BIX ARTICLE

BNM Overtakes Govt as Top Bond Issuer In 3Q, Says BPAM

Oct 04, 2023

|

3 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

Bank Negara Malaysia made RM74.5 billion worth of issuances in the three-month period ended Sept 30 this year.

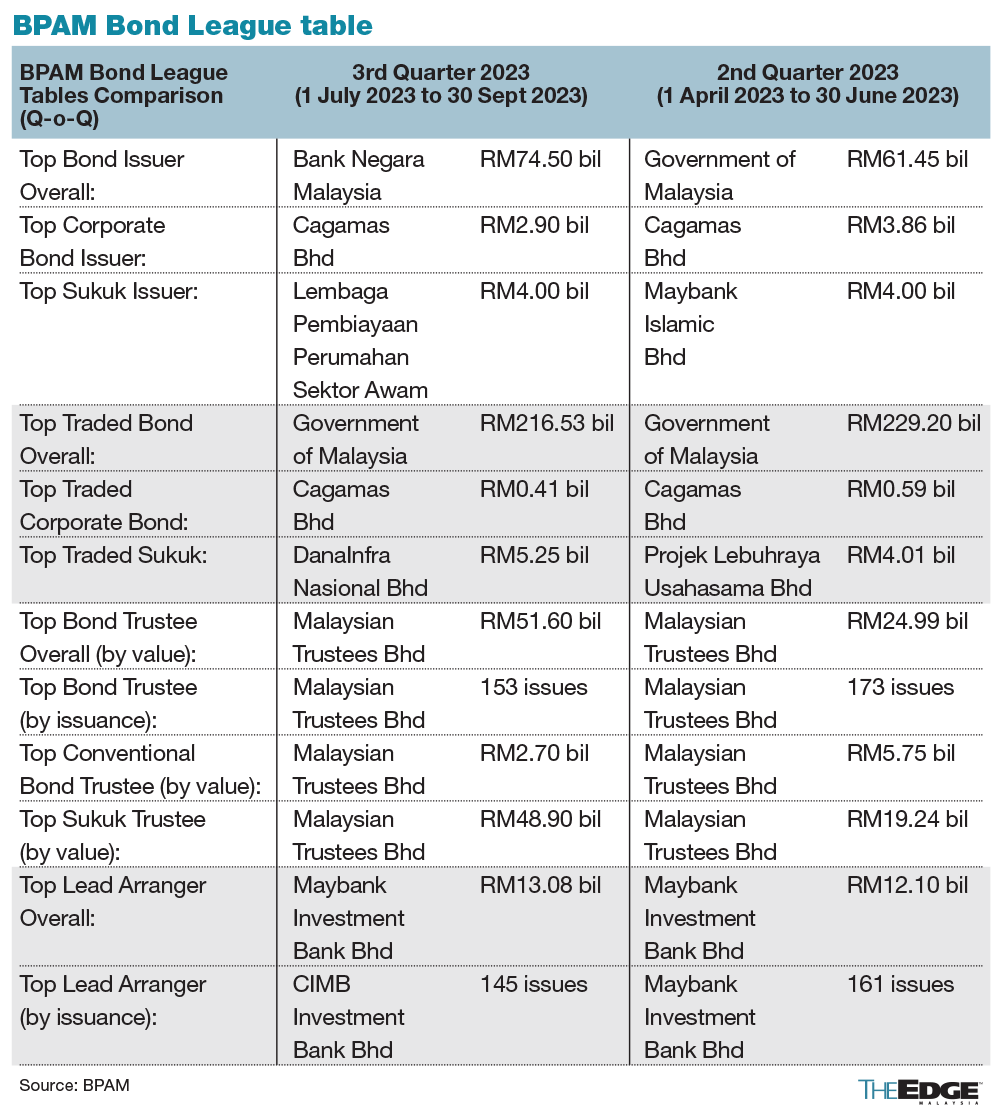

KUALA LUMPUR (Oct 3): Bank Negara Malaysia (BNM) has overtaken the government as the top bond issuer in the country during the third quarter of the year, according to data from Bond Pricing Agency Malaysia Sdn Bhd's (BPAM) Bond League Tables released on Tuesday.

The central bank made RM74.5 billion worth of issuances in the three-month period ended Sept 30 this year.

Nonetheless, the most traded bonds in the country were those issued by Putrajaya, with total traded value amounting to RM216.53 billion in 3Q, said BPAM.

In 2Q, the government was named the top bond issuer after raising RM61.45 billion during the quarter.

BPAM’s Bond League Tables highlights Malaysian bond market performance and rankings of key bond market players.

The biggest corporate bond issuer in 3Q was Cagamas Bhd, which issued RM2.9 billion worth of debt papers, while Lembaga Pembiayaan Perumahan Sektor Awam was the largest sukuk issuer, raising RM4 billion during the quarter under review.

Cagamas’ debt papers were also the most traded corporate bond in 3Q, worth a total of RM410 million, while the top traded sukuk were those issued by DanaInfra Nasional Bhd, valued at RM5.25 billion.

Malaysian Trustees Bhd was named the top bond trustee by value and by issuance, it was also the top conventional bond and sukuk trustee by value.

Maybank Investment Bank Bhd was the top lead arranger by value in 3Q, having handled a total value of RM13.08 billion.

In terms of number of issuances, CIMB Investment Bank Bhd was top, having handled 145 issues during 3Q.

Articl By Chester Tay

Edited By Lam Jian Wyn

Source: BNM overtakes govt as top bond issuer in 3Q, says BPAM (2023, 3 October). theedgemarkets.com. Retrieved from https://theedgemalaysia.com/node/684648

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Dec 03, 2025

|

6 min read

ARTICLE

Dec 03, 2025

|

5 min read

ARTICLE

Dec 02, 2025

|

6 min read

ARTICLE

Dec 01, 2025

|

6 min read