BIX ARTICLE

How’s Gross Domestic Product (GDP) Growth Affect Bond Market

Jan 30, 2026

|

6 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

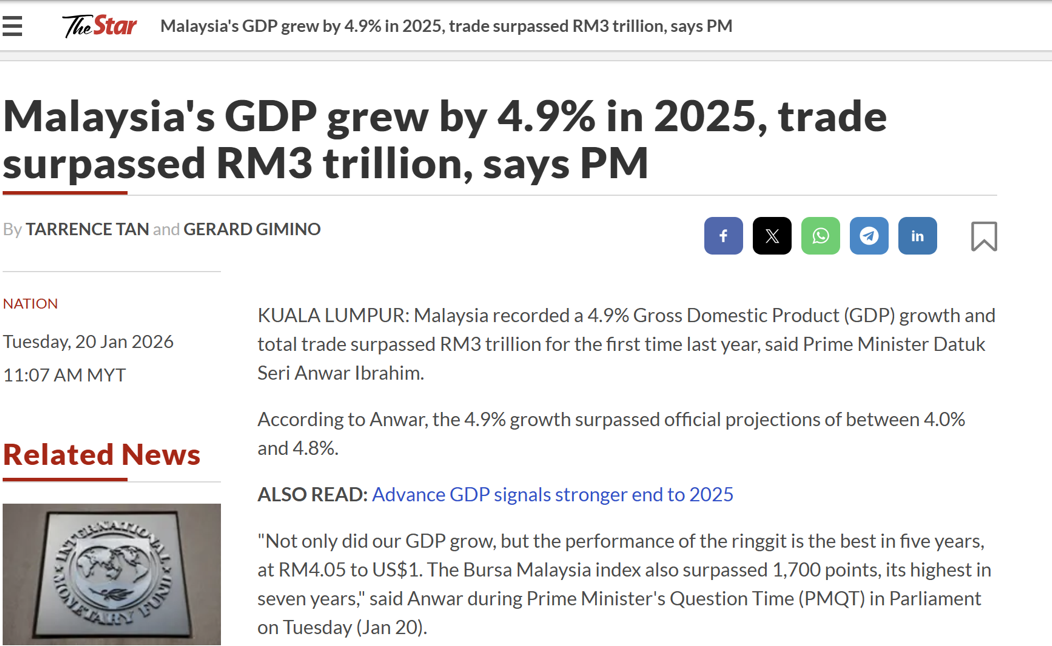

In recent periods, Malaysia’s economy has delivered stronger-than-expected growth. For example, official estimates show GDP expanding by around 4.9 % in 2025, above forecasts, with robust performance in services, manufacturing, and construction. Q4 growth even reached around 5.7 % year-on-year, the fastest since mid-2024.

GDP growth matters to financial markets because it signals the pace of economic activity, corporate profits, and consumer spending which all of which influence investor expectations about inflation, interest rates, and government finances.

Bond Yields and Prices in Response to Growth

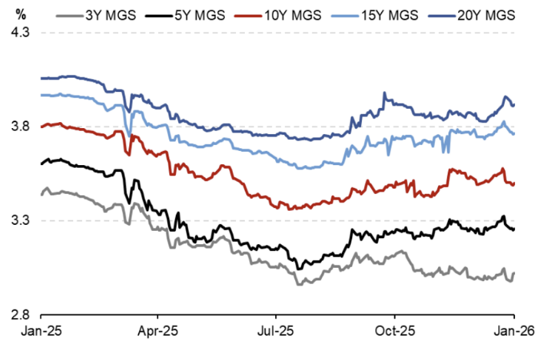

When GDP growth strengthens, bond markets often adjust yields in anticipation of changes in monetary policy and inflation expectations. In Malaysia’s case, recent market data shows that government bond yields on instruments like Malaysian Government Securities (MGS) and Government Investment Issues (GII) have been sensitive to both domestic economic performance and global policy cues.

For instance:

Research reports indicate that yields on the benchmark 10-year MGS/GII have fluctuated modestly, often within a tight range, as markets digest incoming economic data. Strong domestic indicators including higher GDP data helped underpin confidence and keep yields relatively anchored or slightly lower at times due to stable demand.

Conversely, bond yields have also edged higher on certain weeks when global rate expectations shifted, demonstrating that macroeconomic strength can combine with global influences to push yields up.

Fundamentally, when GDP growth is higher, fixed-income investors often anticipate that the central bank might tighten policy to keep inflation in check. This can push yields up (bond prices down), especially for medium-term maturities that are more sensitive to interest rate expectations.

Higher economic growth tends to make a country’s assets more attractive to foreign investors. In 2025, there were periods when Malaysia saw substantial foreign inflows into its government bonds, particularly when growth data surprised on the upside. In one report, foreign investors bought significant amounts of Malaysian bonds, driven by improved growth outlooks with Malaysia receiving over US$1 billion of foreign bond purchases in a single month as part of a broader regional shift back into Asian debt markets.

Foreign demand can support bond prices and temper yield increases, even in a growth environment. This interplay underscores how capital flows and domestic growth signals jointly shape bond market outcomes.

Issuance, Fiscal Policy, and Growth

A stronger GDP base often translates to higher tax revenues and potentially better fiscal balances. Over recent years, Malaysia’s government debt issuance has grown substantially the total value of MGS and GII outstanding surpassed RM1 trillion yet borrowing costs remained modest. Yields stayed low despite heavy issuance, illustrating that confidence in macroeconomic fundamentals has helped absorb supply without sharp rises in interest rates.

However, there are caveats:

Increased growth can lead governments to issue more bonds to finance infrastructure and development programs, especially if strong activity reveals opportunities to invest. Higher issuance can exert upward pressure on yields if demand does not keep pace.

The cost of servicing debt and the associated yield dynamics also depends on the fiscal deficit and broader budgetary stance. Studies using econometric models (e.g., ARDL analyses) show that economic growth, along with fiscal deficits and exchange rates, has a significant long-run relationship with government bond yields.

Thus, while growth boosts investor confidence, the market must balance supply side effects and macro stability considerations.

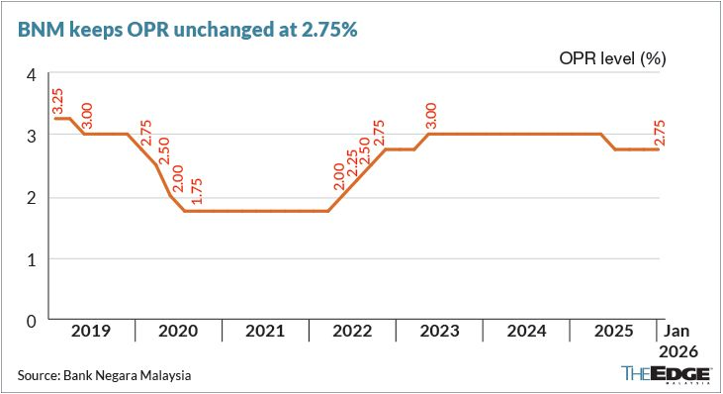

Interaction With Monetary Policy

Bank Negara Malaysia’s policy stance plays a key role in bond market outcomes. Strong GDP growth can influence the central bank’s view on the overnight policy rate (OPR). If growth persists above expectations and inflation rises, the central bank might raise or delay easing of the OPR, which in turn causes yields particularly short-term ones to rise. In some instances, analysts have linked robust domestic data (e.g., robust industrial production and GDP figures) to expectations of upward pressure on yields.

However, the central bank also monitors global and domestic conditions, meaning higher growth does not automatically induce tighter policy especially if inflation remains subdued and external risks persist.

Longer-Term Implications and Takeaways

Pulling the evidence together:

Higher GDP growth generally puts upward pressure on bond yields, as markets price in stronger economic activity especially if it sparks expectations of tighter monetary policy.

Foreign investor demand can offset some yield pressures, supporting prices when growth reinforces confidence in Malaysia’s economic narrative.

Issuance dynamics matter: strong growth alongside increased government borrowing requires careful balancing to avoid undue upward pressure on yields.

Empirical research finds that economic growth is one of the key long-term determinants of bond yields in Malaysia, along with fiscal and exchange rate factors.

In essence, Malaysian bond markets react to higher GDP growth through a complex interplay of monetary expectations, investor sentiment, fiscal policy, and capital flows. Understanding these linkages helps policymakers and investors anticipate how yields and bond prices evolve as the economy expands.

Disclaimer

This report has been prepared and issued by Bond and Sukuk Information Platform Sdn Bhd (“the Company”). The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, the Company does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Feb 04, 2026

|

4 min read

ARTICLE

Jan 30, 2026

|

6 min read

ARTICLE

Dec 01, 2025

|

4 min read

ARTICLE

Nov 04, 2025

|

4 min read