BIX ARTICLE

Mass Biodiversity Loss Would Slash Global Credit Ratings, Report Warns

Jun 24, 2022

|

3 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

The research published on Thursday by a group of British universities looked a range of scenarios, including one where a partial collapse of key ecosystems savaged nature-dependent industries such as farming and fishing that some economies rely on.

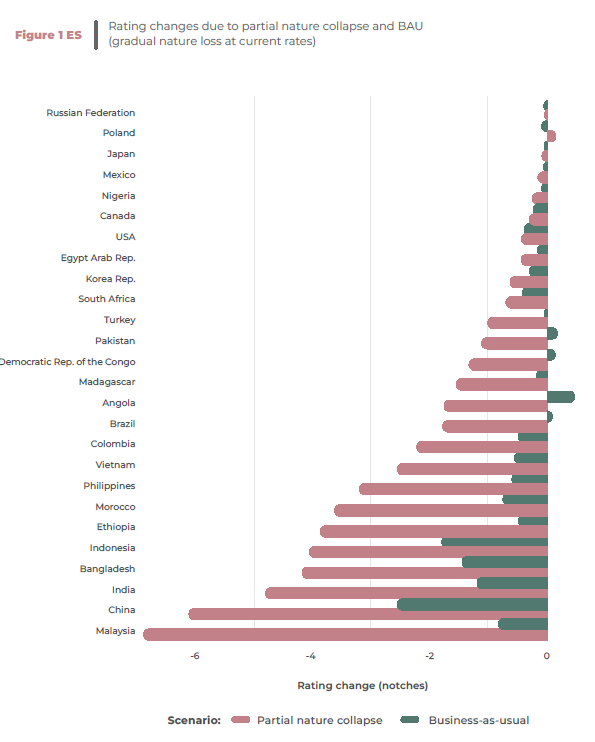

It estimated that the detrimental impact would result in 58% of the 26 countries studied facing at least a one notch downgrade of their sovereign credit rating.

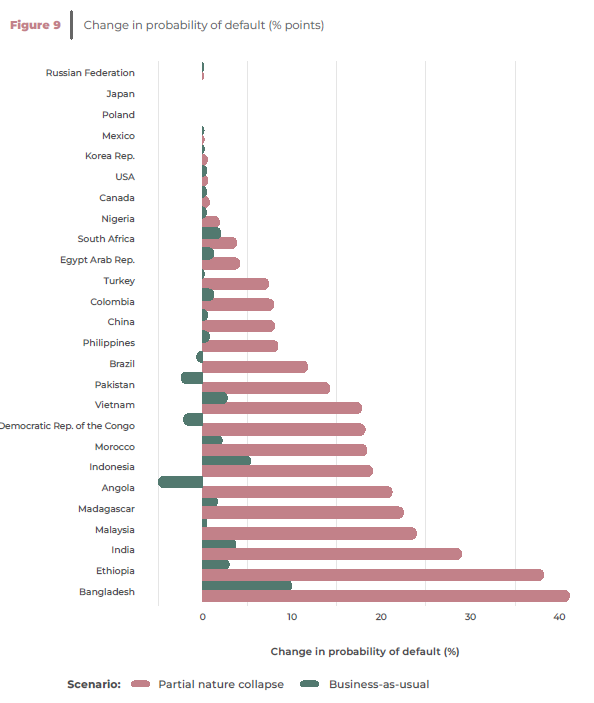

As ratings affect how much governments have to pay to borrow on the global capital markets, the downgrades would result in between $28 to $53 billion of additional interest costs annually.

"The ratings impact under the partial ecosystem services collapse scenario is in many cases significant and substantial," the report said, adding that those additional debt costs would mean governments have even less to spend and that things like mortgage rates would go up.

The study carried out by the University of East Anglia, Cambridge, Sheffield Hallam University and SOAS University of London shows that China and Malaysia would be most severely hit, with rating downgrades by more than six notches in the partial collapse scenario.

India, Bangladesh, Indonesia and Ethiopia would face downgrades of approximately four notches, while almost a third of the countries analysed would see more than three.

For China, that drop in creditworthiness would add an additional $12 to 18 billion to its yearly interest payment bill, while the country’s highly-indebted corporate sector would incur an additional $20 to 30 billion.

Malaysia's costs would rise between $1 to 2.6 billion, while it companies would need to cover additional $1 to 2.3 billion.

"More importantly, these two sovereigns would cross from investment to speculative-grade," the report said, referring to what investors usually dub a higher risk 'junk'-grade credit rating.

"Biodiversity loss can hit economies in multiple ways. A collapse in fisheries, for example, causes economic shockwaves along national supply chains and into other industries,” said co-author Dr Patrycja Klusak, affiliated researcher at Cambridge’s Bennett Institute and Associate Professor at the University of East Anglia.

Source:

- Mass biodiversity loss would slash global credit ratings, report warns By Marc Jones (2022, 23 June). Retrieved from www.reuters.com https://www.reuters.com/business/sustainable-business/mass-biodiversity-loss-would-slash-global-credit-ratings-report-warns-2022-06-22/

- M'sia's biodiversity loss would slash global credit ratings, report warns (2022, 24 June). Retrieved from www.malaysiakini.com https://www.malaysiakini.com/news/625872

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Sep 29, 2025

|

6 min read

ARTICLE

Aug 12, 2025

|

6 min read

ARTICLE

Jul 29, 2025

|

3 min read

ARTICLE

Jul 25, 2025

|

8 min read