BIX ARTICLE

Supporting Affordable Housing Through Issuance of Social Sukuk

Oct 20, 2021

|

5 min read

Featured Posts

SRI Sukuk: The Journey Towards Sustainable and Responsible Investment

Jul 23, 2020

|

5 min read

Securities Commission's Capital Market Masterplan 3 (CMP3)

Sep 21, 2021

|

2 min read

What If We Allowed Retail Investors to Directly Invest in Malaysia’s Government Bond?

Aug 24, 2021

|

8 min read

Islamic Bonds Come Under Microscope After Garuda Indonesia Default

Aug 19, 2021

|

8 min read

In 2012, the Malaysian government issued the RM2.5 billion (US$593.54 million) Sukuk Perumahan Kerajaan (SPK) and another RM2.6 billion (US$617.28 million) in 2014 to finance public servant house financing. Following its success, the government created a new agency, Lembaga Pembiayaan Perumahan Sektor Awam (LPPSA), and through its new vehicle issued a RM25 billion (US$5.94 billion) Sukuk program in 2016.

In an attempt to improve the supply of affordable housing, the Malaysian government has introduced many initiatives such as MyHome, Perumahan Rakyat 1Malaysia, Rumah Mesra Rakyat, Program Rumah Mampu Milik, MyDeposit Scheme, Perumah Penjawat Awam 1 Malaysia and MyBeautiful New Home, and laid out plans for the National Home Ownership campaign and the Widening of the Rent-to-Own campaign.

However, for many who do not qualify for government-supplied housing, their only option is the increasingly expensive private market. Even if housing prices fall, it will be irrelevant if those seeking to purchase them are unable to obtain financing. This is exacerbated by the fact that income levels do not increase in proportion with property costs, which means that even individuals with a secure job may struggle to obtain the appropriate financing for a house near their place of employment, particularly in a metropolitan city.

Furthermore, developers are also tasked with building affordable units as a condition of construction approval, with a cap on their sale price, to which any for-profit organization will be reluctant to allocate their resources. The limited access of funding from banks to finance the development of low-cost housing also leads to a lack of real estate developers in this segment.

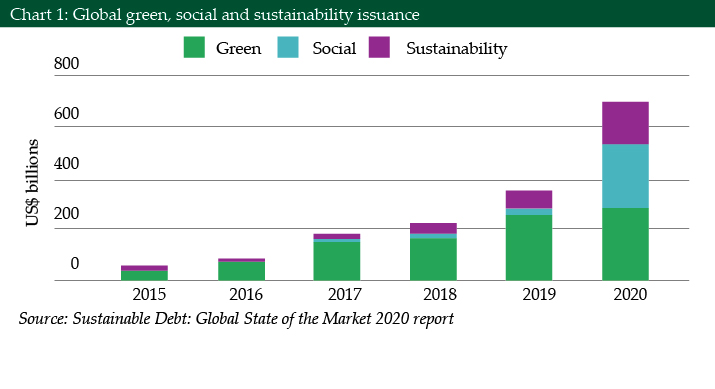

Globally, the issuance of the sustainable finance market has shown tremendous growth year by year. As the COVID-19 pandemic has had a catastrophic impact on the people’s livelihood and the economy, social bonds have emerged as the fastest-growing segment of the sustainable debt market in 2020.

At the back of its success in promoting Islamic finance, Malaysia launched the Sustainable and Responsible Investment Sukuk Framework back in 2014.

Since its inception, there have been 20 SRI Sukuk issuances (April 2021) in Malaysia. The Securities Commission Malaysia also launched a Sustainable and Responsible Investment Centre, a one-stop resource center on SRI Sukuk for greater transparency and access to information for the general public.

Projects to solve affordable housing are one of the eligible SRI projects under the Securities Commission Malaysia SRI Sukuk Framework, which currently provides the SRI Sukuk Grant Scheme. This issuance meets the demand from responsible investors and meets the UN Sustaibable Development Goals (SDGs) 1 (no poverty) and 11 (sustainable cities and communities), uplifting poverty and making cities inclusive, safe, resilient and sustainable. This is also in line with the Shariah principles.

The government can also explore zero-coupon Sukuk, where the government will pass the paid-up cost to investors to finance the project, and the government will pay back the full coupon payment upon maturity like Khazanah’s zero-coupon Sukuk. This option of financing can help ease the government liquidity issues amid the current pandemic.

Conclusion

With all the success stories from Sukuk issuance, we believe the Malaysian government is in the best position to tap into the SRI Islamic capital market to facilitate affordable housing development. Relying on its previous experience through SPK and LPPSA issuance, SRI Sukuk for affordable housing will put Malaysia at the forefront of the region to reach the SDG agenda.

The proceeds from SRI Sukuk should be utilized to support financing for developers and buyers since there is a lack of real estate developers for low-cost housing due to limited funds available from financial institutions with heavy risks and minimal margins.

SRI Sukuk issuance can help developers by creating a special fund to finance housing projects that meet the affordable housing agenda. Another avenue this issuance will help is to provide affordable housing financing for those targeted non-public servants.

As the government has experience with financing provided for its government servants, it is time to provide the facility to others, especially those who are vulnerable during the current pandemic.

Currently, Islamic financing for housing is available mainly through Islamic commercial banks. SRI Sukuk issuance can also create a guarantee facility to improve the creditworthiness of the targeted buyer when asking for financing from banks.

However, this method is not without challenges. The financing facilities provided to government servants have a lower risk due to the payment deducted directly from the borrower’s salary and opening this to the public will expose the issuer to a higher non-performing loan risk.

More ideas need to be explored by the government to ensure that Islamic financing facilities reach the targeted borrowers and provide a sustainable payment framework.

Ahmad Al Izham Izadin is the senior manager of bond and Sukuk, research and business development at BIX Malaysia. He can be contacted at [email protected]

Source: Supporting Affordable Housing Through Issuance of Social Sukuk (2021, 19 July). IFN Islamic Finance news. Retrieved from https://www.islamicfinancenews.com/supporting-affordable-housing-through-issuance-of-social-sukuk

Disclaimer

The information provided in this report is of a general nature and has been prepared for information purposes only. It is not intended to constitute research or as advice for any investor. The information in this report is not and should not be construed or considered as an offer, recommendation or solicitation for investments. Investors are advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situation and particular needs and should seek appropriate personalised financial advice from a qualified professional to suit individual circumstances and risk profile.

The information contained in this report is prepared from data believed to be correct and reliable at the time of issuance of this report. While every effort is made to ensure the information is up-to-date and correct, Bond and Sukuk Information Platform Sdn Bhd (“the Company”) does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information contained in this report and accordingly, neither the Company nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

YOU MAY ALSO LIKE

ARTICLE

Mar 26, 2024

|

9 min read

ARTICLE

Mar 26, 2024

|

7 min read

ARTICLE

Mar 05, 2024

|

3 min read

ARTICLE

Dec 26, 2023

|

4 min read