BIX ARTICLE

Fixed Income: Independent Review to Maintain Integrity of Impact Bonds

Jan 30, 2019

|

7 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

While these efforts have resulted in innovative ways to finance and solve social challenges, ascertaining the credibility of the complex mechanisms poses a challenge, says Milly Leong, technical director of ratings at Malaysian Rating Corp Bhd (MARC). That is why MARC felt that it was crucial to publish an independent assessment of the issuer’s credentials to complement the existing standards, she adds.

Despite the fact that the impact bond market began as an issuer-labelled one, standards and best practices have emerged over time to protect the integrity of the market, namely in the form of the Green Bond Principles (GBPs), Climate Bonds Standard, Social Bond Principles (SBPs) and Sustainability Bond Guidelines (SBGs), says Leong.

“Impact bonds are differentiated from their unlabelled equivalents by the issuers’ pre-issuance commitments regarding the use of proceeds, process for project evaluation and selection, management of proceeds and reporting. Currently, the expectation is for issuers of impact bonds to observe the voluntary process guidelines to facilitate standardisation and credibility within the market,” she adds.

To facilitate the growing interest, after seeing the potential of impact bonds in funding sustainable development, MARC published an impact bond assessment (IBA) alongside its bond credit ratings recently. The IBA is not an evaluation of a bond’s credit quality and should not be confused with the agency’s credit ratings. The criteria is designed to assess green, social and sustainability bonds, which are collectively referred to as impact bonds.

-Analytical-Process.jpg style=)

Leong asserts that the IBA is applicable to impact bonds or sukuk, which are fixed-income financial instruments that mobilise private sector capital to generate positive environmental and/or social benefits. The assessment excludes social impact bonds, which are essentially crafted in a pay-for-success manner. “We hope that we will be able to offer some assistance in terms of trying to facilitate the growth of this market, the responsible investing market,” she says.

Leong says MARC decided come up with the assessment as the nascent field is rapidly developing. “The momentum is picking up in both the public and private sectors to achieve the 17 Sustainable Development Goals (SDGs) as defined by the UN.”

.jpg)

The essence of SDGs is to ensure sustained progress in living standards — a broad concept that extends beyond economic prosperity to include economic opportunity, security and quality of life. To which, some serious money is being directed as a worldwide consensus has emerged on the need for a more inclusive growth and development model.

“There is a lot of potential in striving to make the SDGs a success because governments around the world have committed to these goals and to deliver them by 2030. Social bonds and sustainability bonds represent promising means by which private capital may be mobilised towards the significant investments in social projects and green projects needed to accomplish the SDGs,” says Leong.

The grading mechanism

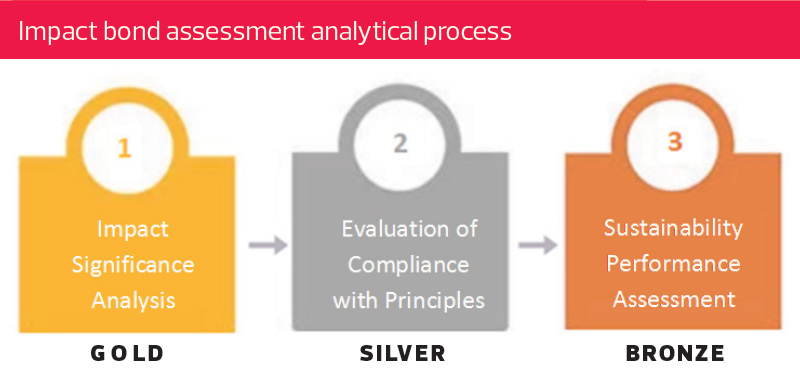

The IBA framework for evaluating the sustainability credentials of impact bonds (green and/or social) comprises three parts. The first is an impact significance analysis or benefit assessment of the underlying project. The second is an assessment of compliance with the Asean Green Bond Standards and the International Capital Market Association’s GBP or SBP and SBG. The third is an evaluation of the issuer’s sustainability performance.

After the impact significance analysis or benefit assessment of the underlying project, the bonds are graded either gold, silver or bronze. Under the framework, the impact bonds will have to meet the minimum threshold of each of the specified components to be graded, says Leong.

“Impact bonds that are unable to demonstrate that they meet the minimum thresholds will not receive an IBA grade. The minimum grade and score thresholds for each of the three analytical components of MARC’s IBA are set relatively high to maintain the value and integrity of each MARC-assigned IBA. Our methodology references market guidelines as well as sector-appropriate sustainability standards and practices as the baseline of performance,” she adds.

According to the Climate Bonds Initiative, green bond issuances alone stood at US$155 billion last year, a whopping increase from US$13 billion in 2013. And the market is only expected to further expand as S&P Global Ratings predicts that the momentum for issuances to reach about US$200 billion this year.

One of the latest impact bonds issued in Malaysia is that of HSBC Amanah Malaysia Bhd, which launched the world’s first UN SDG sukuk. The landmark offering is expected to be a benchmark for sustainable sukuk issuance by a financial institution to support businesses in any of HSBC’s selected SDGs.

The RM500 million sukuk will mature in 2023 and is priced at a fixed profit rate of 4.3%, which HSBC Amanah says is the lowest coupon for a five-year non-government-guaranteed bond issuance in Malaysia this year.

Using the IBA, MARC will scrutinise a bond’s framework — from how the proceeds are used, how impact is measured and the reporting and tracking of the funds used. “We have tried to make it as descriptive as possible so that it will aid understanding. For example, we have five levels of assessment on the first criteria, which is impact significance analysis, and we look at how this aligns with national priorities. For instance, in gender equality, an issuer of a women empowerment bond would receive a high grade for its significant impact,” says Leong.

The colour-coded grading mechanism also helps fund managers to allocate capital based on their investment mandate. “For serious impact investors, for example, if they really want each dollar invested to generate the most impact, then they would probably look for bonds graded gold,” she says.

But I think for most institutional or sophisticated investors, if there is something that offers impact and meets the risk-adjusted criteria, they will still invest in it, whether the bond is labelled gold or otherwise.”

This is similar to the grading provided by the Centre for International Climate Research (Cicero). Cicero Second Opinions are graded dark, medium and light green to offer investors better insight into the environmental quality of green bonds, says Leong. “Not a lot of the green bonds issued get the dark green rating. There are also a lot of light and medium green issuances. This grading system recognises that sustainability is a journey … sometimes they only achieve 20 or 30 ideals instantly. But what matters is the intention to get there.”

She believes that the impact bond market is only expected to grow as such instruments are favoured by the younger generation of investors. A generational shift is already happening, she points out, as the younger generation seem far less driven by narrow definitions of economic returns.

A Morgan Stanley survey says millennials are twice as likely to invest in a stock or fund if social responsibility is part of the value-creation thesis. Similarly, a Fidelity survey found that 77% of affluent millennials and 72% of Generation X donors indicated they had made some form of impact investment, such as investing in a publicly traded company with good social or environmental practices.

Gauging by her own experience and these statistics, Leong opines that such thinking will result in drastic implications for the financial services industry. “Sustainability has seeped into their consciousness. So, it is not just the millennials but also relevant for Generation Z as well,” she says.

Subramaniam, P. (2019, January 02). Fixed Income: Independent review to maintain integrity of impact bonds. The Edge Markets.

Retrieved from

- http://www.theedgemarkets.com/article/fixed-income-independent-review-maintain-integrity-impact-bonds

- https://www.marc.com.my/index.php/marc-news/996-fixed-income-independent-review-to-maintain-integrity-of-impact-bonds-20190115

Disclaimer

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

May 17, 2023

|

5 min read

ARTICLE

Jan 24, 2020

|

4 min read

ARTICLE

Dec 26, 2019

|

3 min read

ARTICLE

Jan 30, 2019

|

7 min read