BIX ARTICLE

Catalysing digital transformation for MSMEs in the capital market

Aug 12, 2024

|

8 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

By Aris Riza Noor Baharin / The Edge Malaysia

This article first appeared in Forum, The Edge Malaysia Weekly on August 12, 2024 - August 18, 2024

With advanced technologies like artificial intelligence (AI) becoming mainstream, it is increasingly important for companies to digitalise their processes to keep pace with developments or risk losing business to more agile and technologically adept competitors.

Kick-starting the digital transformation process can be daunting and risky, so the Securities Commission Malaysia (SC) launched the Digital Innovation Fund (DIGID) in 2023 to address this challenge. This initiative supports micro, small and medium enterprises (MSMEs) in adopting innovative technologies, thereby fostering growth and enhancing the capital market.

The RM30 million fund is designed to run for three years or until the fund is depleted. The SC co-funds innovative projects undertaken by the MSMEs up to RM500,000 per project or up to 70% of the project costs.

Wong Huei Ching, executive director of the digital strategy and innovation division at the SC and chairperson of DIGID, says many capital market players are already keen to innovate their business, being aware of the need to digitalise amid the rise of advanced technologies like AI since the start of the project.

“We know that a lot of the capital market players realised that [innovative technology] is very much needed to stay competitive. It’s no longer a nice-to-have, but a must-have,” she says.

With the assistance of DIGID, MSMEs can pursue their digitalisation goals without fear of the risks involved in embarking on new experiments. The fund acts as a safety net to encourage MSMEs to take their digitalisation journey seriously and not treat it like a pipedream.

With the assistance of DIGID, MSMEs can pursue their digitalisation goals without fear of the risks involved in embarking on new experiments. The fund acts as a safety net to encourage MSMEs to take their digitalisation journey seriously and not treat it like a pipedream.“If they do this on their own, they might say that it is risky [because] they might not get a return on their investment. So, [they may] set it aside. But with DIGID, we’ve actually brought that [risk down] by co-funding all the way up to half a million ringgit, which makes a difference for small players,” says Wong.

According to her, more than RM6 million have been utilised to date, with 17 projects receiving funding since DIGID was launched. Two of the projects have been completed while seven are about halfway through.

Looking for the truly innovative

When it comes to deciding which project will benefit from DIGID, Wong says the key criteria is whether the project is “truly innovative” and if the innovation improves the business or client experience in a tangible way. The SC determines this by asking key questions that encourage applicants to consider their project goals carefully.

“The structure of DIGID includes clear questions [like] ‘What are the pain points?’ and ‘How are you going to address them?’” she says, adding that this put a stop to project pitches that were too vague and overreaching.

In the early days of DIGID’s mobilisation, many market participants were slow to submit their application as they were stuck in the conceptualising phase. The SC then jumped in to help them formulate their pitches and understand the innovations they were after, thus streamlining the application process.

“When we started, it took a couple of rounds for each of these applicants. Some of them went up to three months. But it takes about a month now as it is a lot more structured,” says Wong.

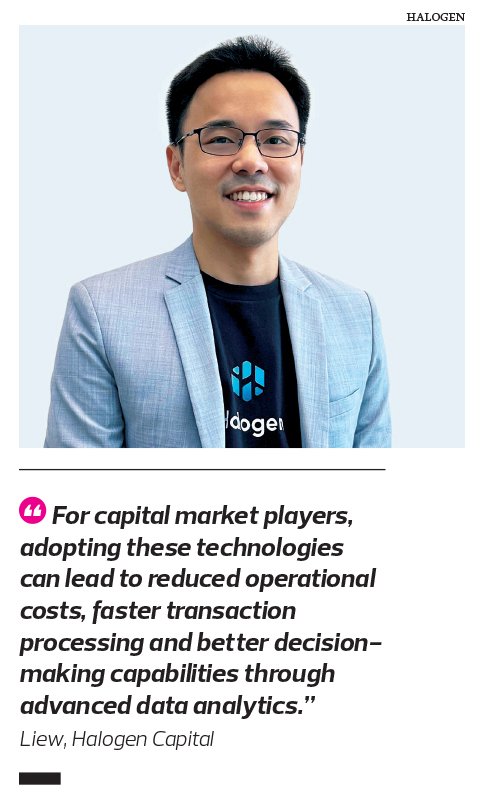

“The guidance and support provided by the DIGID team throughout the process have been invaluable, helping us refine our project proposal and align it with the strategic objectives of the SC as well as our own,” says Halogen Capital Sdn Bhd founder and CEO Hann Liew.

Once the project is approved, DIGID provides the funds on a milestone basis. This ensures the companies still have skin in the game as they only receive the funds upon hitting three milestones: 50% of the project completed, 100% of the project completed and when the objective of the project is reached.

Innovators that have reaped the benefits

Innovators that have reaped the benefitsOf the 17 DIGID recipients, Halogen Capital used the funds on a blockchain-based project to enhance its fund manager solutions that are focused on enhancing transparency, efficiency and accessibility in asset management, says Liew.

Halogen Capital is currently engaged in a distributed ledger technology-based fund administration solution project, which offers tokenised unit trust funds directly to the public via the blockchain, allowing faster processing times for subscription, redemption, net asset value calculation and publishing. The project also opens up the funds to available on-chain liquidity searching for yield in real-world assets.

“These innovations offer numerous benefits, such as increased transparency, enhanced security and improved efficiency. For capital market players, adopting these technologies can lead to reduced operational costs, faster transaction processing and better decision-making capabilities through advanced data analytics,” says Liew.

Meanwhile, AI-powered adviser Crea8 Capital Sdn Bhd is currently engaged in a project that uses AI to help businesses make sustainable investment decisions to meet their environmental, social and governance (ESG) goals.

“[Crea8] adopted machine learning to enable a different approach to sustainable investing. Not just like positive screening, it actually uses the data to provide a more optimised strategy,” says Wong.

These are the kinds of innovations the SC wants to encourage — innovations that small players inherently have very little capability to invest in, which can be scaled later as the company grows, she adds.

Riding innovative trends

The projects undertaken by Halogen and Crea8 reflect the DIGID team’s goal of encouraging innovation such as the use of blockchain, AI and machine learning in the capital market.

While AI is currently the trendiest of innovations, Wong cautions businesses applying for DIGID to not simply implement the technology directly into their business operations, but instead focus on building their data capabilities to layer AI on top of these.

“Everybody forgets that fundamentally, you need your data capability to come up first. AI layered on broken, inaccurate, inefficient or insufficient data does not really help you that much,” she points out.

By encouraging widespread digital adoption among MSMEs, Wong hopes the capital market as a whole will benefit.

The success of this endeavour has prompted the SC to extend DIGID’s eligibility to include larger mid-tier companies, those with revenues of up to RM100 million. Even these companies have been hesitant to invest in innovative projects, she notes.

“If they could demonstrate the use of blockchain to fundraise, improve accessibility, offer better investment options or even use generative AI for example, we are ready to fund up to RM1.5 million,” says Wong.

The SC has had conversations with several of these mid-tier companies, but no actual project applications have been submitted. Wong is hopeful that these mid-tier companies will join in, and with the right innovation and growth, they can grow and team up with MSMEs to directly challenge the larger players in the market.

GROWing initiatives

DIGID is one of the various efforts the SC is spearheading to grow the Malaysian capital market. Its latest initiative, under the Synergistic Collaboration by the SC (SCxSC) platform, is the GROW initiative that is scheduled for launch on Aug 16.

Recognising that food security is a shared responsibility, the focus of the annual event this year will be the role of technology in advancing the country’s food security goals alongside ecosystem partners.

The pilot event of the GROW initiative will emphasise agriculture, positioning alternative funding options like equity crowdfunding (ECF) and peer-to-peer (P2P) financing platforms as powerful enablers to accelerate agricultural transformation and promote food security.

Since 2015, ECF and P2P platforms have supported more than 7,000 MSMEs. Last year, these platforms raised more than RM6 billion. According to the SC, about 2,000 MSMEs across the entire agriculture value chain — from upstream to midstream and downstream businesses — have raised close to RM800 million.

The SC is also launching GROWMatch, which is aimed at bridging the “valley of death” by supporting early-stage start-ups with financial aid and connections. This will help them overcome funding gaps and resource allocation challenges, ensuring that the chosen start-ups can achieve sustainable growth.

The launch of GROWMatch is set to feature 20 shortlisted tech-related solutions across the agriculture, food and biotech sectors. These solutions were shortlisted from the 70 applications the SC received by the June 15 deadline.

The regulator is collaborating with key partners including the Ministry of Agriculture and Food Security, Malaysia Digital Economy Corporation, Bioeconomy Corporation, Selangor Information Technology and Digital Economy Corporation, Universiti Putra Malaysia and Impact Circle to identify promising agri-based MSMEs. These partners, which operate across academia, incubators, accelerators and capacity-building programmes, have contributed significantly to GROWMatch, providing nearly 70% of all applications.

The shortlisted applicants will get to pitch their solutions to investors on GROWMatch Pitch Day on Aug 16.

Source: The Edge

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Dec 23, 2025

|

5 min read

ARTICLE

Dec 22, 2025

|

6 min read

ARTICLE

Dec 18, 2025

|

7 min read

ARTICLE

Dec 16, 2025

|

5 min read