BIX ARTICLE

Malaysia introduces new structure for government Sukuk

Aug 07, 2024

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

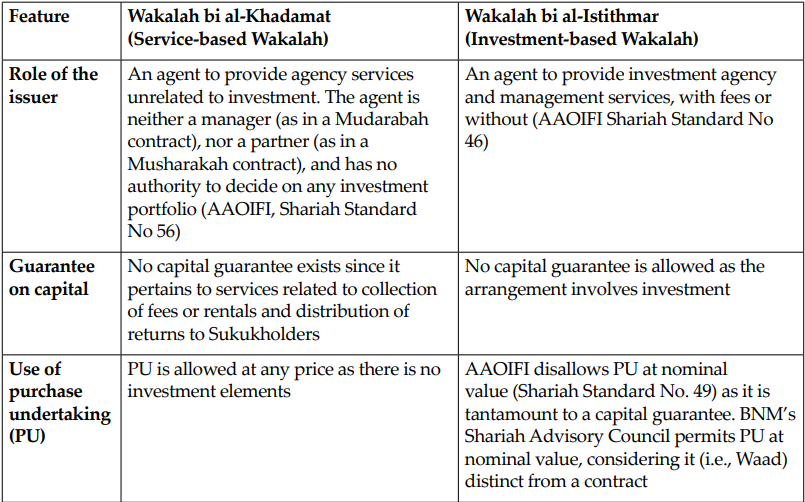

Malaysia’s new government Sukuk, structured using the Wakalah bi alKhadamat (agency for service) concept, represents a significant milestone in the country’s commitment to advancing its Islamic finance ecosystem. Announced in May 2024, the new structure introduces a fresh dimension to Sukuk issuance, combining the principles of Wakalah (agency) and Khadamat (services). The innovative structure allows Malaysia to remain competitive in the global Islamic finance market. In particular, it provides an alternative solution to international investors adhering to AAOIFI standards, who may find Malaysia’s existing Government Investment Issues (GII) (which rely on 100% debt through the Murabahah structure) less appealing due to trading restrictions (prohibition of debt sale, Bay’ al-dayn). Based on official statistics, less than 10% of GII investors currently are held by international investors. This innovative approach aligns with Malaysia's ongoing efforts to strengthen its investment landscape and signals its commitment to innovation and investor-friendly policies. The issuance of AAOIFI Shariah Standard No 59 on Sale of Debt, which came into effect on the 1st January 2021, further restricts the tradability of Sukuk structures which have debt elements such as |

combination Sukuk using Wakalah, Ijarah and Murabahah (via Tawarruq) contracts. According to the standard, tradability of such structure needs to comply with the following parameters:

Siew Suet Ming is deputy CEO and chief rating officer at RAM Ratings. She can be contacted at [email protected]. |

This article was first published in IFN Volume 21 Issue 31 dated the 29th July 2024.

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Dec 02, 2024

|

7 min read

ARTICLE

Aug 07, 2024

|

4 min read

ARTICLE

Jun 25, 2024

|

4 min read

ARTICLE

Oct 23, 2023

|

8 min read