BIX ARTICLE

Supporting SMEs Transition to Greener Practices

Mar 26, 2024

|

7 min read

Featured Posts

SRI Sukuk: The Journey Towards Sustainable and Responsible Investment

Jul 23, 2020

|

5 min read

Securities Commission's Capital Market Masterplan 3 (CMP3)

Sep 21, 2021

|

2 min read

What If We Allowed Retail Investors to Directly Invest in Malaysia’s Government Bond?

Aug 24, 2021

|

8 min read

Islamic Bonds Come Under Microscope After Garuda Indonesia Default

Aug 19, 2021

|

8 min read

This article outlines the risks and opportunities for SMEs arising from the effects of climate change, ways SMEs can embrace sustainability practices and the support provided by BNM and the financial sector.

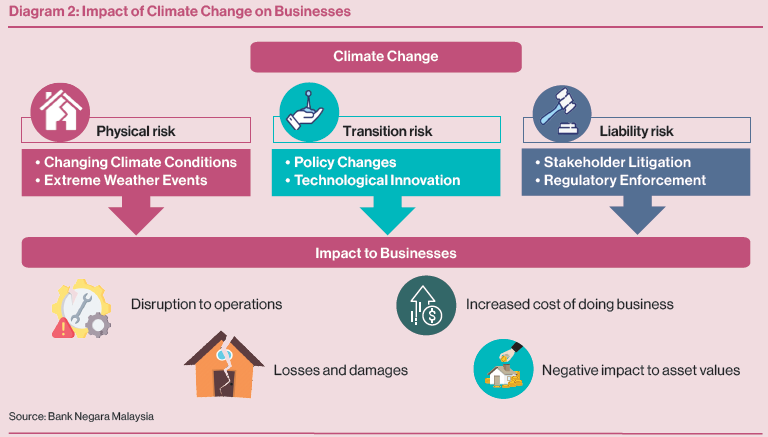

Risks and opportunities

The direct impacts of climate change on the operations of SMEs do not only come from extreme weather events (Diagram 2). SMEs that are part of supply chains can be affected by green and sustainability-related policies of other economies, especially key trading partners as well as domestic producers. For example, mandatory climate-related disclosures have been implemented in more than 15 countries around the world while the European Union Carbon Border Adjustment Mechanism compels businesses, including SMEs, to demonstrate evidence of green and sustainable practices. Large domestic producers are also reducing their carbon footprint and expect suppliers to meet higher standards of sustainable practices. Failure to adopt sustainable practices could therefore put businesses at a significantb disadvantage.

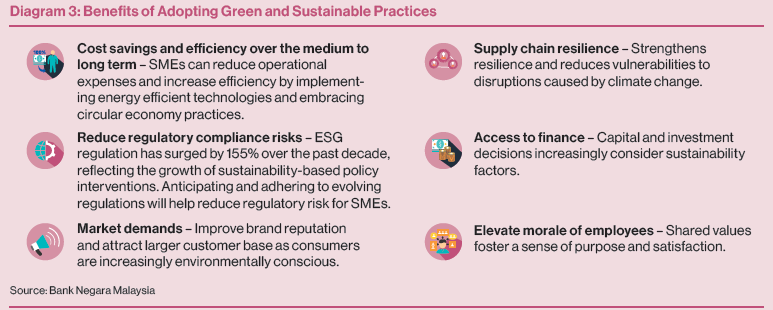

Climate change does not only pose risks to businesses. It also presents huge business opportunities from embracing sustainable practices and focusing on green activities (Diagram 3). A survey by UN Global Compact Network Malaysia & Brunei and SME Corporation highlights that 89% of SMEs adopting greener practices are experiencing average cost savings of 39%, with 11% achieving more than 50% cost savings.

Kickstarting the green transition journey

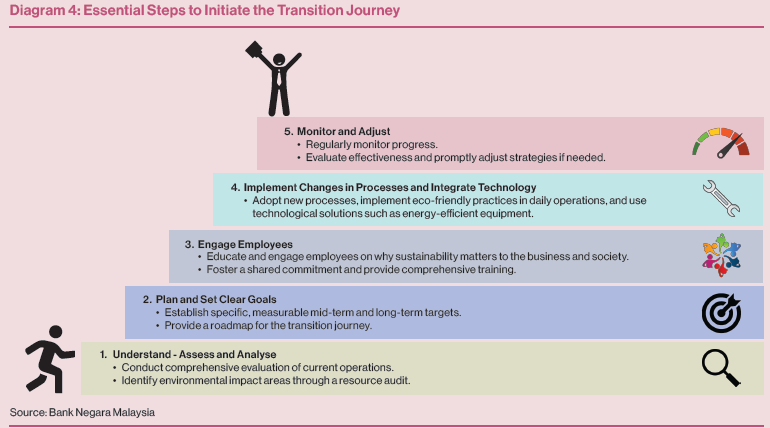

Knowing where and how to start is crucial. This allows SMEs to begin on the right footing and optimise the amount they spend and invest, and use of resources. A study conducted by BNM and the World Bank3 found that even Malaysian SMEs who understand the importance of transition are often unclear on where and how to begin. Diagram 4 outlines five key steps an SME can take to initiate the process.

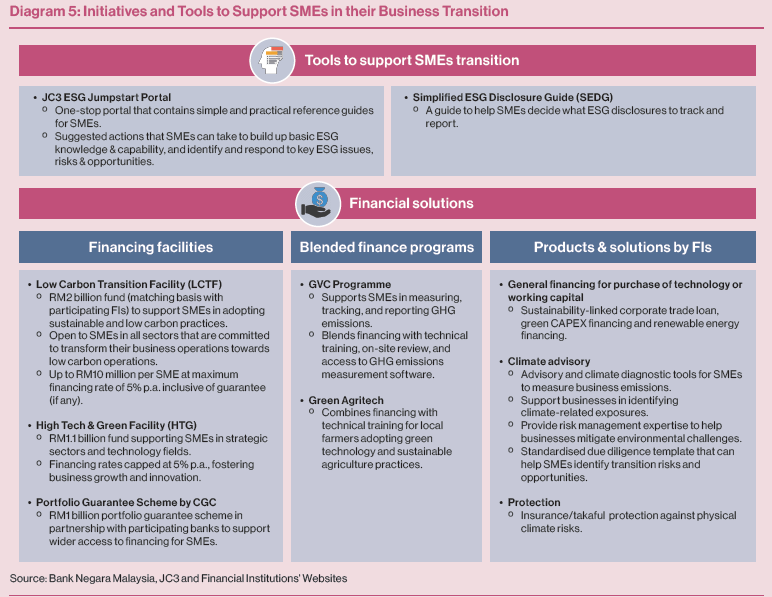

To support Malaysian SMEs on this front, the JC3 ESG Jumpstart portal, a one-stop portal to guide SMEs in transition was launched by the Joint Committee on Climate Change (JC3) in October 2023. This portal houses various resources and tools, including guidance for SMEs to initiate their transition journey.

Initiatives and toolkits to support SMEs transition

The financial sector plays a pivotal role in supporting businesses especially SMEs in their transition. Towards this end, BNM and the financial sector have introduced several initiatives to help SMEs build their technical capability and improve access to finance, as shown in Diagram 5.

Financing approved by BNM’s Low Carbon Transition Facility (LCTF)4 and High Tech and Green Facility (HTG)5 increased further in 2023 to more than RM1.2 billion in financing approved to date. Both facilities have enabled more than 550 SMEs to start their transition journey. The Greening Value Chain (GVC) pilot programme introduced last year has also supported more than 330 SMEs that are part of domestic supply chains. Under the GVC pilot programme, SMEs have access to technical training and tools to measure and report their GHG emissions, in addition to financing under LCTF. The cost of training and tools is borne by the participating anchor corporate or the financier. SMEs under the programme have begun to measure their GHG emissions, of which more than 40 have begun reporting emissions.

Start Small, Start Now, Do Our Part

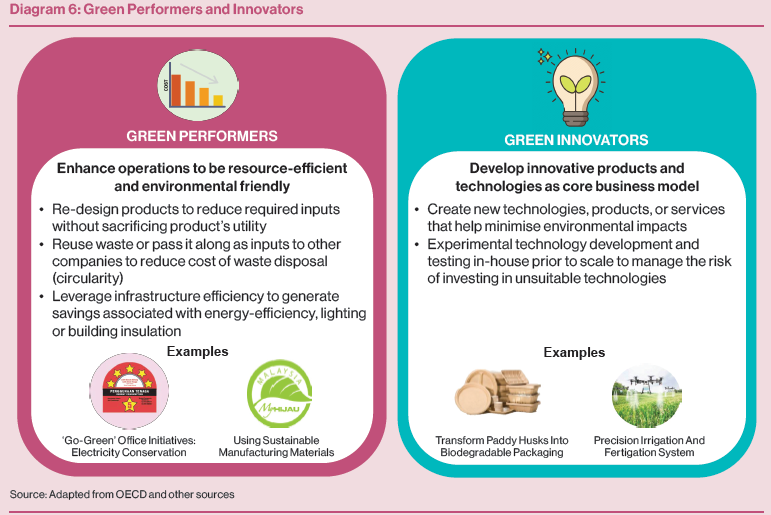

There are at least two ways Malaysian SMEs can think about their role along this journey (Diagram 6). First, SMEs can be green performers. This means seeking to optimise the way they operate. This is achieved through resource efficiency and practices that are environmentally friendly to enhance business competitiveness. Second, SMEs can be green innovators. This means focusing on pioneering innovative green technologies. Both green performers and green innovators have a critical role to support a successful transition.

Greater cooperation and collaboration among SMEs can also contribute to the success of the transition efforts. Platforms and avenues for SMEs to share best practices, pool resources and collectively tackle challenges through networks and partnerships will accelerate the learning of many SMEs.

Different SMEs will be at different stages in their level of awareness and adoption of sustainability practices. This is natural and to be expected. What is more critical is that SMEs start to take important first steps and progressively intensify their efforts to meet aspirations for higher standards in sustainable practices. SMEs should kickstart their green

transition journey now, utilising the available toolkits and solutions provided by the financial sector. Strategies by financial institutions to support the greening of SMEs must also be mainstreamed to secure an orderly and just transition of the economy where businesses regardless of size thrive, whilst contributing to a more sustainable and resilient future.

Accountancy Europe. (2023, November 27). 5-step starting guide to a sustainable transition for SMEs sustainable business calls for ambitious European Sustainability Reporting Standards. Ecopreneur.eu. https://ecopreneur.eu/2023/09/05/5-step-starting-guide-to-a-sustainable-transition-for-smes/

Capital Markets Malaysia (CMM) (2023). Simplified ESG Disclosure Guide (SEDG) https://sedg.capitalmarketsmalaysia.com/wp-content/uploads/2023/10/SEDG-Full-Guide.pdf

Department of Statistics Malaysia. (2023). PERUSAHAAN MIKRO, KECIL DAN SEDERHANA 2022 = MICRO, SMALL AND MEDIUM ENTERPRISES 2022. Jabatan Perangkaan Malaysia, Putrajaya. (ii, 80). ISBN 2948-4146

Financial Stability Board. Progress Report on Climate-Related Disclosures. (2023). https://www.fsb.org/wp-content/uploads/P121023-1.pdf

Green Growth Report (English). Washington, D.C.: World Bank Group. http://documents.worldbank.org/curated/en/863801468337280535/Green-growth-report

McDaniels, J., & Robins, N. (2017). Mobilizing Sustainable Finance for Small-and Medi-um-Sized Enterprises. Reviewing Experience and Identifying Options in the G7. Enquiry: Design of a Sustainable Financial System.

OECD (2021). Facilitating the green transition for ASEAN SMEs. https://www.oecd.org/southeast-asia/regionalprogramme/networks/OECD-Facilitating-the-green-transition-for-ASEAN-SMEs.pdf

OECD (2022), ‘Financing SMEs for sustainability: Drivers, Constraints and Policies’, OECD SME and Entrepreneurship Papers, No. 35, OECD Publishing, Paris, https://doi.org/10.1787/a5e94d92-en.

Schaper, M. T. (2022). SME responses to climate change in Southeast Asia. Iseas - Yusof Ishak Institute.

SME Sustainability Action Guide | UNGCMYB. (n.d.). UNGCMYB. https://www.ungcmyb.org/smesustainabilityactionguide

The SME Guide to Corporate Sustainability | UN Global Compact. (n.d.). https://unglobalcompact.org/library/5933.

World Bank. (2012). Inclusive Green Growth: The Pathway to Sustainable Development. @ Washington , DC. http://hdl.handle.net/10986/6058 License: CC By 3.0 IGO.

| 1 | Data as at December 2022. |

| 2 | The Paris Agreement is an international treaty under the United Nation Framework Convention on Climate Change (UNFCCC). It aims to limit global temperature rise to well below 2°C above pre-industrial levels. |

| 3 | Managing Flood Risks: Leveraging Finance for Business Resilience in Malaysia. |

| 4 | Launched in January 2022. Total size of RM 2.0 billion equally funded by BNM and participating financial institutions. |

| 5 | Launched in December 2020. Total size of RM 1.1 billion. |

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Aug 12, 2025

|

6 min read

ARTICLE

Jul 09, 2025

|

4 min read

ARTICLE

May 16, 2025

|

6 min read

ARTICLE

May 08, 2025

|

4 min read