BIX ARTICLE

BNM Is Exploring Stablecoins and Tokenised Assets. Here’s What You Should Know

Oct 31, 2025

|

11 min read

Featured Posts

Social Bonds Illustrative Use-Of-Proceeds Case Studies Coronavirus

Jul 06, 2020

|

2 min read

Sustainable Banking Network (SBN) Creating Green Bond Markets

Jul 06, 2020

|

2 min read

Why is Inflation Making a Big Comeback After Being Absent for Decades in the U.S.?

Mar 24, 2022

|

7 min read

SC issues Corporate Governance Strategic Priorities 2021-2023

Mar 29, 2022

|

3 min read

Bank Negara Malaysia (BNM) has released a Discussion Paper on Asset Tokenisation in the Malaysian Financial Sector to gather industry feedback on how digital representations of real-world assets could transform financial services.

The central bank defines tokenisation as the process of converting physical or traditional financial assets into digital tokens that can be issued, traded, and settled on programmable platforms.

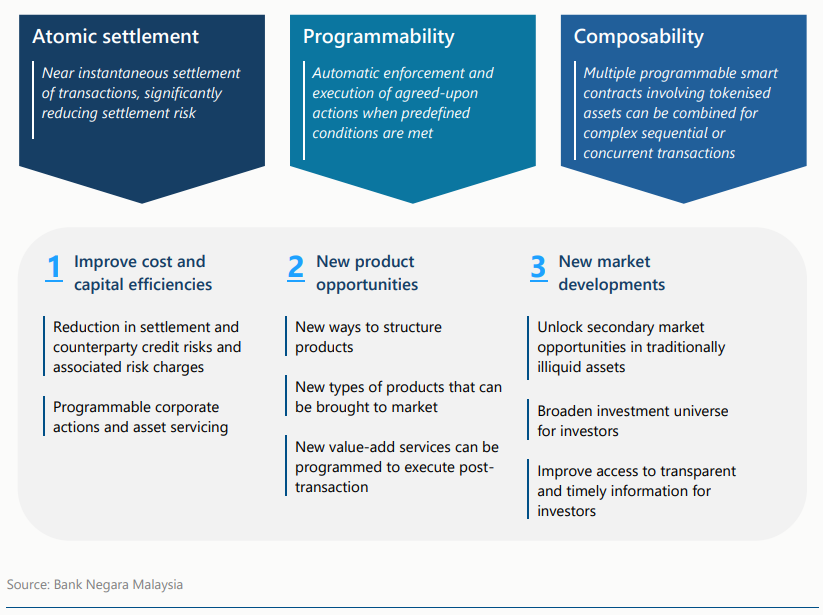

These tokens enable features such as atomic settlement, where transactions are completed instantly once conditions are met; composability, which allows seamless interaction between financial instruments; and programmability, which automates processes through smart contracts.

BNM believes these features could deliver measurable improvements in transparency, efficiency, and accessibility across Malaysia’s financial system.

By embedding logic directly into digital assets, financial institutions could streamline settlement, reduce operational friction, and create more inclusive financing solutions.

The discussion paper emphasises that the initiative remains exploratory.

Rather than introducing new regulations, BNM seeks feedback from financial institutions, fintech firms, and technology partners to identify practical use cases that bring tangible economic value.

Across the region, other regulators are testing similar ideas.

Singapore’s Project Guardian now includes more than 40 financial institutions experimenting with tokenised asset pilots, while Hong Kong’s Project Ensemble is developing wholesale settlement infrastructure to support tokenised transactions.

Malaysia’s discussion paper takes a similar exploratory approach, focusing on collaboration and feedback before any policy decisions are made.

The Rationale Behind BNM’s Tokenisation Push

BNM’s interest in tokenisation stems from its potential to modernise financial infrastructure and make markets more efficient.

Tokenisation enables financial assets to exist as programmable units that can settle automatically once agreed conditions are met.

In traditional markets, settlement can take days, and counterparties must hold large buffers to manage risk. Tokenisation could shorten this cycle dramatically, lowering settlement risk and freeing up liquidity.

At the same time, tokenisation offers traceability, as transactions are recorded on distributed ledgers that are secure and auditable. This creates new ways to manage risk while supporting greater transparency and trust in the financial system.

Exploring Tokenisation’s Economic Potential

BNM’s discussion paper identifies a range of potential applications for tokenisation across Malaysia’s financial ecosystem.

The goal is not to experiment for its own sake but to test where tokenisation can deliver real economic value and solve structural inefficiencies.

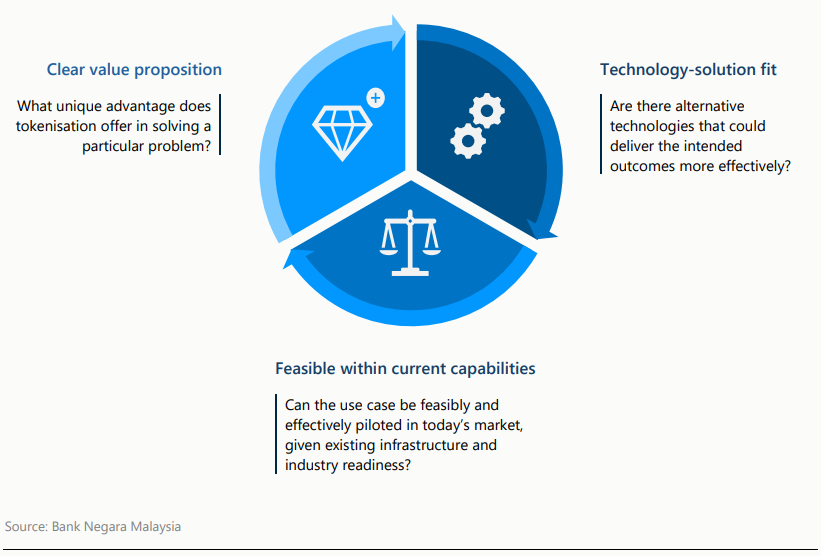

The paper outlines a clear framework for identifying viable use cases based on three guiding principles: value proposition, technology-solution fit, and feasibility within current capabilities.

Below are BNM’s initial exploration highlights for key areas of tokenisation:

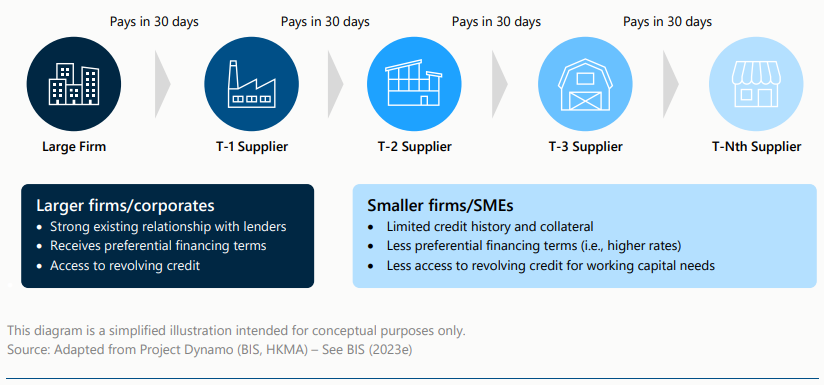

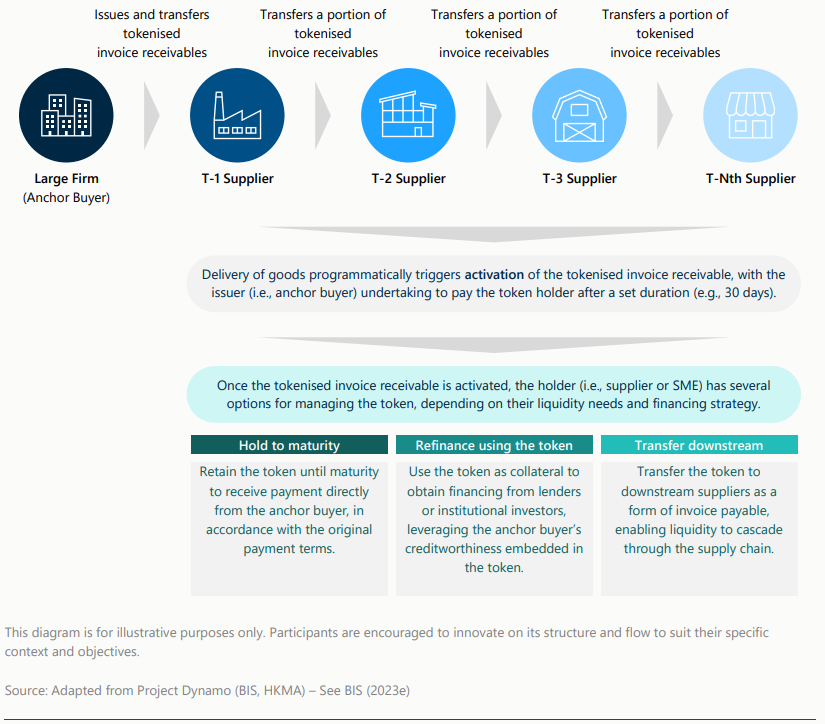

In traditional supply chains, payments flow sequentially from anchor buyers to multiple tiers of suppliers, making it difficult for smaller firms to leverage large buyers’ creditworthiness.

.png)

These digital tokens carry the anchor buyer’s credit risk and verifiable transaction data. SMEs can then use these tokens as collateral for financing, transfer them downstream as invoice payables, or hold them to maturity.

This model could encourage lenders and investors to extend more affordable financing to SMEs, improving liquidity and financial inclusion across supply chains.

.png)

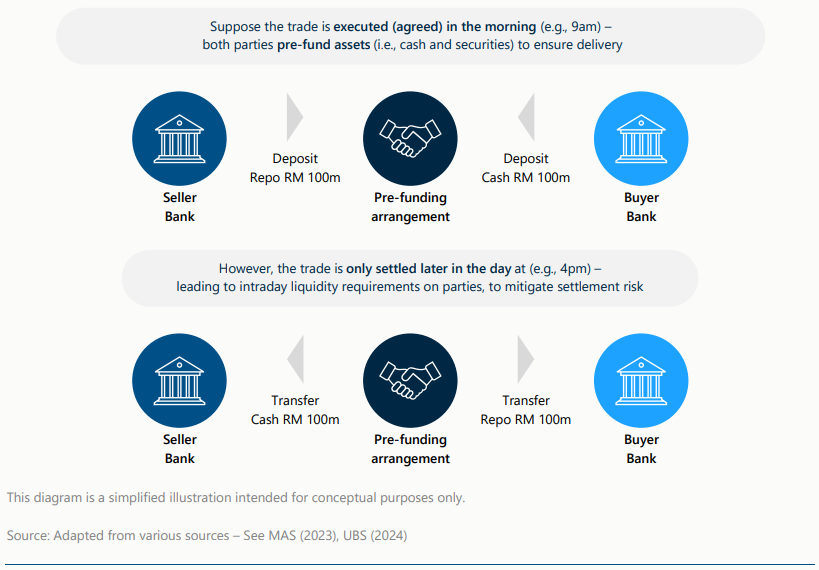

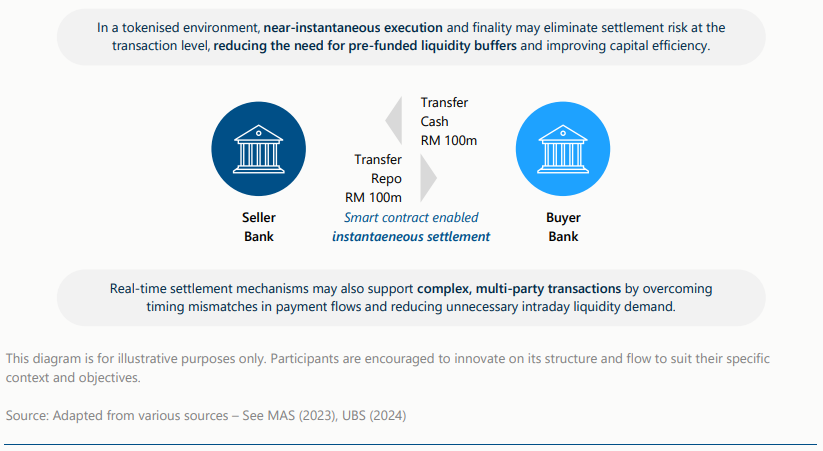

Traditional financial markets rely on sequential settlement processes that require pre-funded liquidity buffers to mitigate settlement risk. Trades often take hours or even days to settle, tying up capital that could otherwise be deployed for investment or lending.

.png)

Institutions could use programmable smart contracts to perform Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) settlements in real time, cutting operational complexity and reducing intraday liquidity mismatches.

By adopting this model, financial institutions could manage capital more efficiently and potentially reduce reliance on costly short-term funding facilities.

Islamic Finance

Malaysia’s RM2.4 trillion Islamic Capital Market, which makes up 63.7% of the total market, presents significant opportunities for tokenisation.

In Islamic finance, tokenisation can ensure simultaneous exchanges of assets and funds in compliance with Shariah principles.

Smart contracts can automate structures such as murabahah (cost-plus financing), ijarah (leasing), and waʿd (unilateral promises).

Tokenised systems could also enhance secondary market activity for instruments such as sukuk and investment accounts, improving liquidity and reducing operational risk.

BNM sees this as a natural extension of Malaysia’s established leadership in Islamic finance innovation.

Sustainability and Climate Finance

Malaysia’s financial institutions have pledged over RM240 billion in ESG-linked financing up to 2027, and SRI sukuk issuance reached RM11.9 billion in 2024.

BNM highlights that tokenisation could strengthen the integrity of green and sustainable finance. Tokenised instruments can record non-financial data directly on programmable platforms.

For example, a sustainability-linked sukuk could automatically adjust its profit rate based on verified environmental metrics. Similarly, a green bond could release funds only when pre-defined sustainability milestones are met.

By making impact data verifiable and immutable, tokenisation can reduce greenwashing and increase investor confidence in Malaysia’s growing ESG market.

Programmable Payment Tokens

Another area of exploration is programmable payment tokens (PPTs). These tokens embed conditions within their programming logic, allowing automatic execution of payments once specific criteria are satisfied.

For instance, government disbursements or social aid could be released automatically upon verification of eligibility. In commercial contexts, programmable tokens could streamline escrow payments, milestone-based contracts, or supplier settlements, enhancing efficiency and transparency.

This programmable structure offers more flexibility than current provider-based systems and can significantly reduce administrative costs.

24/7 Trade and Cross-Border Payments

BNM is also exploring the use of tokenisation to enable real-time, round-the-clock trade and cross-border payments.

By representing trade receivables and settlement obligations as digital tokens, businesses could complete transactions instantly, even beyond traditional banking hours. This would improve liquidity for exporters and importers and help reduce settlement delays that often affect smaller trading firms.

As cross-border trade becomes more digitalised, tokenised payments could complement global initiatives like Project Dunbar and Project Guardian, positioning Malaysia within a wider regional network of interoperable settlement systems.

While the current focus is on financial instruments, BNM acknowledges future potential in real-world asset tokenisation, such as property deeds or machinery.

These applications, however, would require deeper legal reforms and industry readiness before implementation.

In the short term, BNM aims to build confidence through pilots that tokenise financial assets already well-understood within Malaysia’s regulatory framework.

BNM’s Framework for a Safe Tokenisation Ecosystem

The discussion paper sets out six key considerations that will guide how Malaysia approaches tokenisation.

BNM limits participation to licensed and registered financial institutions to uphold accountability and governance.

Access to tokenised financial services will also take place in permissioned environments with strong Know-Your-Customer and anti-money laundering safeguards.

Findings from the Bank for International Settlements support BNM’s cautious stance, showing that stablecoins account for about 63% of illicit cryptocurrency transactions.

The data underscores the need to maintain clear boundaries between regulated finance and open crypto markets.

BNM will allow flexibility in how tokenisation models evolve, ranging from hybrid systems that combine on-chain and off-chain elements to fully digital implementations as infrastructure matures.

Early efforts will focus on familiar financial assets such as bonds, loans, and deposits before expanding to more complex instruments.

The central bank is also open to exploring MYR-denominated tokenised deposits and stablecoins, as long as they maintain the “singleness of money”.

This means that all forms of money remain interchangeable at par and fully backed by regulated institutions.

In terms of infrastructure, BNM adopts a technology-neutral stance, emphasising resilience, security, and interoperability rather than prescribing any specific distributed ledger platform.

Co-Creating the Future of Tokenised Finance

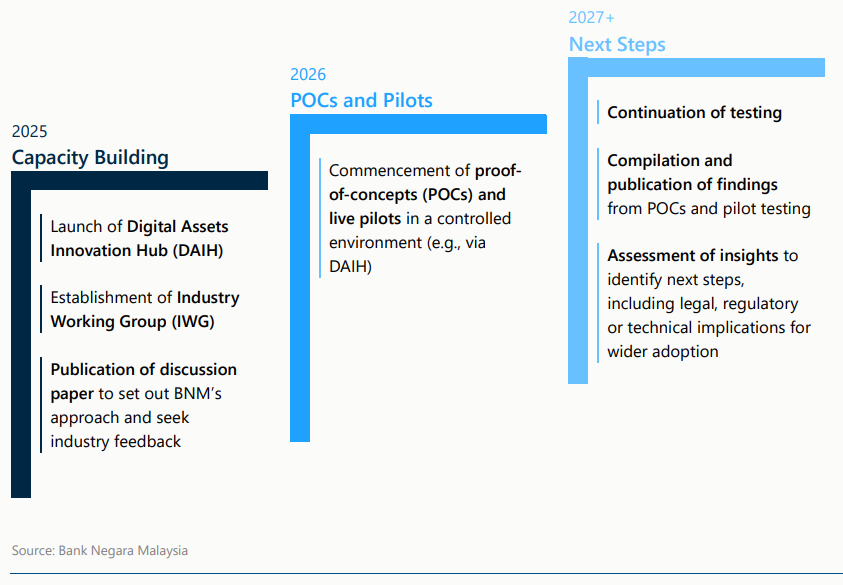

BNM’s approach to developing tokenisation is based on co-creation and industry experimentation. The Digital Asset Innovation Hub (DAIH) will serve as a test environment where financial institutions, fintech firms, regulators, and technology partners can collaborate on proof-of-concept trials.

Complementing this is the Asset Tokenisation Industry Working Group (IWG), which will coordinate policy dialogue and identify potential regulatory gaps.

The roadmap spans 2025 to 2027, moving from conceptual exploration to live pilots. Insights from these pilots will guide future regulations and help determine how tokenisation fits within Malaysia’s existing legal and supervisory frameworks.

BNM has invited public feedback on the discussion paper, with responses due by 1 March 2026 via [email protected].

Preparing for Malaysia’s Digital Finance Feature

BNM’s exploration of asset tokenisation represents an important step in preparing Malaysia’s financial system for the digital future.

If the concept proves viable, it could help narrow the RM101 billion SME financing gap, enhance the resilience of the RM2.4 trillion Islamic financial sector, and support more than RM240 billion in ESG-linked investments.

More broadly, it reflects a shift toward financial innovation that is practical, inclusive, and grounded in real economic value.

By engaging the industry early, BNM is ensuring that Malaysia’s path toward tokenised finance evolves in a way that balances opportunity with trust, paving the way for a more connected and efficient financial ecosystem.

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile. The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Mar 02, 2026

|

6 min read

ARTICLE

Feb 27, 2026

|

6 min read

ARTICLE

Feb 25, 2026

|

3 min read

ARTICLE

Feb 24, 2026

|

7 min read