BIX ARTICLE

Importance Of Bond in Investment Portfolio

Mar 06, 2023

|

5 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

When it comes to investment portfolio management, many investors tend to focus on equities, as they are often seen as the most exciting and potentially profitable asset class. However, it's important not to overlook the role of bonds in a well-diversified portfolio.

Bonds, also known as fixed income securities, are debt instruments issued by governments, corporations, and other organizations to raise capital. When you invest in a bond, you are essentially lending money to the issuer, who promises to pay you back the principal plus interest over a specified period.

While bonds generally offer lower potential returns than equities, they also come with less risk. In fact, bonds are often referred to as a "safer" investment, as they are less volatile and less likely to experience large swings in value. This makes them an important component of a well-diversified portfolio, as they can help mitigate risk and provide a stable source of income.

One of the main benefits of bonds is that they can help balance out the riskier components of a portfolio, such as equities. When equity markets are performing well, bonds may underperform, but they can help limit losses during market downturns. This is because bond prices tend to rise when interest rates fall, which typically happens during economic downturns. As a result, a well-diversified portfolio that includes bonds can help cushion the impact of market volatility.

Another important benefit of bonds is that they provide a reliable and predictable source of income. While equity dividends are not guaranteed and can fluctuate from year to year, bonds typically pay a fixed rate of interest, which provides a steady stream of income for investors. This can be particularly important for retirees and other investors who rely on their portfolios for income.

In addition to their risk mitigation and income-generating capabilities, bonds can also provide a valuable source of liquidity. While equities may take some time to sell in order to generate cash, bonds can generally be sold quickly and easily, providing investors with a readily accessible source of funds. Bonds typically have a more predictable income stream and a fixed maturity date, which makes them easier to value and trade. However, it's important to note that liquidity can vary depending on the specific bond or equity in question, as well as market conditions at any given time. Some bonds may be less liquid than certain equities, especially those issued by smaller companies or those with less well-known credit ratings. In addition, extreme market conditions can lead to decreased liquidity across all asset classes. Therefore, it's important to evaluate the liquidity of a specific security based on its individual characteristics and market conditions at the time of evaluation.

Of course, not all bonds are created equal, and investors need to carefully consider the risks associated with individual bonds before investing. For example, government bonds are generally considered to be less risky than corporate bonds, as governments are less likely to default on their debt obligations. Similarly, bonds with longer maturities tend to be more sensitive to changes in interest rates than bonds with shorter maturities.

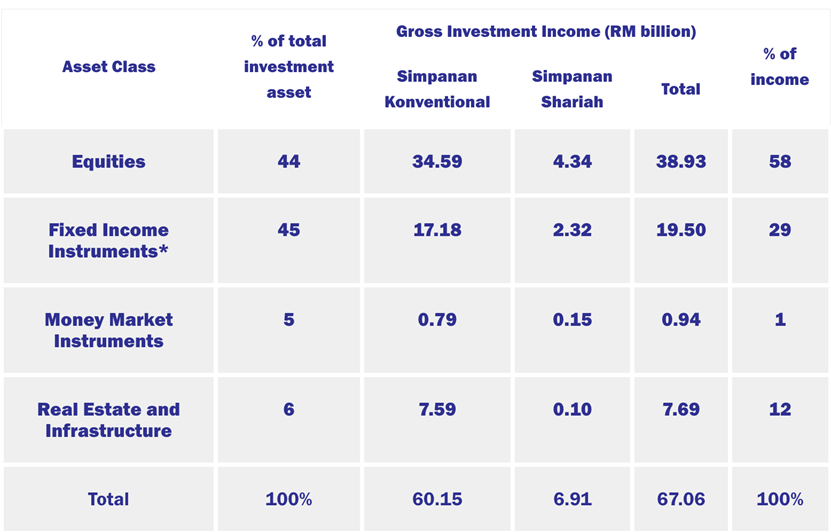

Strategy to invest in fixed income assets to manage a well-diversified investment portfolio has been utilized by major investment firms, including Government-Linked Investment Corporations. Taking the Employee Provident Fund (EPF) as an example, the Malaysian government-managed retirement saving fund manages a large and diverse portfolio of assets that are allocated across multiple asset classes. The EPF's asset allocation strategy aims to achieve a balance between capital preservation and long-term growth. Guided by EPF’s Strategic Asset Allocation (SAA), EPF’s investment portfolio in 2021 shows 45% of the fund’s portfolio consists of fixed income instruments, while equities comprised 44%. Real estate and infrastructure as well as money market instruments made up 6% and 5% of EPF assets, respectively. The SAA has kept the fund resilient to financial shocks and remain stable in unprecedented situations.

,-EPF%e2%80%99s-investment-portfolio-in-2021.png)

In conclusion, while equities may get more attention from investors, bonds play an important role in investment portfolio management. They can help mitigate risk, provide a stable source of income, and offer valuable liquidity. By including bonds in a well-diversified portfolio, investors can create a balanced investment strategy that can weather market volatility and provide long-term growth.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 16, 2025

|

5 min read

ARTICLE

Dec 01, 2025

|

4 min read