BIX ARTICLE

Monthly Fixed Income Report: January 2025

Feb 05, 2025

|

4 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

BIX MALAYSIA

MONTHLY FIXED INCOME REPORT: JANUARY 2025

Ringgit Bond and Sukuk market stood at RM2.11 trillion in January 2025

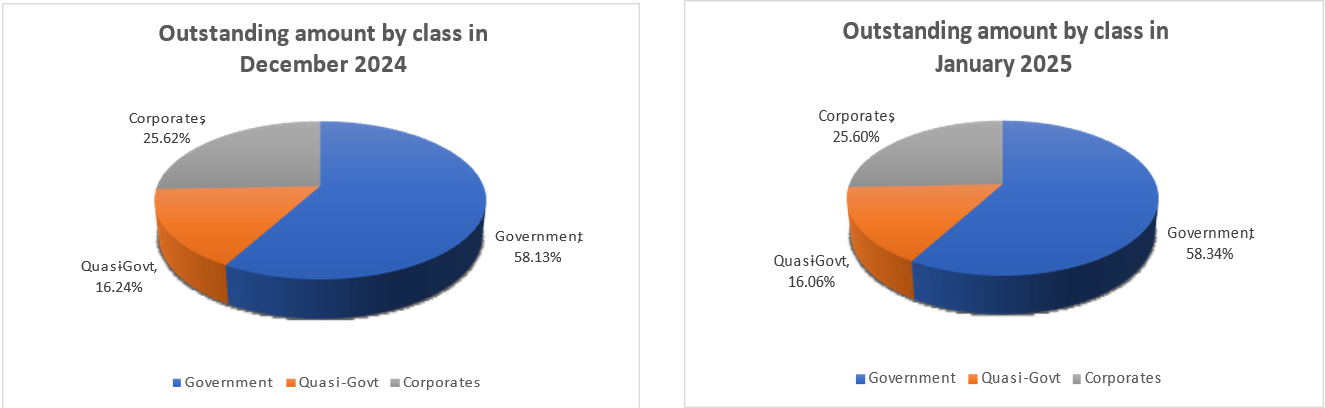

The ringgit bond and sukuk market slightly increased by 0.48% in January compared to the previous month. Total outstanding recorded in January 2025 was RM2.11 trillion which gained by 0.48% compared to RM2.10 trillion in December 2024. This outstanding amount contributed from government outstanding at 58.34%, followed by quasi government and corporates at 16.06% and 25.60%, respectively. For the first month of 2025, the local bond market shows positive momentum and expanded by RM0.01 trillion compared to last year, where ringgit bond and sukuk market outstanding totalling amount of RM2.10 trillion as at end December 2024.

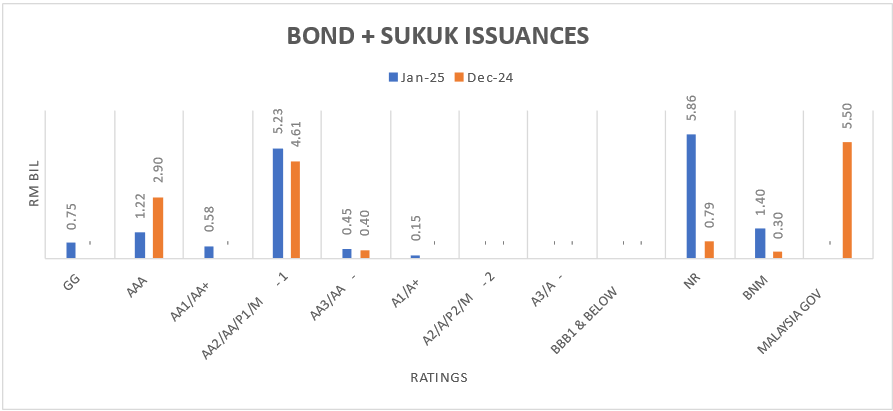

Total issuance for ringgit bond and sukuk in January 2025 declined by 7.29% to RM14.50 billion compared to RM15.64 billion in December 2024. The Malaysian Government issuance dropped in January 2025 to RM1.40 billion compared to RM5.80 billion December 2024 while Bank Negara Malaysia (BNM) recorded issuance of RM0.30 billion in January 2025, reduced by 78.57% compared to issuance of RM1.40 billion in the previous month.

Corporate issuance dropped by 38.90% to RM8.70 billion in January 2025 compared to RM14.24 billion in December 2024. AA2/AA/P1/M-1 rated bonds recorded the highest issuance in January 2025 with total issuance of RM4.61 billion, lessened by 11.50% compared to RM5.23 billion in the previous month. No issuances of government guaranteed recorded in January 2025 compared to RM0.75 billion in December 2024.

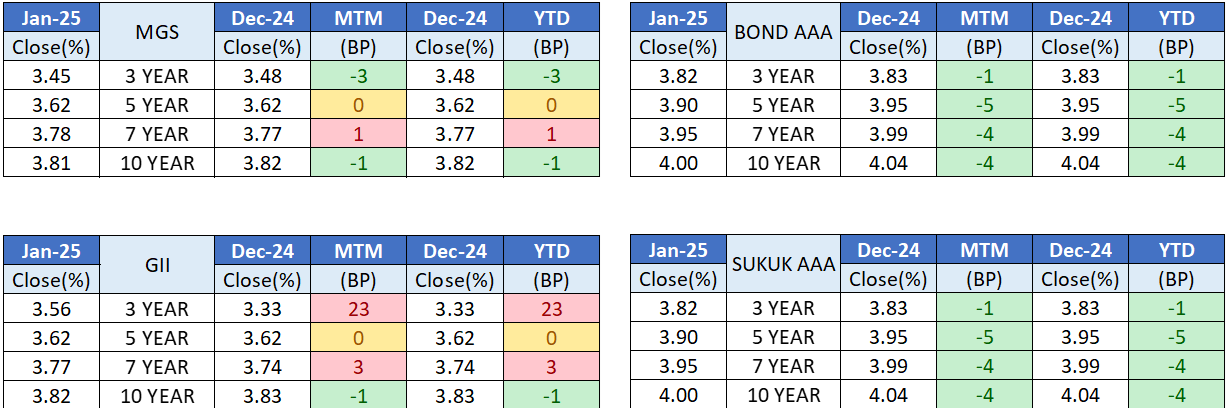

Malaysian Government Securities (MGS) 3-Year yield decreased to 3.45% in January 2025 compared to 3.48% in December 2024. The 10-year MGS closed at 3.81% in January 2025 compared to 3.82% in December 2024 which is slightly down by 0.01% or 1bps. Government Investment Issues (GII) 3-Year closed at 3.56% and 3.33% in January 2025 and December 2024, respectively, with the yield surged by 0.23% or 23bps where most likely players took profits after past month gains and ahead of news of US tariffs on its neighbouring countries and before US consumer spending and PCE data release. 10-year GII closed at 3.82% in January 2025 slightly declined by 0.01% or 1bps compared to 3.83% in December 2024.

3-Year AAA-rated corporate bond and sukuk closed at 3.82% in January 2025 compared to 3.83% in December 2024 which lessened by 0.01% or 1bps, while the 10-year AAA-rated bond and sukuk closed at 4.00% in January 2025 compared to 4.04% in previous month.

5th February 2025

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

(201701039928) (1254101-K)

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read