BIX ARTICLE

Monthly Fixed Income Report: July 2024

Aug 02, 2024

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

BIX MALAYSIA

MONTHLY FIXED INCOME REPORT: JULY 2024

Ringgit Bond and Sukuk market stood at RM2.072 trillion in July 2024

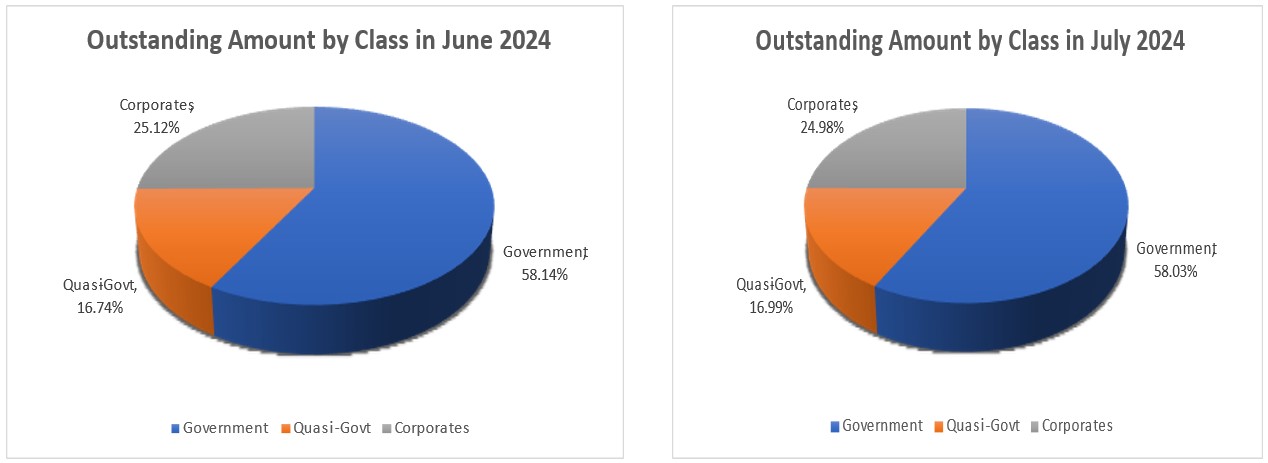

The ringgit bond and sukuk market grew by 0.39% in July compared to the previous month. Total outstanding recorded in July 2024 was RM2.072 trillion which increased by 0.39% compared to RM2.064 trillion in June 2024. This growth mainly contributed from government outstanding at 58.03%, followed by quasi government and corporates at 16.99% and 24.98%, respectively. For the first six months of 2024, the local bond market shows positive momentum by growing RM0.061 trillion compared to last year, where ringgit bond and sukuk market outstanding totalling amount of RM2.011 trillion as at end December 2023.

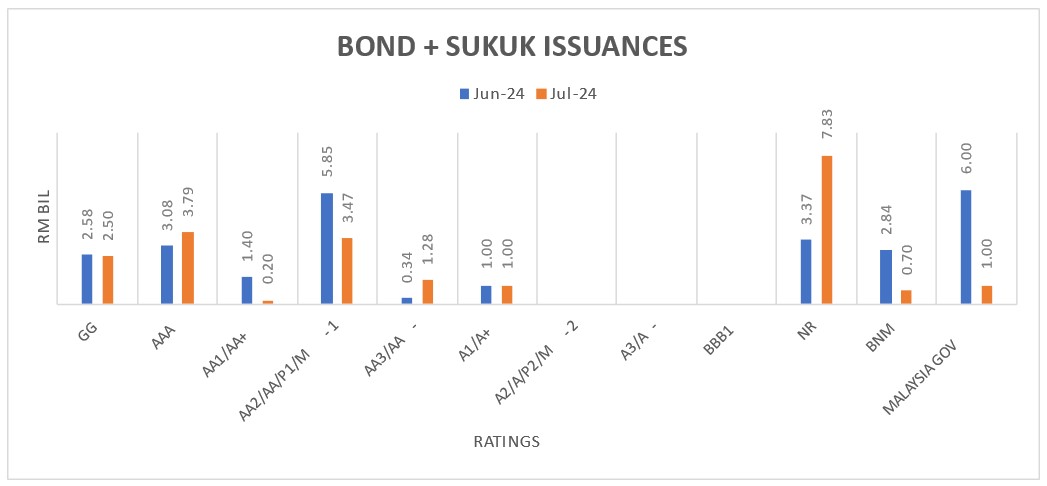

Total issuance for ringgit bond and sukuk in July 2024 declined by 17.72% to RM21.77 billion compared to RM26.46 billion in June 2024. Government ringgit bond and sukuk issuance decreased by 80.77% to RM1.70 billion in July 2024 compared to RM8.84 billion in the previous month. Bank Negara Malaysia (BNM) recorded issuance of RM0.70 billion in July 2024, lowered by 75.35% compared to an issuance of RM2.84 billion in the previous month.

Corporate issuance increased by 13.90% to RM20.07 billion in July 2024 compared to RM17.62 billion in June 2024. Non-rated bonds recorded the highest issuance in July with total issuance of RM7.83 billion, an increase of 132.34% compared to RM3.37 billion in the previous month.

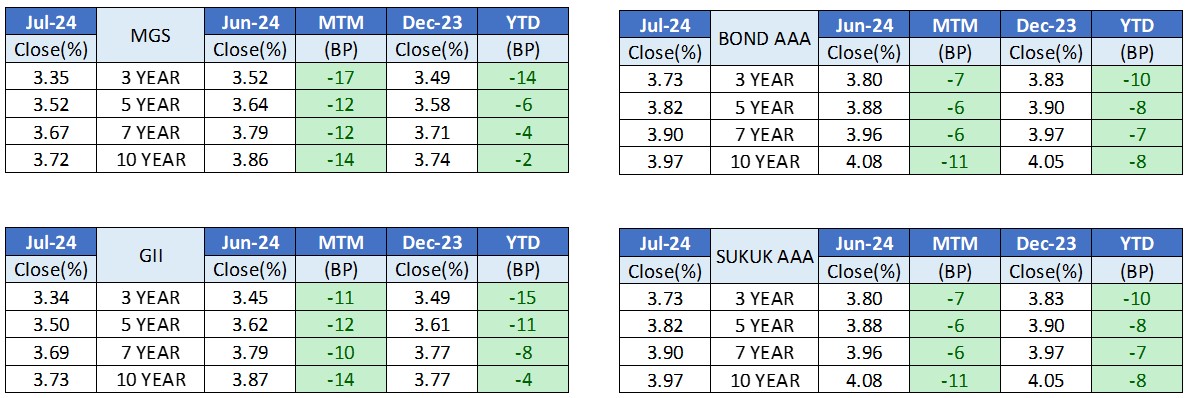

Malaysian Government Securities (MGS) 3-Year closed lower at 3.35% in July compared to 3.52% in June 2024. The 10-year MGS closed at 3.72% in July compared to 3.86% in June showing reduction of 0.14% or 14bps. Government Investment Issues (GII) 3-Year closed at 3.34% in July and at 3.45% in April 2024 where it’s yield declined by 0.11% or 11bps. 10-year GII also declined to 3.73% in July, down by 0.14% or 14bps compared to 3.87% in June 2024.

3-Year AAA-rated corporate bond and sukuk closed at 3.73% in July compared to 3.80% in June 2024 which reduced by 0.07% or 7bps, while the 10-year AAA-rated bond and sukuk closed at 3.97% in July compared to 4.08% in the previous month which is down by 11bps.

END OF REPORT

2nd August 2024

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

(201701039928) (1254101-K)

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read