BIX ARTICLE

Malaysia Bond and Sukuk: Quarterly Report 3Q2025

Oct 08, 2025

|

7 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

3Q2025 – Malaysia's Bond and Sukuk Market posts strong Q3 2025 growth

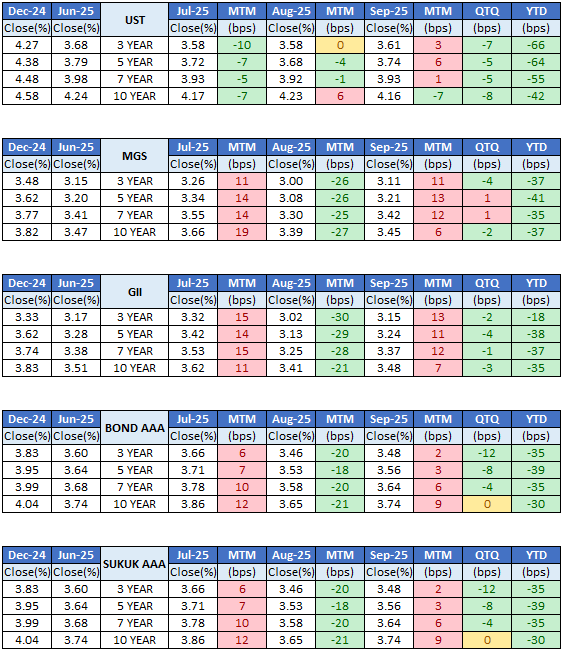

Malaysia’s bond and sukuk market kicked off 2025 well, reaching an astounding RM2.239 trillion in outstanding issuances within the first nine months. According to Bank Negara Malaysia (BNM), the combined value of Malaysian Government Securities (MGS) and Government Investment Issues (GII) rose 123 per cent from RM582.46 billion at the end of 2015 to RM1.30 trillion by September 2025. The expansion in borrowing was driven largely by pandemic-related stimulus, infrastructure investments, ongoing subsidies and the refinancing of earlier debt. The US Federal Reserve also cut interest rates by 25 basis points to 4%-4.25%, the first cut this year, due to concerns about slower job gains and employment risks.

GOVERNMENT BOND AUCTION

Overview

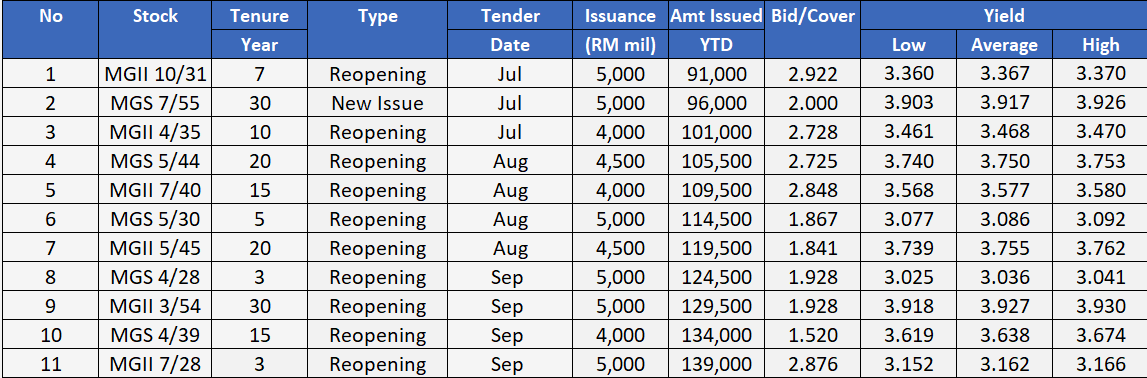

| Government bond auction for 3Q25 garnered an average BTC of 2.289x, decreased from the previous quarter (2Q25: 2.893x). Reopening of MGII 10/31 marked the highest BTC at 2.922x. The new and reopening issuances of MGS/GII amounted to RM51 billion in Q3 2025, reflecting an increase of 37.84% compared to the previous quarter (Q2 2025: RM37 billion). The outstanding amount of MGS/GII stood at RM1.285 trillion and grew by 1.66% in 3Q 2025 (2Q25: RM1.264 trillion). |

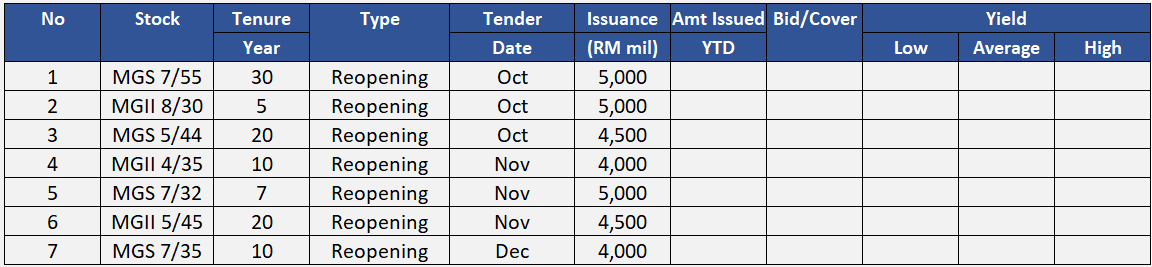

| In the upcoming 3Q25, there will be one (1) new issuance and four (4) reopening of MGS. On the other hand, there will be one (1) new issuance and five (5) reopening of GII, totalling to two (2) new issuances and nine (9) reopening. |

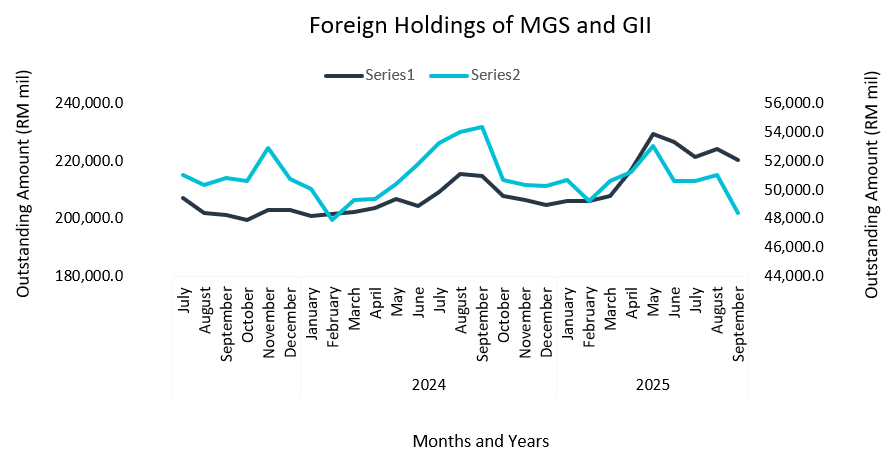

FOREIGN HOLDINGS OF MGS AND GII

Overview

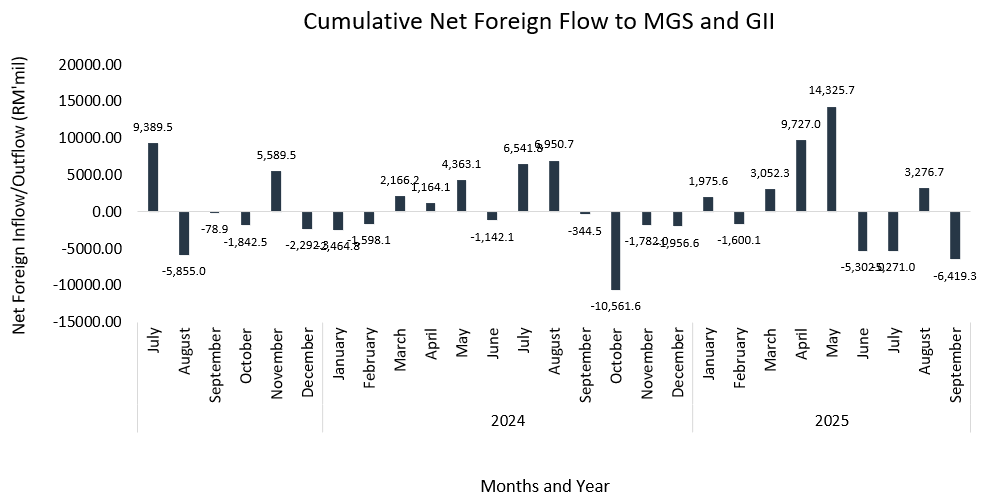

| The foreign net flow to MGS and GII in 3Q25 amounted to –RM5.27 billion, RM3.27 billion and –RM6.42 billion in July, August and September respectively, with foreign investors turned net sell. As of September 2025, the total foreign holdings of MGS and GII stood at RM268.69 billion (June 2025: RM277.10 billion), 3.04% lower from the previous quarter. |

CORPORATE BOND & SUKUK

Overview

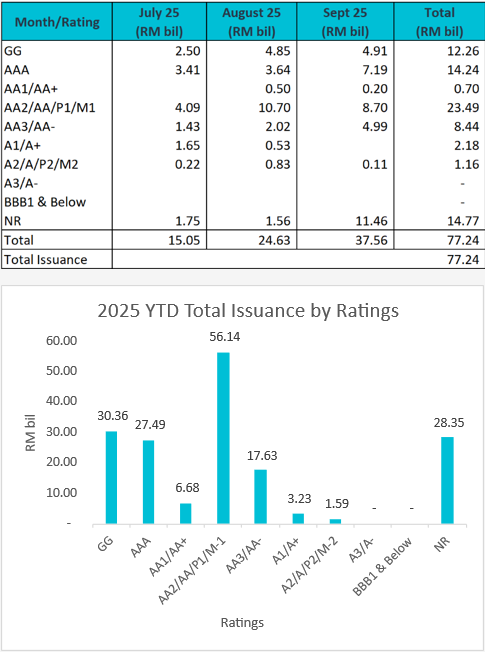

| RM77.24 billion corporate bonds and sukuk were issued in 3Q25 (2Q25: RM46.62 billion), 65.68% higher than the previous quarter. The AA2/AA/P1/M1-rated bonds and sukuk recorded the biggest issuance at RM23.49 billion issuances, followed by non-rated bonds at RM14.77 billion issuances. For 3Q25, the largest corporate issuances were issued by MALAYAN BANKING BERHAD, namely MAYBANK SUBORDINATED SUKUK 3.920% 07.09.2040 worth RM3.00 billion. |

RATING OUTLOOK

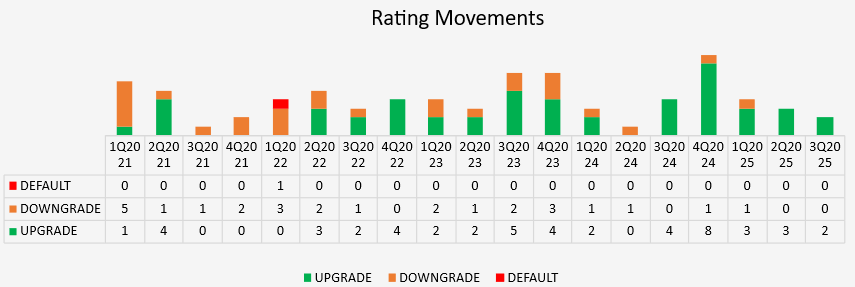

| There was zero (0) default and downgrade recorded in 3Q25. However, there were two (2) upgrades bonds/sukuk in the quarter. ⬆️ Upgrade

|

Source: MARC, RAM and BIX Malaysia

BOND STATISTICS

Overview

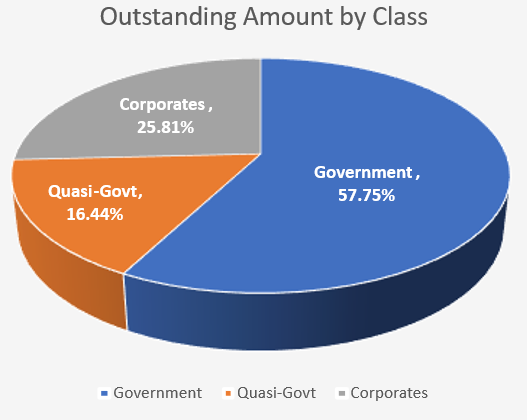

Outstanding Amount by Bond Classes

| As of September 2025, the outstanding amount of the Malaysian bond market stood at RM2.239 trillion, increased by 2.85% compared to the end of 2Q25 (June 2025: RM2.177 trillion). The largest outstanding bonds were from government issuances which consist of 57.75% of total issuances at RM1.293 trillion, followed by corporate issuances of 25.81% at RM577.99 billion, and Quasi-government issuances of 16.44% at RM368.05 billion. |

Overview

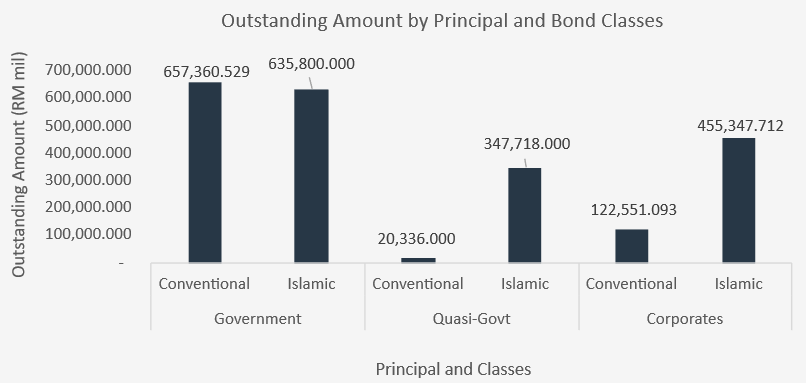

Outstanding Amount by Principal and Bond Classes

| As of September 2025, the outstanding amount of Government conventional bond and Government Sukuk stood at RM657.36 billion and RM635.80 billion, respectively. The conventional quasi-govt outstanding amount stood at RM20.34 billion, much smaller compared to its Shariah-compliant counterpart of RM347.72 billion. For corporate issuances, the conventional bond outstanding amounted RM122.55 billion while the corporate Sukuk was recorded higher at RM455.35 billion. |

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalized financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Jan 09, 2026

|

7 min read

ARTICLE

Oct 08, 2025

|

7 min read

ARTICLE

Jul 08, 2025

|

7 min read

ARTICLE

Apr 10, 2025

|

7 min read