BIX ARTICLE

Westports’ Strong Liquidity to Weather Impact from Covid-19 Outbreak

Apr 30, 2020

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

MYR10bn capex plan extended by another five years to 30 years amid global pandemic.

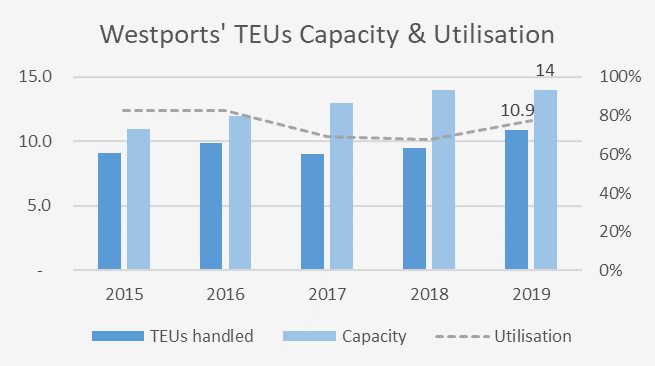

Westports announced their intention to build eight more container terminal facilities (CT10-CT17) from the existing nine (CT1 – CT9) after the acquisition of 146.4ha land for MYR393.96m. The current facilities were reportedly operating at 72% utilisation rate as of March 31. The Group is expected to spend c.MYR10bn over a period of 25 years (or around MYR400m per annum on average) including development of eight additional berths. The proposed expansion is to cater for the expected demand growth for port services as current capacity is expected to reach full utilisation in the coming years.

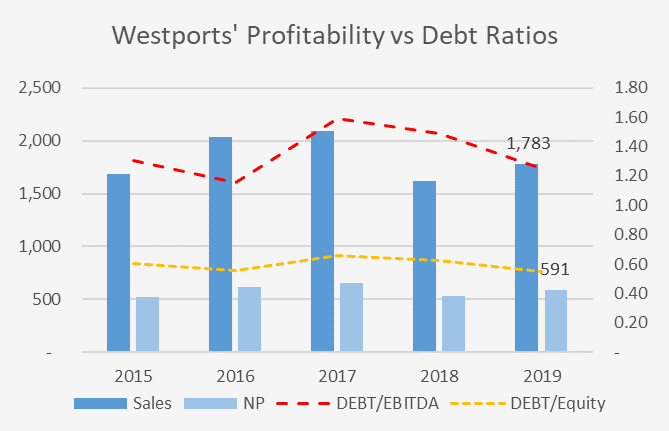

Improved profitability in 2019 as more containers handled and tariff hike. Westports’ revenue and net profit grew 10% and 11% respectively in 2019 to MYR1.78bn and MYR591m contributed by growth in container volume and tariff hike in March 2019. Its debt/equity improved to 0.55x from 0.62x, well-below rating agency’s threshold of 0.7x while debt/EBITDA dropped to 1.25x from 1.49x which gives Westports sufficient room to gear-up.

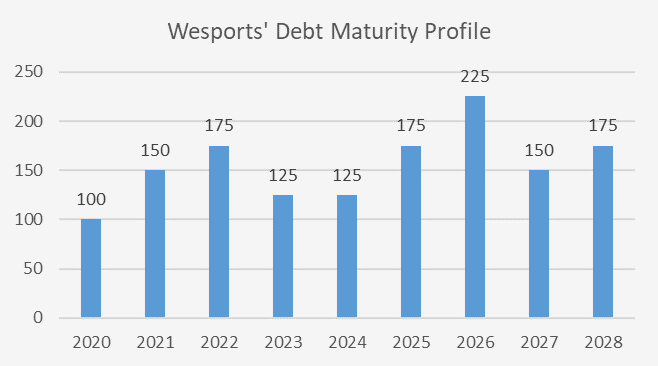

Westports’ debt maturity is well-distributed with strong cash balance. Only MYR100m of WESTPORTS IMTN 4.22% set to mature in August 2020 vs cash of c.MYR690m, Westports is in strong position to weather the downside impact from slowing global economic amid Covid-19 pandemic. The planned expansion could well be extended beyond 2028. Other than sizeable maturity due in 2026, Westports could issue the usual benchmark issue of 3Y, 5Y, 7Y and 10Y quite comfortably.

Virus outbreak to weigh on Westports’ earnings growth and dividend in 2020, but investors may enjoy uninterrupted profit payment from the sukuk. (For the list of Westports’ outstanding sukuk, click here)

As highlighted in Westports’ 4Q19 results announcement, the coronavirus outbreak could dampen the growth of container throughput in 2020 which may have eventual impact to their earnings and dividend. Compared to the last twelve month dividend yield of circa 3.32% (based on full year 2019 of MYR0.13), Westports sukuk (based on WESTPORTS 4.68 23.10.25) last traded yield was reportedly at 3.93% in March which is optically higher than the dividend yield of c.3.38%.

Fakrizzaki Ghazali is a former Head of fixed income and credit analyst,

covering GCC and Global Sukuk markets. He previously worked as a credit strategist at one of Malaysia’s sell-side research house; also used to serve a private bank in Kuala Lumpur with focus on generating bottom-up ideas from both Investment Grade and High Yield bonds in the Asian credits space. Fakrizzaki was a bond analyst at one of local asset management firm having debuted his career as an auditor at one of the ‘Big 4’. The article is his own opinion from experience in the industry for over sixteen years. He believes that retail investors need more understanding to the credit markets in order to diversify their portfolio risks amid global pandemic.

covering GCC and Global Sukuk markets. He previously worked as a credit strategist at one of Malaysia’s sell-side research house; also used to serve a private bank in Kuala Lumpur with focus on generating bottom-up ideas from both Investment Grade and High Yield bonds in the Asian credits space. Fakrizzaki was a bond analyst at one of local asset management firm having debuted his career as an auditor at one of the ‘Big 4’. The article is his own opinion from experience in the industry for over sixteen years. He believes that retail investors need more understanding to the credit markets in order to diversify their portfolio risks amid global pandemic.Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read