BIX ARTICLE

Bond funds pile into swath of Asia's emerging markets for first time since 2021

Aug 22, 2024

|

3 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

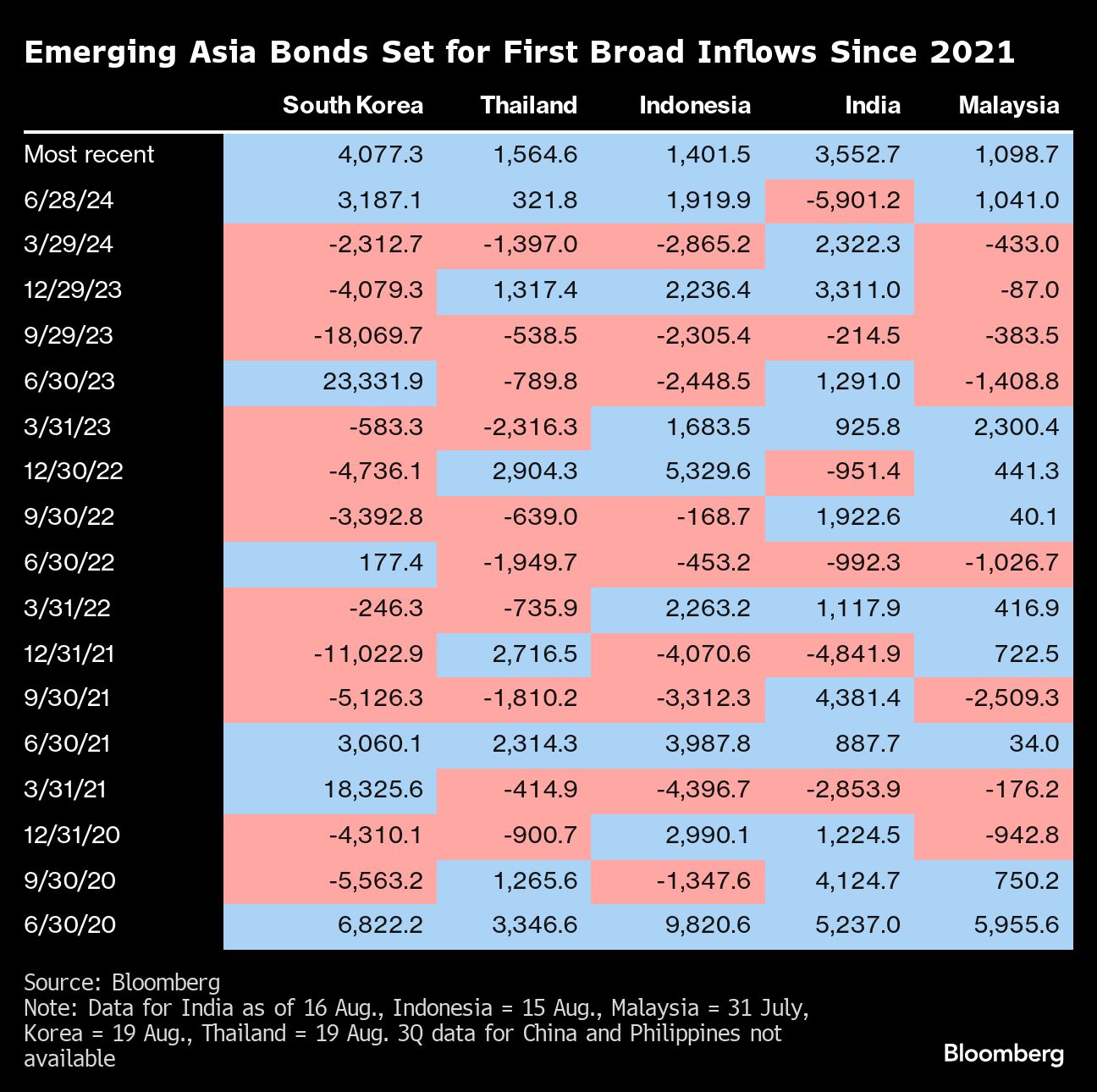

Overseas funds have boosted holdings of debt in each of South Korea, Thailand, Indonesia, India and Malaysia since the start of July, according to data compiled by Bloomberg. If the inflows continue through the end of September, it would be something that hasn’t been seen on a quarterly basis since the middle of 2021.

“Many global investors would have been underweight on lower-yielding Asian bonds — but once Fed cuts became more certain, they had to reduce that underweight,” said Charlie Robertson, the head of macro strategy at FIM Partners. “US dollar weakness has also reopened the prospect of rate cuts” in the region.

The broad-based inflows indicate investors are turning more positive on emerging-market debt as a whole as the Federal Reserve (Fed) moves closer to cutting interest rates. That contrasts with the underperformance of developing-nation bonds during the US central bank’s period of higher-for-longer borrowing costs.

While many emerging economies in Asia are expected to cut interest rates along with the Fed, the quantum of easing is forecast to be less than it will be in the US. For example, investors are pricing in roughly two percentage points of rate cuts for the Fed by the end of 2025, but only about 75 basis points in South Korea during the same period, swap markets showed.

Source: Bond funds pile into swath of Asia's emerging markets for first time since 2021 (2024, 21 August). theedgemalaysia.com. Retrieved from https://theedgemalaysia.com/node/723629

Disclaimer

YOU MAY ALSO LIKE

ARTICLE

Feb 23, 2026

|

5 min read

ARTICLE

Feb 23, 2026

|

3 min read

ARTICLE

Feb 16, 2026

|

5 min read

ARTICLE

Feb 12, 2026

|

4 min read