BIX ARTICLE

Emerging-market bonds in Asia, including Malaysia, seen as the new standards for fiscal control

Jul 15, 2025

|

5 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

While long-dated bonds in developed markets have come under pressure this year as investors grow wary about government spending, emerging-market bonds in Asia have become a hot pick. Yields have tumbled, foreign funds have flowed in and recent debt auctions have enjoyed strong demand, unlike a number of prominent developed-market sales from the US to Japan.

“Many countries in the region are expected to be hit by tariffs, but we haven’t seen them rolling out fiscal stimulus and most are maintaining low budget deficit targets,” said Yifei Ding, a portfolio manager at Invesco Hong Kong Ltd, who said emerging-market bonds now offer good value.

This investment thesis underscores the stark shifts that have taken place in global markets this year. When Treasuries were roiled in April by deep anxiety over tariffs, former Treasury Secretary Lawrence Summers said US bonds had started trading like emerging-market debt. Now, investors are increasingly turning to the real thing.

Primary auction results underscore the demand. Indonesia’s early July bond sale drew the strongest interest since early 2020. Thailand’s 30-year benchmark offering on July 2 was met with the highest bid-to-cover ratio in two years. A similar super-long issuance by Malaysia in June drew bumper demand.

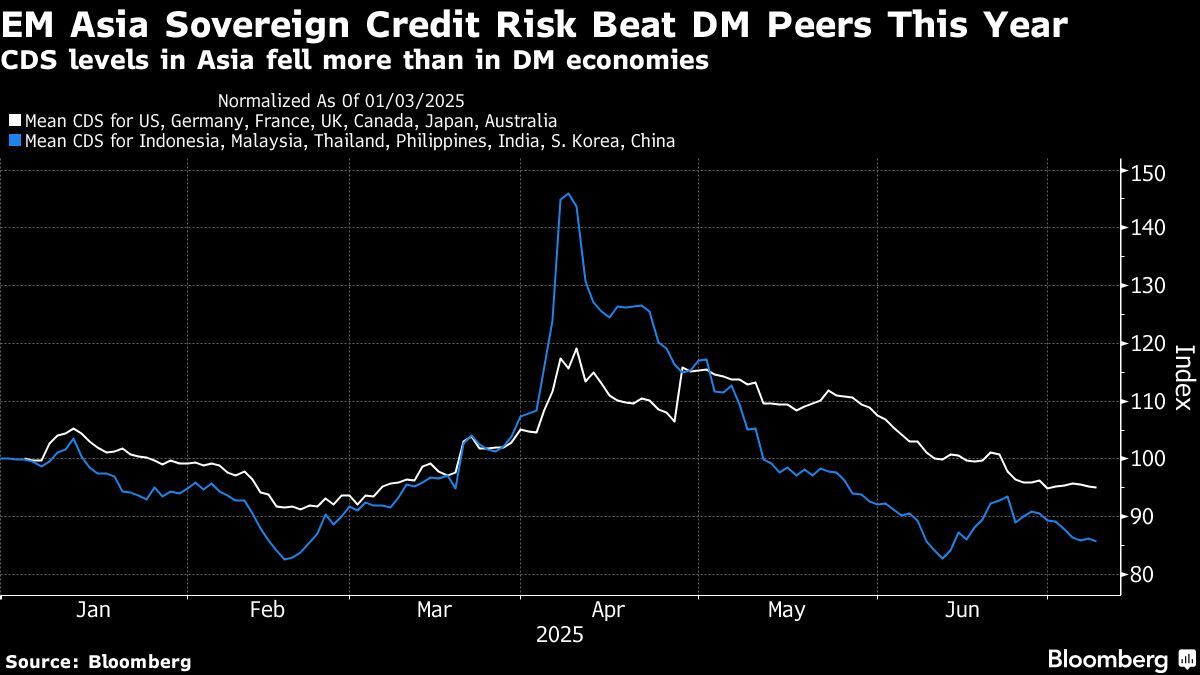

Emerging-market bond yields have declined over the past year, while those in major developed markets have pushed higher, according to Bloomberg data. Credit default swaps on emerging Asian countries — a measure of how much investors pay to insure against default — have fallen much more than those on developed countries since US President Donald Trump announced his so-called ‘Liberation Day’ tariffs in April.

Sovereign credit ratings for large Asian economies appear resilient given their strong currency reserves, limited reliance on overseas debt and healthy current account balances, wrote Goldman Sachs Group Inc analyst Kenneth Ho in a note on July 10.

Fiscal prudence

The differing fortunes of emerging and developed bond markets aren’t all down to fiscal policy. Emerging-market bonds still offer higher yields than those in the US and elsewhere. There is often less supply. Central banks in these countries may have a clearer read on inflation than the Federal Reserve, allowing them to get ahead of the US with rate cuts.

The dollar’s roughly 8.3% slump this year is also a big factor. Investors who expect the decline to continue will naturally look at bonds in other currencies.

But improving fiscal responsibility in emerging markets is helping tip the balance. While the US fiscal deficit rose from 3.7% in 2022 to 7.3% last year, the average deficit in emerging Asia fell slightly to 6.7%, according to the International Monetary Fund.

“Many countries were unwilling to pursue deficit-driven growth policies,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management. “Monetary and fiscal prudence have also helped contain inflation and allowed emerging-market policymakers to cut rates even with the Fed holding steady.”

There are signs that fiscal consolidation is improving in some emerging economies outside of Asia, giving a glimmer of hope for investors in other developing markets. Romania recently tapped bond investors in euros and dollars after announcing an austerity plan that fuelled a rally in its debt. Argentina has returned to a primary budget surplus thanks to the sweeping cuts of free-market-loving President Javier Milei.

But so far, the clear moves by bond investors are happening in Asia. Global funds collectively poured US$34 billion (RM144.72 billion) into Thai, Indonesian, Malaysian, Indian and South Korean bonds in the second quarter, according to data compiled by Bloomberg, the largest quarterly inflow in two years.

BY MARCUS WONG & BHASKAR DUTTA / BLOOMBERG

Uploaded by Tham Yek Lee

Source: Emerging-market bonds in Asia, including Malaysia, seen as the new standards for fiscal control (14 Jul 2025, 03:23 pm). The Edge. Retrieved from https://theedgemalaysia.com/node/762504

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile. The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 16, 2026

|

5 min read

ARTICLE

Feb 12, 2026

|

4 min read

ARTICLE

Feb 06, 2026

|

5 min read

ARTICLE

Feb 06, 2026

|

3 min read