BIX ARTICLE

Callable Bonds in Malaysia

May 15, 2025

|

5 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

Introduction

Callable bonds are fixed-income securities that grant issuers the right (but not obligation) to repay the bond before its maturity date. In Malaysia, these bonds are used by corporations, banks, and the government to reduce borrowing costs when interest rates fall. This article breaks down how callable bonds work, their pros and cons, and their role in Malaysia’s financial market. This article explores the features, benefits, risks, and market trends of callable bonds in Malaysia.

What Are Callable Bonds?

A callable bond lets the issuer "call back" (redeem) the bond early, usually when interest rates drop. For example, if a company issues a 10-year bond at 5% and rates later fall to 3%, it can call the bond, repay investors early, and re-borrow at the lower rate. While this saves money for issuers, investors risk losing their high-interest income and may struggle to reinvest at the same rate.

Key Features of Callable Bonds in Malaysia:

- Call Option: Issuer can repay the bond early at a preset price.

- Call Protection Period: A "safety period" (e.g., first 5 years of a 10-year bond) where the bond cannot be called.

- Higher Coupons: Investors earn extra interest to compensate for the risk of early redemption.

- Common Issuers: Banks (e.g., Public Bank), government-linked firms (e.g., Petronas), and large corporations.

Advantages of Callable Bonds

For Issuers:

- Lower Interest Costs: Refinance expensive debt if rates fall.

- Flexibility: Adjust debt structure without waiting for maturity.

For Investors:

- Higher Returns: Callable bonds pay more interest than regular bonds.

- Liquidity: Actively traded on Bursa Malaysia’s bond market.

Risks of Callable Bonds

For Investors:

- Reinvestment Risk: If the bond is called, you might reinvest at lower rates (e.g., earning 3% instead of the original 5%).

- Price Volatility: Bond prices drop when rates rise (since issuers are less likely to call them).

- Unpredictable Income: Early redemption disrupts long-term income plans.

- Higher Initial Payments: Must offer attractive rates to offset investor risks.

- Reputation Damage: Frequent bond calls may deter future investors.

Callable Bonds in the Malaysian Market

Regulatory Framework

The Securities Commission Malaysia (SC) regulate bond issuances, including callable bonds. Key guidelines include:

- Securities Commission Malaysia (SC): Requires clear disclosure of call terms in bond prospectuses.

- Call Protection: Rules ensure a minimum period (e.g., 5 years) where bonds can’t be called.

Example Callable Bonds in Malaysia

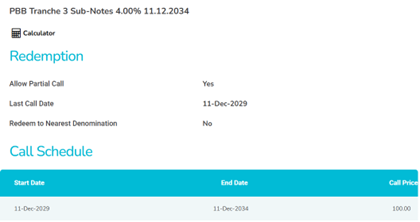

- Issuer: Public Bank Berhad (PBB).

- Details: 10-year bond issued in 2024 at 4% interest, callable after 5 years.

- Call Schedule: After 5 years, PBB can redeem the bond at a preset price

Details: Issued third tranche of subordinated notes (sub-notes) amounting to RM0.5 billion under its RM20 billion note programme.10-year subordinated bonds in 2024, callable after 5 years.

References: https://www.bixmalaysia.com/security-info-page?SBID=15279#security-information-tab1

Recent Trends

- Corporate Issuers: Infrastructure firms like Tenaga Nasional use callable bonds to lock in low rates.

- Government-Linked Issuers: Khazanah Nasional issues callable bonds for flexible debt management.

- Islamic Callable Sukuk: Structured under Sharia principles (e.g., Mudarabah profit-sharing).

Should You Invest?

Consider If You:

- Want higher returns and accept some uncertainty.

- Have a short- to medium-term horizon (e.g., 3–7 years).

- Need stable, long-term income (e.g., retirees).

- Prefer predictable returns (e.g., risk-averse investors).

Conclusion

Callable bonds offer higher yields but require careful risk assessment. Investors should:

- Check the call protection period and issuer’s financial health.

- Monitor interest rate trends.

In Malaysia’s growing bond market, these instruments remain valuable for issuers and informed investors alike.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read

.png)