BIX ARTICLE

Progress in Strengthening Climate Risk Management Practices

Mar 26, 2024

|

9 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

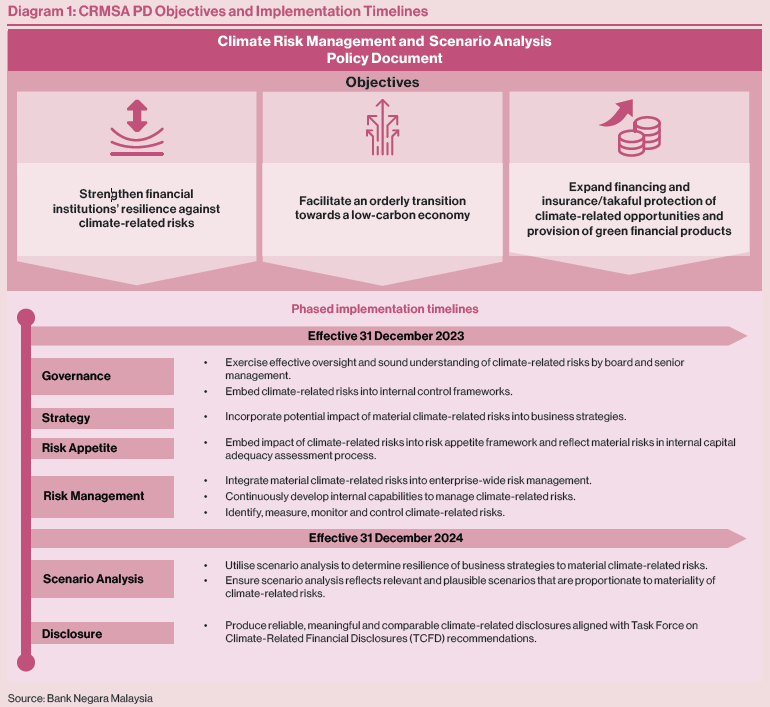

As part of Bank Negara Malaysia’s (BNM) ongoing supervisory approach, financial institutions update BNM regularly on their implementation plans in adopting the CRMSA PD.

This article reviews the progress reported by financial institutions in implementing the CRMSA PD requirements – including the range of practices observed, drivers of financial institutions with better progress and the initiatives put in place to strengthen the financial sector’s resilience to climate-related risks.

Steady progress in the implementation of CRMSA PD

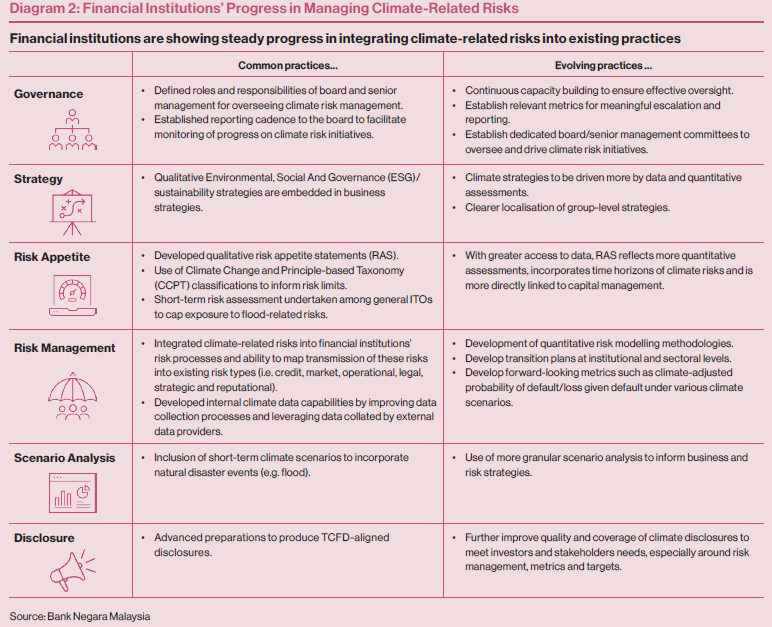

Generally, we observed that all financial institutions2 are making meaningful progress in adopting the requirements in the CRMSA PD and integrating climate-related risks into their existing practices. Diagram 2 provides an overview of the common practices observed, and practices that continue to evolve as financial institutions strengthen their capability to

better manage climate-related risks.

Across the six pillars of the CRMSA PD, financial institutions demonstrated the most progress in the area of governance. Almost all financial institutions have augmented existing governance structures and internal policies to enable better oversight of climate-related risks. Among larger financial institutions, dedicated board-level committees to oversee the financial institution’s response to climate-related risks are common. In smaller financial institutions, this responsibility is assumed by existing committees, under expanded terms of reference. We also observed improved reporting mechanisms to update the board and senior management on climate-related risks. In some institutions, this is supported by responsibility for climate risk and strategy assigned to a dedicated member of senior management. Most institutions also have in place climate-related key performance indicators that are tracked and monitored.

In the area of strategy, financial institutions are beginning to incorporate climate-related risk considerations into their existing sustainability frameworks,3 processes and business strategies. Although most financial institutions are still developing their climate strategies, some have begun to introduce high-level green financing commitments and investment targets that are aligned with their risk appetites and business strategies. These are sometimes, though not always, accompanied by clear portfolio decarbonisation strategies and capital allocated to fund climate-aligned assets. More generally, financial institutions are taking concrete steps to increase engagement levels and the due diligence process with counterparties.

Data availability remains a key challenge identified by all financial institutions. Given the challenges posed by the lack of sufficiently granular and credible data, as well as relatively underdeveloped quantitative climate risk models, most financial institutions are building qualitative approaches to develop their risk appetite, risk management policies and practices, scenario analysis and disclosures. Some examples include:

- Utilising the Climate Change and Principle-based Taxonomy (CCPT) classifications to set risk tolerance thresholds and estimate exposures.

- Incorporating better insights obtained through due diligence surveys conducted on counterparties to improve judgements on exposures to physical and transition risks.

- Utilising conceptual assumptions underpinning climate risk models to sharpen initial assessments of how climate-related risks may impact their risk exposures, internal operations and business strategies.

- Evidence of a strong tone from the top, with the board of directors and senior management playing a pivotal role. An appointed board member or member of senior management provides active sponsorship of the financial institution’s climate response. This includes actively steering the direction to align resources, frameworks and incentives which in turn, accelerates efforts taken to implement climate-related strategies across the organisation.

- Better access to skilled resources to help build internal capabilities. Leading financial institutions actively work with experts within or outside their financial group, and are deeply engaged in collaborative platforms4 to tap multi-disciplinary insights and keep abreast of sectoral, national and global developments.

- High commitment of financial and non-financial resources. This includes making meaningful investments in systems to capture granular climate-related data, a comprehensive and thoughtful approach to strategic pivots and a sustained focus on structured training to elevate staff capability.

Domestically, the Joint Committee on Climate Change (JC3),5 co-led by BNM and Securities Commission Malaysia (SC), continues to play an important role in supporting efforts by financial institutions to strengthen their climate risk management practices and expand financial solutions for climate transition and adaptation activities. In helping to

bridge critical data gaps, the JC3 will continue to expand the Climate Data Catalogue6 to capture more granular data sources, while working with data partners to improve the quality, accessibility and usability of available data. The JC3 has also recently established the physical and transition risk working groups to develop relevant guidance and tools to

assist with the construction of physical and transition risk assessment methodologies and models. In February this year, BNM issued the Methodology Paper on Climate Risk Stress Testing (CRST) with inputs from the industry including JC3 members, to guide financial institutions in using stress testing to better understand risks coming from climate change.

A stronger focus on transition plans and planning will also be pursued in 2024 to promote critical alignment between financial institutions’ climate strategies and targets, national policies, macroeconomic risk impacts and developments in the supervisory and prudential framework.

On the international front, the Financial Stability Board (FSB) continues to promote a globally consistent supervisory and regulatory response to climate change.7 Similarly, the Basel Committee on Banking Supervision (BCBS) is undertaking a holistic approach to address climate-related risks across all three pillars of regulation, supervision and disclosure.8 The International Association of Insurance Supervisors (IAIS) has also included climate change as a key theme within the IAIS Strategic Plan, focusing on sharpening risk assessments and developing supervisory capacity.9

The path forward

Building on the ongoing progress in implementing the CRMSA PD by financial institutions, the near-term regulatory and supervisory priorities will focus on:

- Addressing fragmented approaches to managing climate-related risks that are still being observed in some financial institutions. We expect financial institutions to ensure implementation of their climate risk management frameworks are well integrated across all functions. Financial institutions’ risk reporting systems should reflect this in order to enable integrated monitoring and escalation of climate-related risks within the organisation.

- Ensuring financial institutions develop credible transition plans. It is crucial for financial institutions to align their business and risk strategies with their climate commitments, the transition plans of their customers and national aspirations. Financial institutions will be expected to demonstrate how they operationalise climate targets in their business and risk strategies. An aggregate view of transition plans will also be important to identify potential disproportionate impacts of climate-related measures on vulnerable groups, such as low-income communities, hard-to-abate sectors, and small and medium enterprises. This in turn will enable mitigating actions to ensure an orderly transition of the economy.

- Ensuring financial institutions produce climate disclosures that meet the needs of investors and stakeholders. Disclosures that are accurate and adhere to international standards are important to manage greenwashing risk. The Advisory Committee on Sustainability Reporting (ACSR)10 is conducting a public consultation11 on the proposed implementation of the sustainability disclosure standards issued by the International Sustainability Standards Board

(ISSB) in Malaysia. Consistent with that, we expect financial institutions to continue to make progress towards producing climate disclosures that are fully aligned with the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations and the sustainability disclosure standards issued by the ISSB.

| 1 | Issued on 30 November 2022. |

| 2 | Banks (including commercial, Islamic and investment banks as well as developmental financial institutions), insurers and takaful operators (ITOs) |

| 3 | These include Environmental, Social and Governance (ESG) frameworks and policies. |

| 4 | Including platforms such as the JC3 and United Nations Environment Programme Finance Initiative. |

| 5 | The JC3 is a platform established in September 2019 to pursue collaborative actions for building climate resilience within the Malaysia financial sector. The JC3 is co-chaired by BNM and SC, and the members include Bursa Malaysia and 21 financial institutions. |

| 6 | Climate Data Catalogue was issued in end-2022 by the JC3 to serve as a source of reference on climate and environmental data for the financial sector. |

| 7 | Supervisory and regulatory approaches to climate-related risks: Final report. (2022). Financial Stability Board. |

| 8 | Basel Committee Work Programme and Strategic Priorities for 2023/24. (2022). Basel Committee on Banking Supervision. |

| 9 | Climate risk. International Association of Insurance Supervisors. Retrieved March 1, 2024 from https://www.iaisweb.org/activities-topics/climate-risk/ |

| 10 | The ACSR, chaired by the SC and formed with the endorsement of the Ministry of Finance, comprises representatives from BNM, Bursa Malaysia Berhad, |

| 11 | The public consultation period is from 15 February 2024 to 21 March 2024. The consultation paper seeks feedback on the scope and timing for implementation, the transition reliefs required and issues related to assurance for sustainability disclosures. |

Source: BNM Financial Stability Review: Second Half 2023, Page 50 - 53

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 13, 2026

|

4 min read

ARTICLE

Feb 13, 2026

|

6 min read

ARTICLE

Jan 22, 2026

|

3 min read

ARTICLE

Jan 21, 2026

|

4 min read