BIX ARTICLE

One-stop Platform on Green, Social, Sustainability SRI Bond/Sukuk Issuances in Malaysia

Sep 21, 2020

|

5 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

BIX Malaysia in collaboration with the Securities Commission Malaysia (SC) has launched a new Sustainable and Responsible Investment (SRI) Center, an information platform dedicated for green, social, sustainability SRI bond and sukuk in Malaysia. The SRI Center was launched by the Chairman of Securities Commission Malaysia (SC), Datuk Syed Zaid Albar at the SRI Virtual Conference 2020 on 25 August 2020.

The SRI Center was established with objectives to:

- Strategically positioning Malaysia as a regional SRI Center.

- Centralized Green, Social, and Sustainable and Responsible bond and sukuk information for easy access by market participants.

- Provide transparency in Green, Social, and Sustainable and Responsible bond and sukuk market in Malaysia with a comprehensive and up-to-date information.

- Support the development of Green, Social, and Sustainable and Responsible bond and sukuk market in Malaysia.

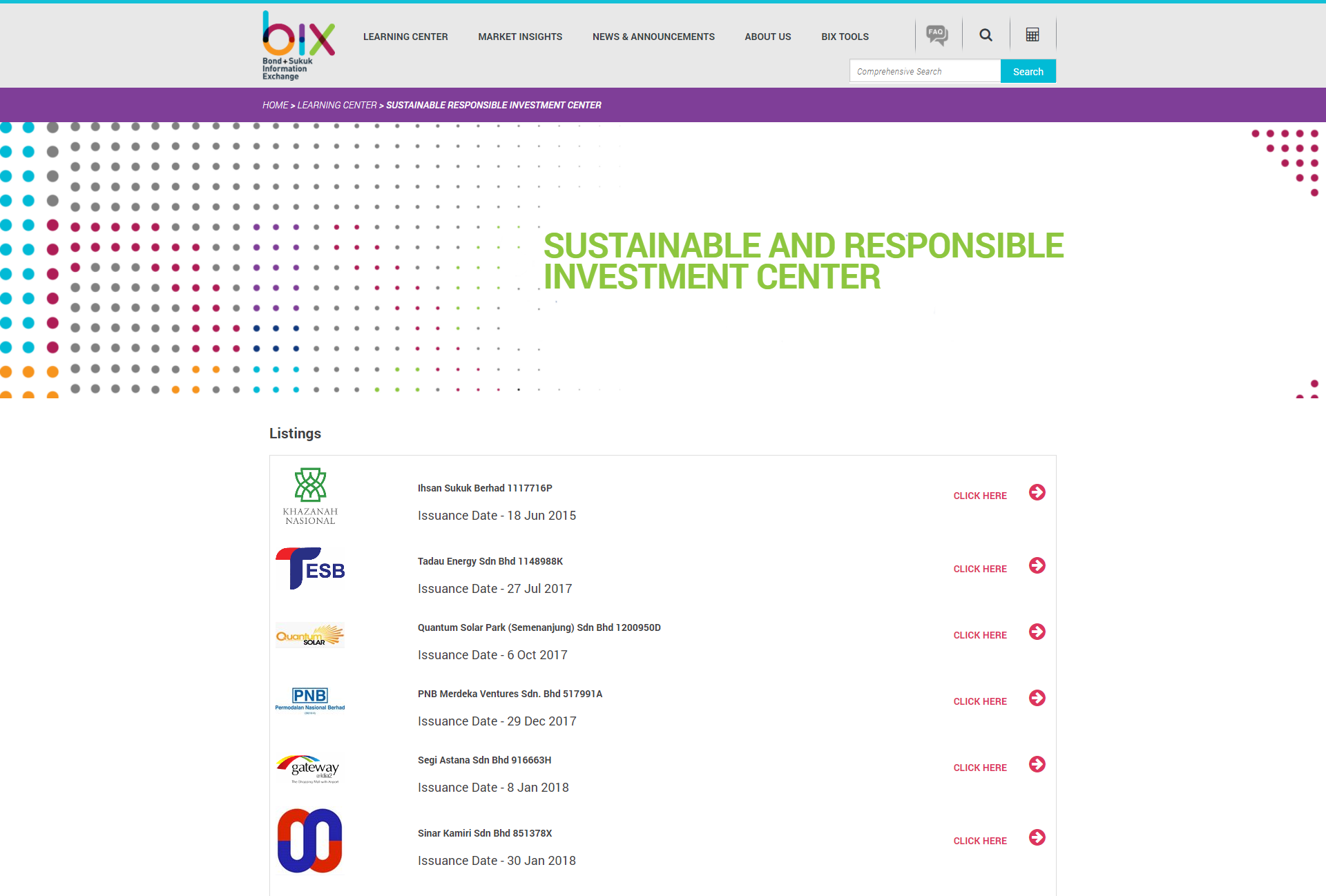

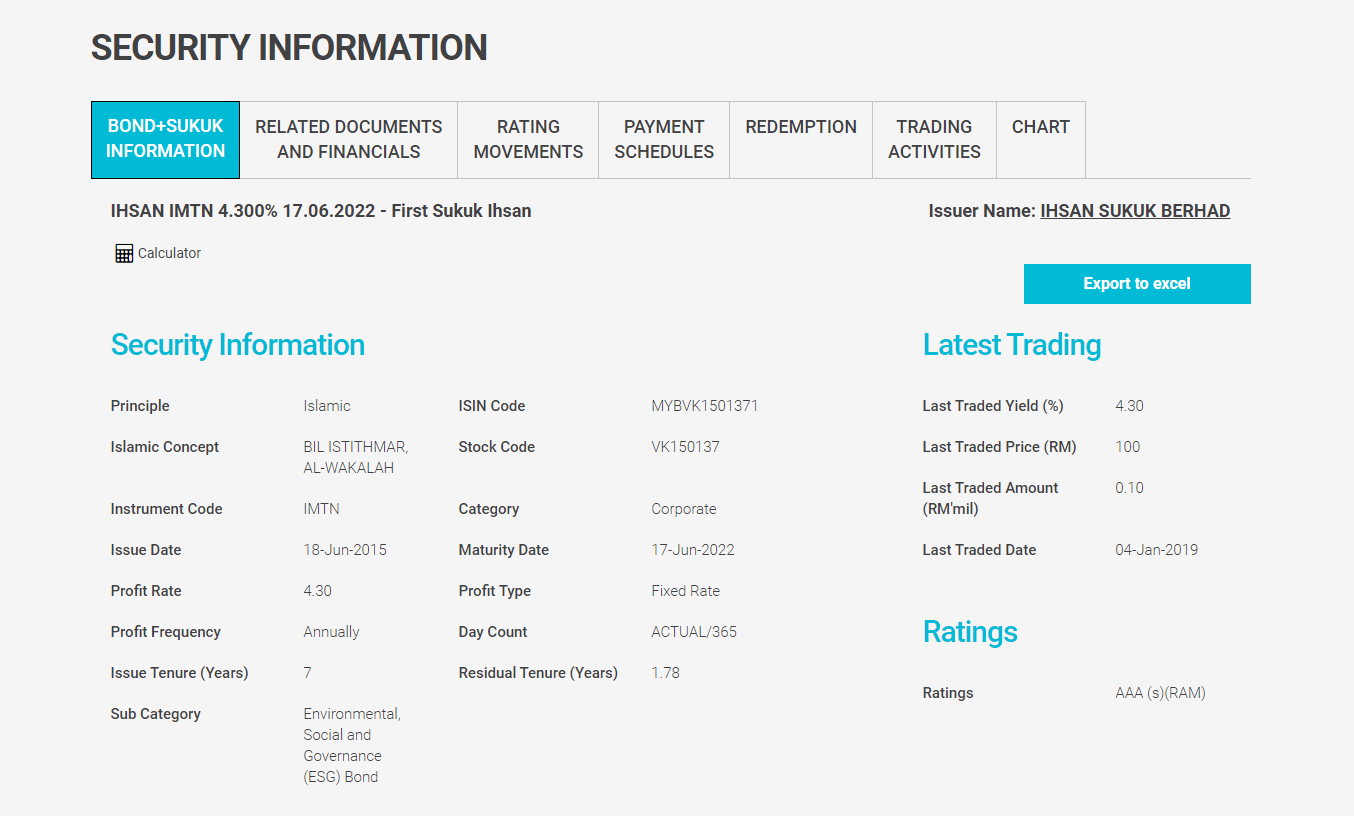

The SRI Center provides comprehensive and up-to-date information of ringgit-denominated SRI as well as ASEAN-labelled bond and sukuk in Malaysia such as Ihsan Sukuk Berhad, Tadau Energy Sdn Bhd, and Quantum Solar Park (Semenanjung) Sdn Bhd.

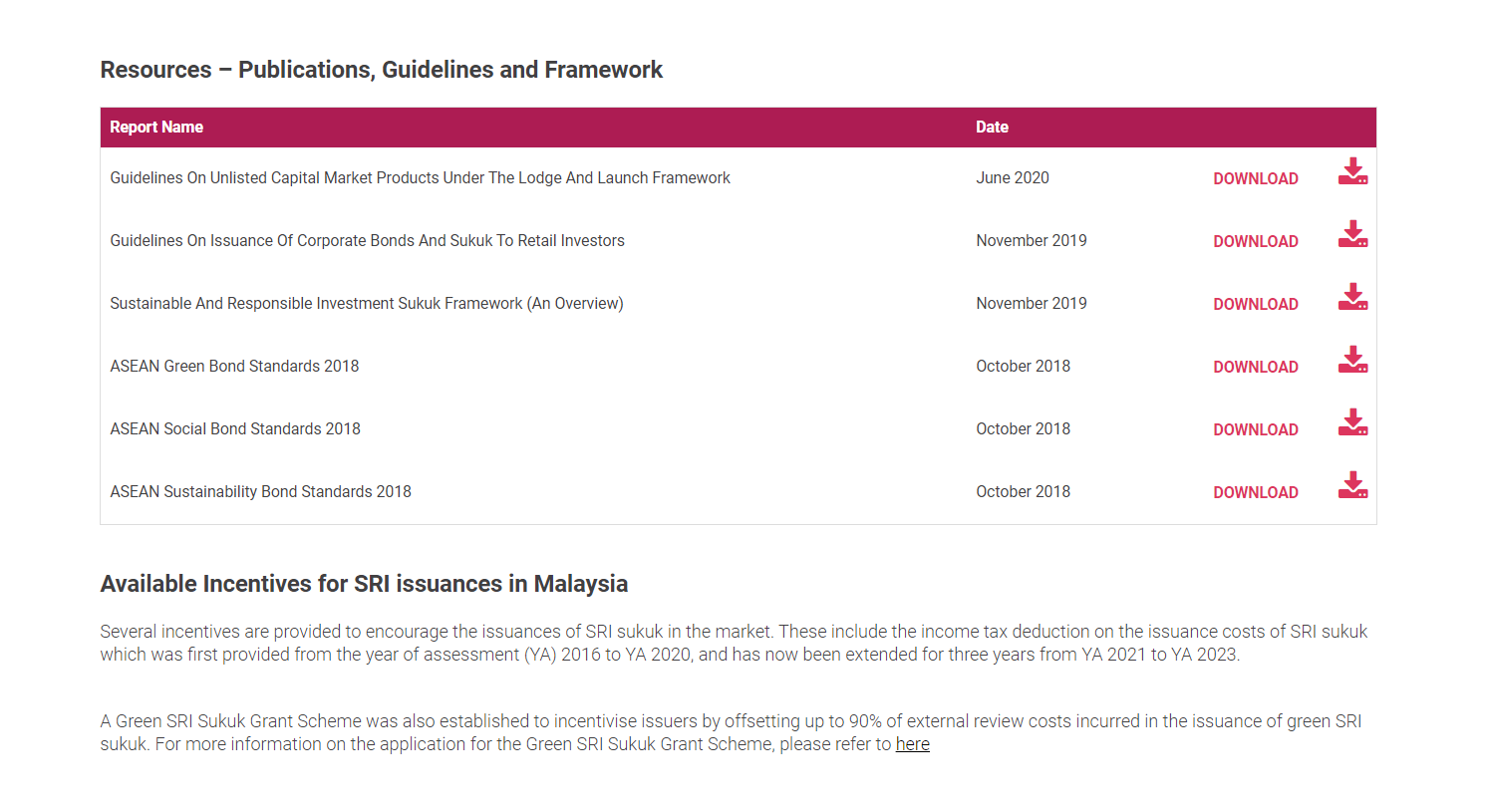

The information available on the SRI Center platform includes the bond and sukuk security details, trading activities, coupon and profit payment schedules, ratings, yield charts and other related information. In addition, the SRI Center is a central resource for issuers and investors to find SRI-related guidelines, framework, and articles to deepen the understanding of SRI investment.

Malaysia has been driving the SRI agenda since 2014, when the Securities Commission Malaysia introduced the Sustainable and Responsible Investment (SRI) Sukuk Framework, Guidelines on SRI Funds, and implemented the ASEAN Green, Social and Sustainability Bond Standards, as well as the SRI Roadmap for the Malaysian Capital Market in 2019. All these initiatives aim to facilitate the development of an ecosystem that promotes SRI. More information on the initiatives to develop the SRI ecosystem can be read here.

With the issuance of the world’s first green sukuk in 2017, Malaysia has earned the World Bank Group’s recognition as the pioneer in harnessing the capital markets to support the United Nation’s SDGs. At the regional level, Malaysia hosted the inaugural issuance of an ASEAN-labelled sukuk in 2017 which was dually recognised under the SRI Sukuk Framework. Malaysia continues to accelerate the development of SRI sukuk and ASEAN-labelled green, social and sustainability bonds, providing RM5.3 billion (cumulative April 2020) financing for eligible projects. In addition, there is also the USD 680 million CIMB SDG Bond, issued under the ASEAN Sustainability Bond Standards in 2019.

The SRI Center is part of the SRI Roadmap recommendations, a 5-year plan by the Securities Commission Malaysia (SC), aimed to drive the development of a vibrant SRI ecosystem for Malaysia as well as the region. The SRI Center will enhance transparency and provide access to information on ringgit-denominated SRI bonds and sukuk for all market participants as well as the general public.

SRI Center, a one-stop platform on Green, Social, Sustainability SRI Bond/Sukuk Issuances in Malaysia is now available at bixmalaysia.com. The Sustainable Responsible Investment Center (SRI Center) is located under the Learning Center tab on BIX Malaysia website.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 13, 2026

|

4 min read

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read