BIX ARTICLE

Sukuk Issuance to Remain Under Pressure

Dec 21, 2022

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

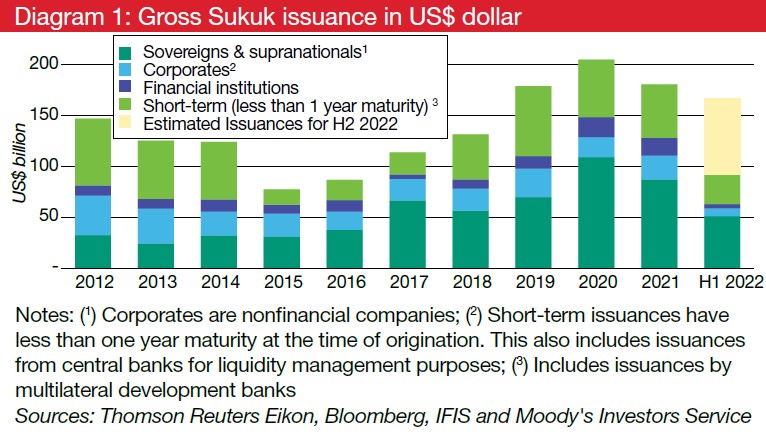

We expect total gross short- and long-term Sukuk issuance of US$160-170 billion in 2022, down from US$181 billion in 2021 and a record US$205 billion in 2020. Issuance reached US$92 billion in the first six months of 2022, down from US$102 billion in the same period of 2021.

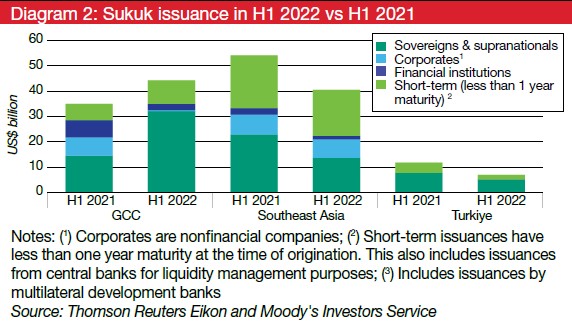

Stronger than expected issuance activity from the GCC sovereigns offset a drop in issuance in Southeast Asia and Turkiye. We expect gross Sukuk issuance of US$70-80 billion in the second half of the year. While issuance in Southeast Asia is likely to improve, we do not expect the GCC’s strong performance in the first half of the year to continue into the second half.

Sukuk issuance moderated in the first half of 2022 despite surprisingly strong activity in the GCC

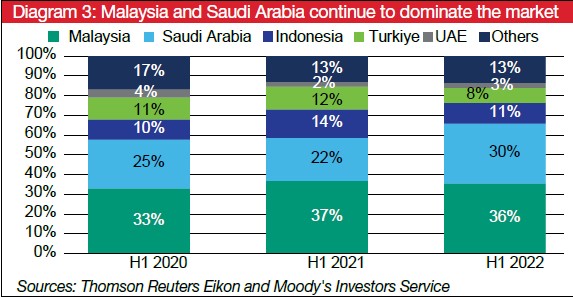

Issuance volumes declined by 10% year-over-year to US$92 billion as strong issuance activity in the GCC on the back of one-off issuances by Saudi Arabia (‘A1/Stable’) could not compensate for a drop in issuances by Southeast Asian issuers. Sovereigns’ contribution to overall issuance activity further increased as higher interest rates weighed on the issuance activity of corporates and financial institutions.

We expect issuance activity to moderate further in the second half of the year

While we expect issuance to slightly recover in Southeast Asia, we do not expect the GCC’s strong performance in the first half of 2022 (H1 2022) to continue into the second half. High oil prices will support fiscal surpluses across the region, which will limit new sovereign issuances to refinancing maturing Sukuk. Moreover, Saudi Arabia, the region’s largest sovereign issuer, has indicated that it has completed its issuance program for the year.

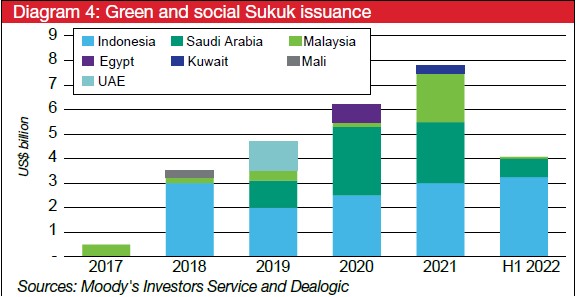

New entrants and rising demand for green and sustainable Sukuk support the long-term positive trend

New issuers seeking to diversify their funding sources are joining the market as Sukuk becomes widely accepted. Green Sukuk issuance will also accelerate as governments promote sustainable policy agendas and demand for sustainable investments encourages new issuers to consider green Sukuk as an alternative financing tool.

Growth opportunities

The low penetration rate of Islamic products in several Muslim-majority countries also offers additional growth opportunities for Sukuk. This potential has been identified by several governments across the MENA and Southeast Asia regions, who have accordingly implemented favorable regulations and issued sovereign Sukuk to support market growth.

This is particularly true in the case of Turkiye, where the authorities have played a prominent role in the creation of Islamic banks and taken on issuing Sukuk on a regular basis. It is also the case in Saudi Arabia, where the government used its debt refinancing in the first half of the year as an opportunity to further increase the share of Sukuk in its debt mix.

Finally, it is important to note that most Muslim-majority countries benefit from strong demographic and economic growth potential that will provide Islamic debt markets with a growing economic base to continue to expand in the coming years. The global Muslim population is projected to rise from 25% of the world’s population currently to 30% in 2050.

Written by: MOODY'S INVESTORS SERVICE

Source: Sukuk Issuance to Remain Under Pressure (December 2022). IFN Annual Guide 2023 (pp. 16)

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 13, 2026

|

4 min read

ARTICLE

Sep 29, 2025

|

6 min read

ARTICLE

Aug 12, 2025

|

6 min read

ARTICLE

Jul 29, 2025

|

3 min read