BIX ARTICLE

How ESG Bonds and Sukuk Can Accelerate Malaysia’s Green Technology Master Plan

Jul 16, 2025

|

5 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

Introduction

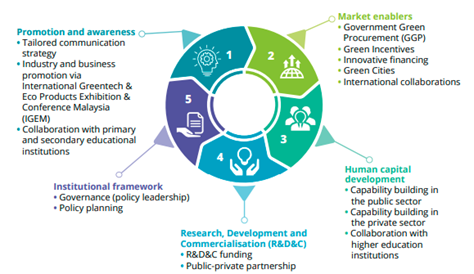

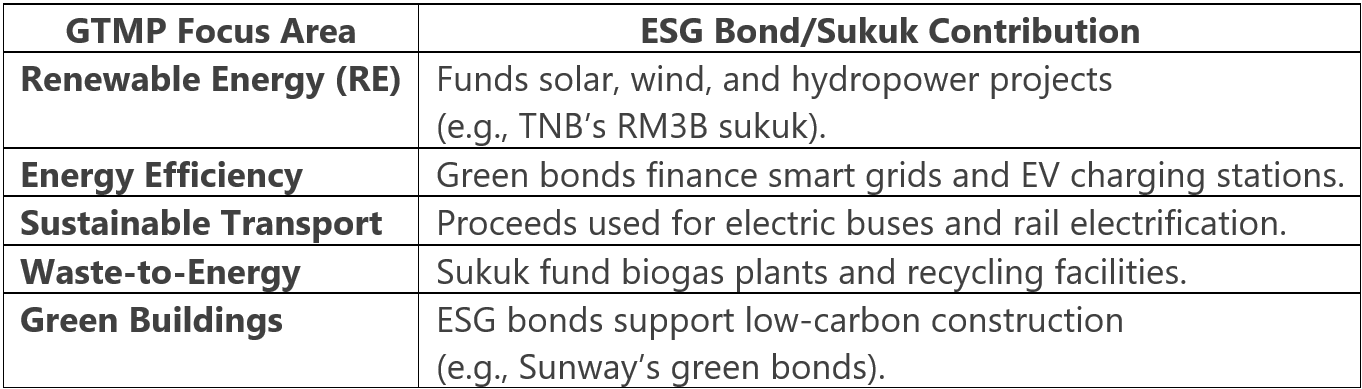

Malaysia’s Green Technology Master Plan (GTMP) 2030 aims to position the country as a leader in sustainable development, targeting carbon neutrality by 2050 and a green economy contribution of RM100 billion by 2030. To achieve these ambitious goals, ESG bonds and sukuk are emerging as critical financing tools, attracting both domestic and global investors.

The Rise of ESG Bonds & Sukuk in Malaysia

Key ESG Bond/Sukuk Trends Supporting GTMP

- Government-Led Green Sukuk

- Bank Negara Malaysia (BNM) issued RM5.5 billion in sustainability sukuk (2023), funding renewable energy (RE) and electric vehicle (EV) infrastructure.

- The World Bank endorsed Malaysia’s sovereign green sukuk framework, boosting investor confidence.

- Corporate Green Financing

- PETRONAS raised RM4.8 billion via sustainability-linked bonds (SLBs) for carbon capture and hydrogen projects.

- Tenaga Nasional (TNB) issued RM3 billion green sukuk for solar and hydropower expansion.

- Blended Finance & Public-Private Partnerships

- The Malaysia Green Technology and Climate Change Corporation (MGTC) collaborates with banks to structure blended ESG sukuk, combining public grants with private capital.

Challenges & Opportunities

Challenges:

- Limited standardized ESG metrics for issuers.

- Higher due diligence costs for green projects.

- Investor education needed on Sharia-compliant ESG instruments.

✔ Digital Sukuk & Blockchain – BNM’s DuitNow Sukuk streamlines retail investor access.

✔ ASEAN Green Taxonomy – Malaysia’s alignment improves cross-border ESG investments.

✔ Carbon Credit-Linked Sukuk – New structures incentivize emissions reduction.

The Road Ahead

With GTMP 2030 in full swing, ESG bonds and sukuk will be pivotal in:

- Scaling up renewable energy (target: 31% RE mix by 2025).

- Building climate-resilient infrastructure.

- Attracting foreign ESG investments (especially from the Middle East and Europe).

In a bold move to accelerate Malaysia’s green finance agenda, BIX Malaysia has unveiled its Sustainable and Responsible Investment (SRI) Center —a dedicated digital hub on the BIX website designed to empower investors, businesses, and the public with critical ESG investment insights.

Once considered niche, SRI has now surged into the mainstream, fueled by a global shift toward climate-conscious investing. Discerning investors are increasingly aligning their portfolios with sustainable ventures, recognizing the capital market’s pivotal role in financing a greener future.

The SRI Center is more than just a webpage—it’s a comprehensive toolkit for navigating the future of finance, featuring:

- SRI Overview

- Articles & Tutorials

- SRI Announcements

- BPAM ESG Bond Index

- Listings

Conclusion

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 13, 2026

|

4 min read

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Jan 21, 2026

|

4 min read