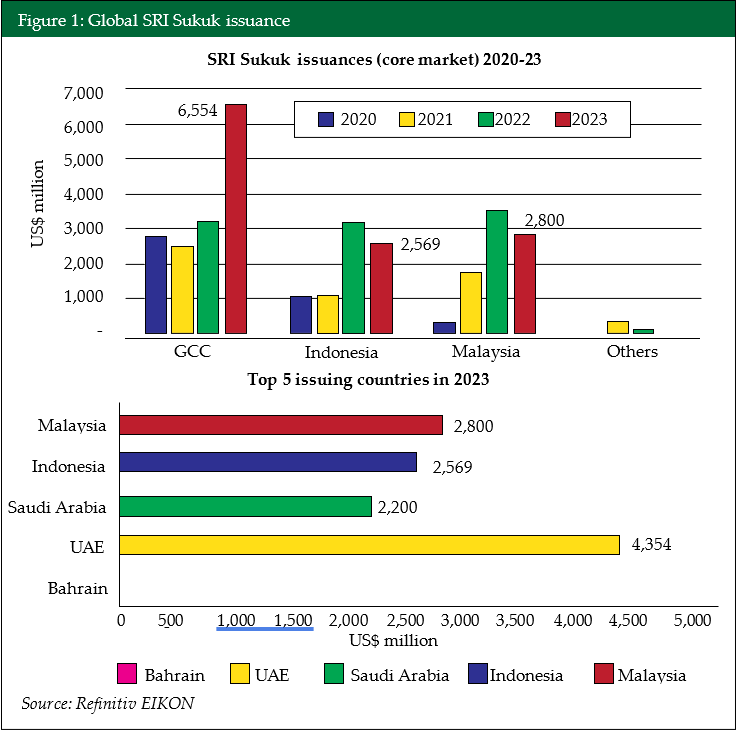

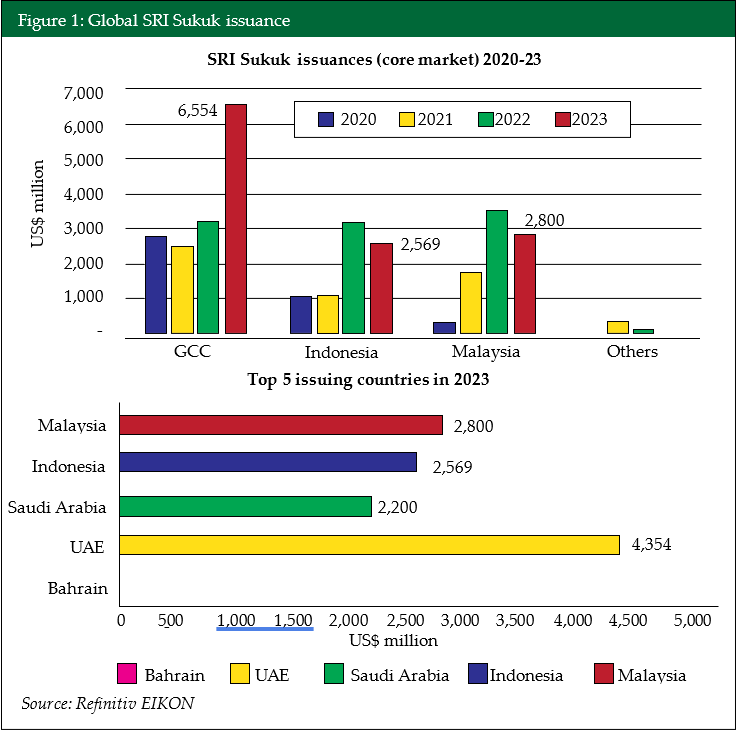

Since the introduction of the SRI framework, SRI Sukuk now encompass sustainability-linked Sukuk, which allocate proceeds for general purposes while being tied to sustainability performance targets; transition Sukuk which fund firms’ efforts to reduce environmental impact and carbon emission; and blue Sukuk, which finance marine-related projects. Alongside this growth in the SRI market, Malaysia’s leadership has also grown in issuing both green and sustainability (combination of green and social) Sukuk (Figure 1). SIEW SUET MING writes.

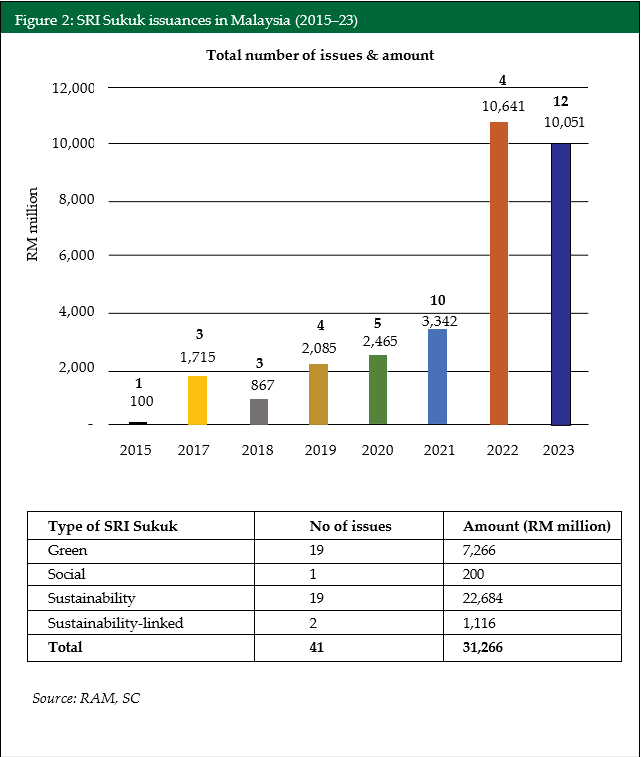

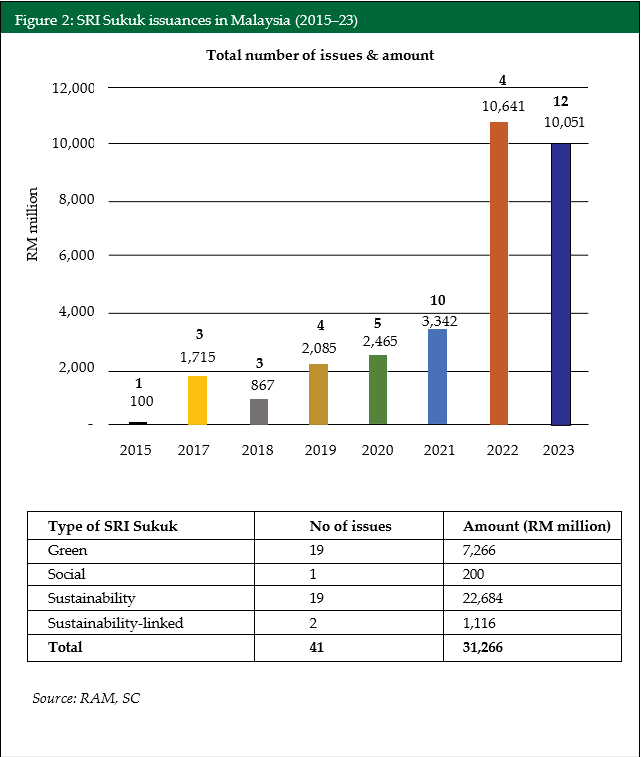

Since the first SRI Sukuk facility was issued in 2015, the market has seen 41 corporate SRI Sukuk consisting of green, social, sustainability and sustainability-linked issuances with a cumulative volume of RM31.27 billion (US$6.67 billion) as at December 2023. Those issued were mostly aligned with the Securities Commission Malaysia (SC)’s SRI Sukuk Framework and ASEAN Sustainability Bond Standards.

By 2023, SRI Sukuk made up about 11% of the RM91.4 billion (US$19.5 billion) corporate Sukuk issued (Figure 2). 2023 also witnessed the highest number of green and sustainability SRI issuances, with both new and existing issuers tapping the market. Its growth story in recent years has been nothing short of impressive, with the SRI Sukuk market volume accelerating by over 200 times in 2022 (Figure 2), putting it at the top of the global SRI Sukuk leaderboard that year.

This was bolstered by big-ticket issuances from Amanat Lebuhraya Rakyat (a trust-like entity in the highway sector, emphasizing affordable tolling) with a RM5.5 billion (US$1.17 billion) SRI Sukuk issuance and the government of Malaysia (GoM)’s RM4.5 billion (US$959.99 million) inaugural domestic Sustainability Malaysian Government Investment Issues (MGII), despite there only being four SRI Sukuk issues.

The GoM’s MGII build on the success of its world’s first US dollar-denominated sovereign sustainability Sukuk worth US$800 million which debuted in April 2021. MGII Sukuk proceeds finance eligible social and green projects, aligning with the GoM’s commitment to climate action and the inclusive, sustainable MADANI economy.

Additionally, initiatives like the Net Energy Transition Roadmap, with an anticipated RM1.3 trillion (US$277.33 billion) of cumulative investments through 2050, are expected to drive further SRI Sukuk issuances, As of the 3rd April 2024, Malaysia boasts 58 green and sustainability-linked Sukuk and bond issues, of which more than a third originate from the power sector.

To encourage more SRI issuances, Budget 2024 announced an extension of tax exemption on management fee income for SRI funds and tax deduction on SRI Sukuk issuances, both to 2027 (from 2023). It also expanded the scope of income tax exemption on the SRI Sukuk Grant and Bond Scheme to include ASEAN Sustainability-Linked Bond Standards. The grant allows eligible issuers to claim 90% of the cost for actual external review subject to a maximum of RM300,000 (US$63,999.6).

These incentives, still available, together with the recent release of the Maqasid Al-Shariah Guidance Islamic Capital Market Malaysia 2023, are expected to increase momentum and spur SRI Sukuk market development. |

.png)

|

This article was first published in IFN Volume 21 Issue 21 dated the 22nd May 2024.

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

.png)