. For investors and issuers alike, navigating these discrepancies requires clarity and standardization. Harmonizing definitions and benchmarks for what constitutes a "green" project or investment can streamline decision-making processes, ensuring that green bonds fulfill their intended role in advancing sustainability objectives effectively.

Green Bond and Sukuk in Malaysia

In 2017, Malaysia issued the world’s first green SRI sukuk to finance the construction of large-scale solar photovoltaic power plants in Kudat, Sabah. In June 2022, the Securities Commission Malaysia (SC) introduced the Sustainable and Responsible Investment linked (SRI-linked) Sukuk Framework (SRI-Linked Framework), with the goal of enabling companies to raise funds to tackle sustainability concerns such as climate change or social agendas. Such funds would entail features that are connected to the issuer’s sustainability performance commitments.

Moreover, SRI-linked sukuk will enable companies in the relevant sectors to transition to a low-carbon or net zero economy. The SRI-Linked Framework represents an extension of the initiatives under the SRI Roadmap, which was unveiled in 2019 to amplify the range of SRI products. It also underlines the SC’s commitment to extending the reach of the Islamic capital market (ICM) to the broader stakeholders while developing an enabling ICM ecosystem for the sustainability thrust.

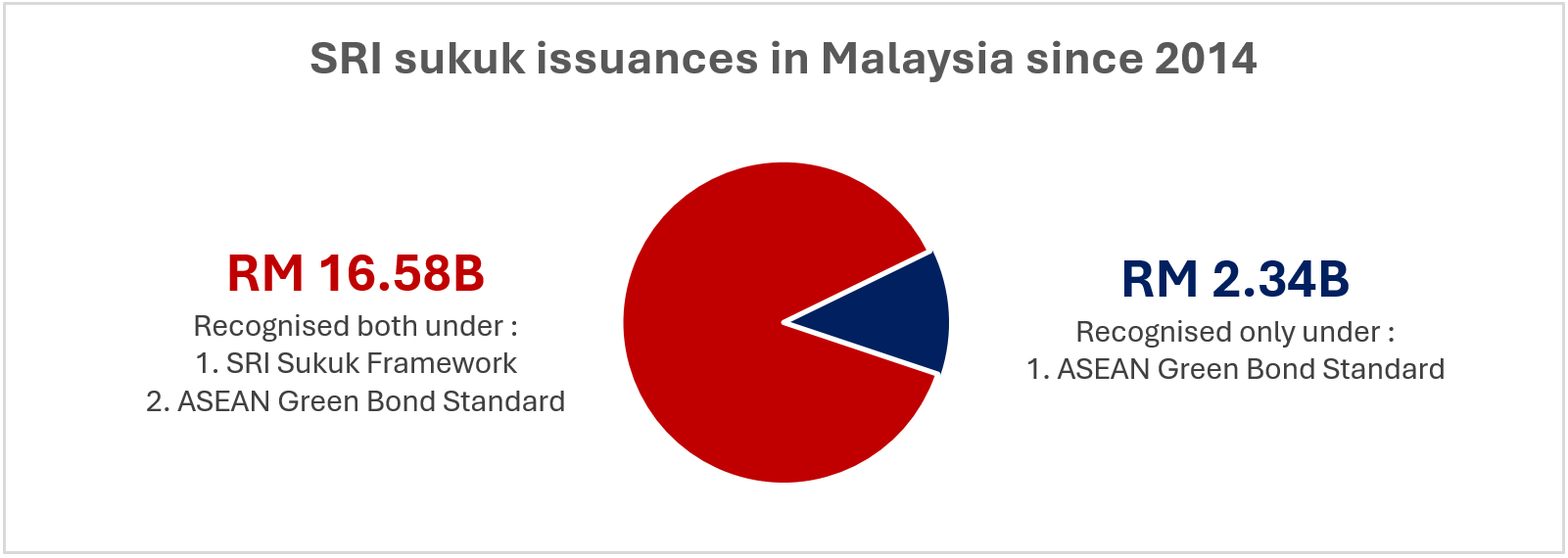

Notably, RM10.58 billion of SRI sukuk was issued in Malaysia in 2022. This brought the cumulative amount of SRI sukuk issuance under the SRI Sukuk Framework to RM18.92 billion since its debut in 2014. Of this, some RM16.58 billion was recognized under both the SRI Sukuk Framework and the ASEAN Standards. Issuances from Malaysia made up about 24% of the total issued under the ASEAN Standards.

Source: Capital Market Malaysia

Source: Capital Market Malaysia

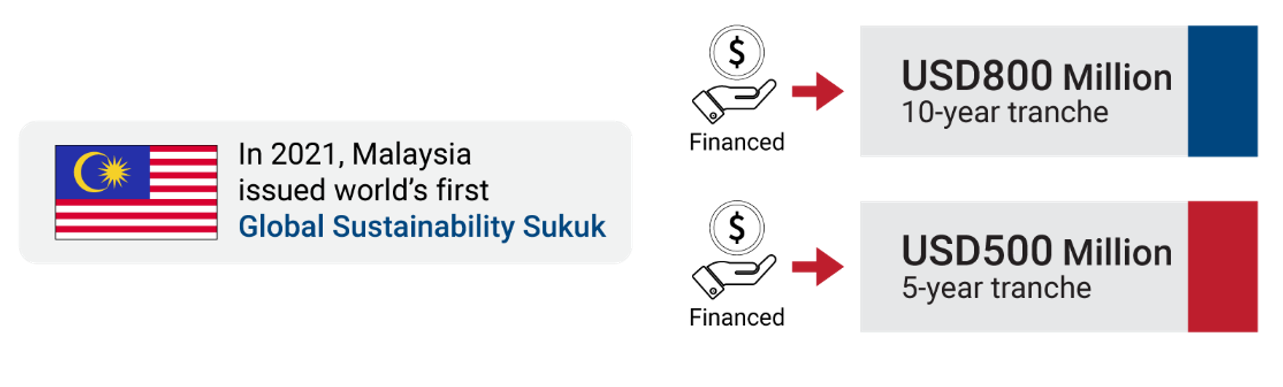

An interesting trend that has been a boon for the sukuk market in recent years is the uptick in environmental, social and governance (ESG)-related sukuk. While there have been issuances of sustainability conventional bonds or green sukuk, the Government of Malaysia (GoM)’s sukuk issuance on 28 April 2021 marked the first global sustainability sukuk when Malaysia issued its first sustainability Islamic trust certificates, comprising a USD800 million 10-year tranche (sustainability sukuk) and a USD500 million 30-year tranche. This maiden issuance via a special-purpose vehicle — Malaysia Wakala Sukuk — is in line with the GoM’s launched Sustainability Development Goals (SDGs) Sukuk Framework.

Source: Capital Market Malaysia

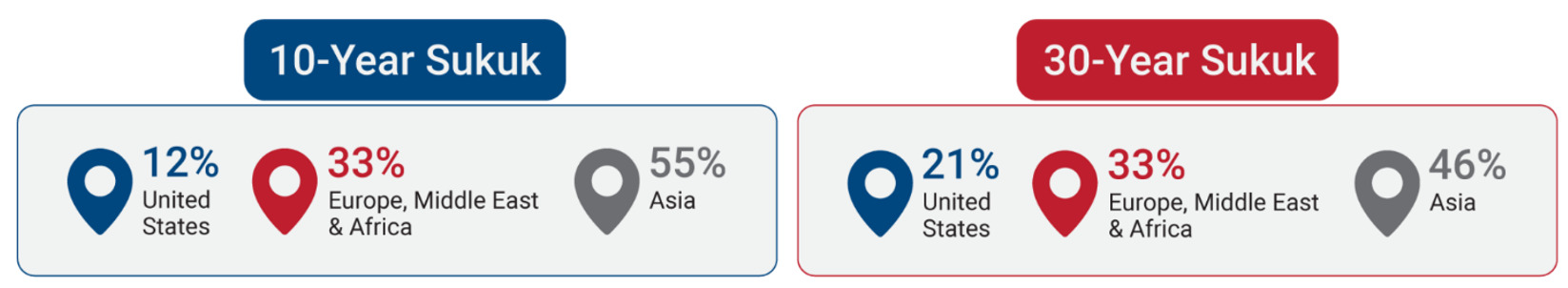

This issuance aligns with the ASEAN Sustainability Bond Standards and underlines the Government’s key role in driving Malaysia’s sustainability agenda. The sukuk proceeds will be used for eligible social and green projects that uphold the SDGs, which will also contribute to the country’s socioeconomic development. Notably, the 10-year sukuk attracted a diverse pool of investors, with 55% of the principal amount distributed to Asia, 33% to Europe, the Middle East and Africa (EMEA), and 12% to the US. Meanwhile, some 46% of the principal amount of the 30-year sukuk was channeled to Asia, followed by EMEA (33%) and the US (21%).

In terms of investor type, about 67% of the 10-year sukuk comprised fund managers and insurance companies, with central banks and governments taking up 18%, banks another 14% and other investors, 1%. As for the 30-year tranche, some 83% is attributable to fund managers, 10% to banks, 4% to central banks and governments, and 3% to other investors.

Tax Incentives on SRI Sukuk and Bond Issuances in Malaysia

In general, Tax deductions are available for issuance expenses related to all types of bonds and sukuk that meet green, social, and sustainable standards in Malaysia, as approved by the SC, up to the Year of Assessment (YA) 2023. As announced under Budget 2021, income tax exemptions are available to recipients of the SRI Sukuk and Bond Grant Scheme, for five years from Year of Assessment (YA) 2021 to YA 2025.

SRI Sukuk and Bond Grant Scheme

As part of ongoing efforts to encourage green financing, the SC established the SRI Sukuk and Bond Grant Scheme (the Scheme, formerly known as the Green SRI Sukuk Grant Scheme) in 2018. The Scheme covers up to 90% of the costs incurred by issuers on independent expert reviews of sustainable sukuk issuances under the SC’s SRI Sukuk Framework and bonds issued in Malaysia under the ASEAN Green, Social and Sustainability Bond Standards and SRI-linked Sukuk under the SRI-linked Sukuk Framework or bonds issued under the ASEAN Sustainability-Linked Bond Standards. As of June 2022, it had benefited 15 issuers involved in renewable energy, green building, and sustainable projects.

In August 2022, the SC expanded the Scheme to include SRI-linked sukuk issued under its SRI -Linked Sukuk Framework (announced in June 2022). This now renders SRI-linked sukuk issuers to also be eligible for the same benefits as those enjoyed under the SRI Sukuk Framework. The move is in line with the Capital Market Masterplan 3 emphasis on transition finance that will support Malaysia’s commitments and aspirations vis-à-vis changing to a low-carbon and climate-resilient economy. It aspires to encourage the issuance of SRI-linked sukuk by corporates in carbon-intensive industries, as they transition to better sustainability practices and low-carbon activities.

ASEAN Green Bond and Sukuk in Malaysia

As of 30 June 2024, 317 bonds and sukuk have been categorized as ASEAN on the BIX Malaysia platform. The platform defines ASEAN bonds and sukuk as those that comply with the ASEAN Green Bond Standards, ASEAN Social Bond Standards, or ASEAN Sustainability Bond Standards, as issued by the ASEAN Capital Markets Forum.

331 Bonds and Sukuk also has been categorized as Sustainable and Responsible Investment (SRI) as of 30 June 2024 on BIX Malaysia platform. BIX Malaysia platform provides the SRI bonds and sukuk as issuances that have complied with the SC’s SRI Sukuk Framework under the Guidelines on Unlisted Capital Market Products under the lodge and Launch Framework or Guidelines on Issuances of Corporate Bonds and Sukuk to Retail Investors.

Conclusion

In Malaysia, green bonds have expanded to include sukuk (Islamic bonds) under frameworks like the Sustainable and Responsible Investment (SRI) Sukuk Framework. This initiative supports projects aligned with sustainability goals, including Malaysia's transition to a low-carbon economy. Tax incentives and grant schemes further encourage issuers to adhere to green and sustainable standards in bond and sukuk issuance.

Overall, green bonds are crucial for financing projects that address climate change and environmental challenges. They attract socially responsible investors and enhance market transparency, contributing significantly to sustainability goals.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalized financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 13, 2026

|

4 min read

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Jan 21, 2026

|

4 min read