BIX ARTICLE

What Is Bond & Sukuk Covenant and Why Is It Important?

Jul 02, 2018

|

6 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

You can see the company PTC using steps below:

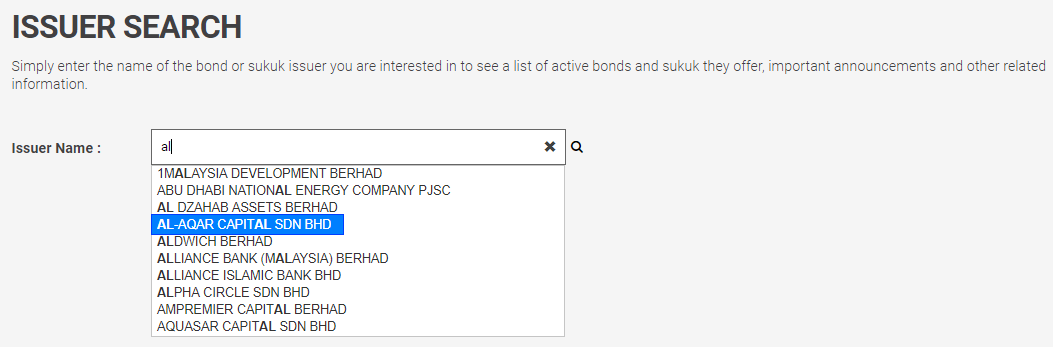

- Go to BIX Tools at the top right corner of screen below and choose BIX Issuer Search in the BIX Malaysia website.

- Search the issuer name Example we use here is Al-Aqar Capital Sdn Bhd:

- In this example we will look at Al Aqar sukuk maturing 4 May 2023 at 4.95% cpn with AAA Rating.

- You can find the Principal Term and Condition (“PTC”) of the sukuk by choosing the Related Document and Financials Tab and download the document.

If you scroll down and search covenant in the document you, you will find that Issuer of this sukuk will have to adhere to the positive covenant, negative covenant and financial covenant throughout the lifetime of this sukuk. So, what is the difference between these covenants?

Positive Covenant

Positive covenant is the obligation that the issuer will have to adhere through out the bond life time. Example in Al-Aqar positive covenant are:

- The Issuer will preserve and keep in full force and effect all consents and rights necessary for the conduct of its business;

- The Issuer shall exercise reasonable diligence in carrying out its business in a proper and efficient manner which should ensure, amongst others, that all necessary approvals or relevant licenses are obtained;

- The Issuer will keep proper books and accounts at all times and to provide the Trustee and any person appointed by it to have access to such books and accounts;

- The Issuer will comply with all provisions and perform all its obligations under the Transaction Documents;

Negative Covenant

Negative covenant is the issuer promise not to do something through out the bond or sukuk lifetime. Example in Al-Aqar negative covenant are:

- The Issuer shall not incur, assume or permit any additional indebtedness except in connection with the Sukuk Ijarah issuance and shareholders advances (if any) which are to be subordinated to the Sukuk Ijarah;

- The Issuer shall not declare any dividends or make any other distributions on or in respect of its share capital;

- Other than those as disclosed to and agreed by the Lead Arranger, the REIT Trustee, shall not charge, pledge, assign or otherwise create or permit to exist any security interest over the Secured Properties and/or revenues present or future of the Secured Properties without approval of the Trustee;

Financial Covenant

Financial covenant on the other hand normally is the financial ratio that issuer have to maintain throughout the bond or sukuk lifetime. Example in Al-Aqar financial covenant are required to maintain:

- Finance service cover ratio (“FSCR”) at Issue level of not less than 1.5 times,

- FSCR at REIT Trustee level of not less than 1.5 times and

- Such other financial covenant(s) as may determined by the RAM Ratings and agreed to by the Issuer.

When an issuer fails to comply or violate any of the item in the covenant, the bond will consider to be in technical default. This mean that even if the issuer is paying its interest and principal payment on time, it is not operating as agreed in the covenant which increase its risk of default on possible downgrading of its rating. However, depending on the term, investor may allow some time for issuer to improve but it will still negatively impact the rating or bond price.

WHY IS IT IMPORTANT?

Bondholder need to understand their right in monitoring the issuer operation activity which will ensure that the issuer credit ability to pay the coupon and principal still intact throughout the bond lifetime. Normally the issuer will agree on the most flexible covenant to allow some space for decision making and risk to improve its financial strength. The covenant will provide a safety mechanism for the bond holder and guideline for issuer to protect both its interest.

Nonetheless, it is paramount that private or institutional investors are well acquainted with any covenant clauses that subsist in the corporate bond agreement as if any stipulated clauses are breached by the issuer during the term, this circumstance will then trigger the introduction of a specific predefined event. It should be noted that bond covenants, even if restrictive or negative, can’t turn a bad investment into a good one. If the company is financially weak, bond covenants can’t improve the finances, so it is always better to avoid bonds that have high yields and a long list of covenants unless you are a bond expert. Bond covenants also don’t truly restrict bad management from making bad choices. They can help to position the bondholders to receive more favorable treatment in the event of company liquidation, but this is not a reason to buy a bond from a company that is likely to go into default.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read