BIX ARTICLE

Bond Pricing & Performance

Dec 22, 2022

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

HOW BONDS ARE PRICED

When it comes to bonds, there are two types of "pricing" an investor needs to understand. The first is the initial price of the bond – or its face value – which is set when the bond is first issued to the market. This is also the amount of capital that will be returned to the investor at maturity barring a default.

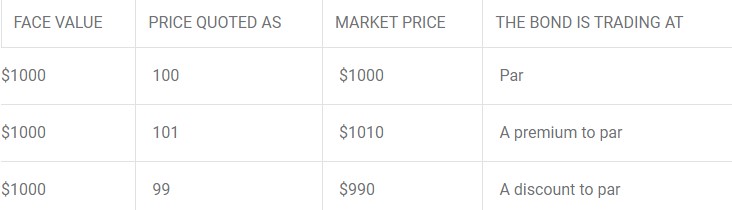

The second relates to the price of the bond as it trades in the secondary market. Such prices are quoted as a percentage of the bond’s face value. For example, if the face value is $10,000 and the quoted market price is $9,900, then the bond price is quoted as 99. Similarly, if the market price is $10,100, the bond is trading at a price of 101.

When the bond price is higher than its face value, it’s described as trading at a premium to par. On the other hand, when the bond price is lower than its face value, it is said to be trading at a discount to par.

This concept is illustrated in the table below:

WHY BOND PRICES MOVE UP AND DOWN

Investors who plan on holding their bond until maturity typically don’t need to worry about the movement of bond prices on the secondary market as they will be repaid their principal in full at maturity, barring a default. But for those looking to sell their securities sooner, an understanding of what drives secondary market performance is essential.

The price of a bond relative to yield is key to understanding how a bond is valued. Essentially, the price of a bond goes up and down depending on the value of the income provided by its coupon payments relative to broader interest rates.

If prevailing interest rates increase above the bond’s coupon rate, the bond becomes less attractive. In this situation, the bond price drops to compensate for the less attractive yield. Conversely, if the prevailing interest rate drops below the bond’s coupon rate, the price of the bond goes up as it becomes more attractive.

For example, if a bond has a 4% coupon and the prevailing interest rate rises to 5%, the bond becomes less attractive and so its price will fall. On the other hand, if a bond has a 4% coupon and the prevailing interest rate falls to 3%, that bond becomes more attractive which pushes up its price on the secondary market.

FACTORS THAT INFLUENCE THE PERFORMANCE OF BONDS

Apart from interest rate movements, there are three other key factors that can affect the performance of a bond: market conditions, the age of a bond and its rating. Let’s look at each in turn.

- Market conditions

Broader market conditions can have an impact on bonds. For example, if the stock market is rising, investors typically move out of bonds and into equities. By contrast, when the stock market is going through a correction, investors may seek the perceived safety of bonds. - Ratings

Bonds are assigned credit ratings by ratings agencies, such as RAM and MARC. The ratings signal to investors the agency’s view of the issuer’s ability to pay the interest and principal when due. If a bond’s credit rating is downgraded, the bond becomes less attractive to investors and its price will likely fall. - The age of a bond

The age of a bond relative to its maturity date can affect pricing. This is because the bondholder is paid the full face value of the bond when the bond reaches maturity. As the maturity date gets closer, the bond's price will move towards par.

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read